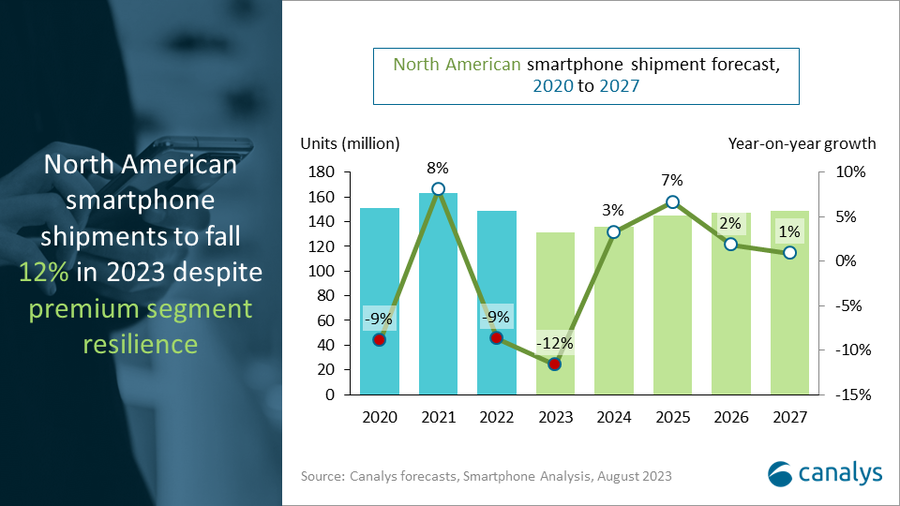

In the wake of economic challenges, including rising interest rates and persistent inflation, North America’s smartphone market is bracing for a significant dip in shipments in 2023, with Canalys forecasting a 12% decline. This sobering news comes on the heels of the region’s worst quarterly performance in over a decade during Q2’23.

However, there is a glimmer of hope for the industry in the second half of 2023, as smartphone vendors prepare to launch new models in Q3. Despite the overall downturn, the premium segment of smartphones, defined as those costing $1,000 or more, is expected to remain resilient. Both vendors and the channel are investing in this high-end market, capitalizing on early trade-ins and financing options to keep it solid. On the other hand, the low-end segment, consisting of smartphones priced below $200, is expected to continue struggling as prepaid demand dwindles.

Looking ahead, smartphone shipments are anticipated to make a modest recovery in 2024, with an estimated 3% increase. However, it is unlikely that shipments will surpass the 150-million-unit mark before 2027.

In response to the challenging business environment, mobile carriers and smartphone vendors are adopting more targeted approaches to build sustainable business models. Major carriers are optimizing their premium plans to drive user and device upgrades, as well as higher average revenue per account and customer loyalty. You could use Apple’s revenue-boosting price hikes on the iPhone 15 as a pretty good example of how that will work for the poor consumer.

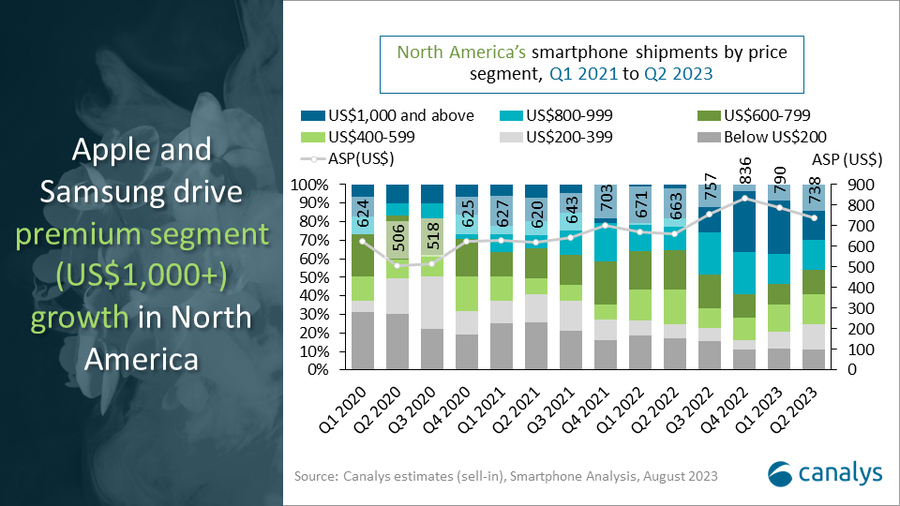

The average selling price (ASP) of North American smartphones rose to $738 in Q2’23, up from $663 in Q2’22. Apple and Samsung experienced significant growth in their premium segment shipments, with 25% and 23% growth, respectively, during Q2’23.

In the coming months, Apple’s iPhone 15 portfolio and Samsung’s Galaxy Fold5 and Flip5 are expected to stimulate consumer upgrades in the premium segment. Brands like Google Pixel and Motorola, which have been competing in the premium market with their flagship foldable devices, are also expected to contribute to holiday sales.

However, vendors are approaching the mass-market segment with caution, as a longer road to recovery is foreseen. Extended inflation affecting consumer budgets and double-digit declines for vendors like Samsung, TCL, HMD, and OnePlus in the past six months highlight this caution. Major carriers have shifted their focus from prepaid to postpaid and premium segments, further complicating the outlook for the mass-market segment.

| Vendor | Q2’23 Shipments (Millions) | Q2’23 Market Share | Q2’22 Shipments (Millions) | Q2 2022 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Apple | 14.8 | 54% | 18.5 | 52% | -20% |

| Samsung | 6.6 | 24% | 9.0 | 26% | -27% |

| Motorola | 2.3 | 8% | 3.1 | 7% | -25% |

| TCL | 1.3 | 5% | 1.8 | 5% | -30% |

| 1.2 | 4% | 0.8 | 5% | 59% | |

| Others | 1.2 | 5% | 2.2 | 5% | -43% |

| Total | 27.4 | 100% | 35.4 | 100% | -22% |

The smartphone upgrade cycle is unlikely to return to pre-pandemic levels as market players continue to rationalize spending on marketing and promotion. Sustainability regulations will also play a role in North America, with a focus on the right to repair and refurbished devices, potentially reshaping the smartphone business model in the region.