The smartphone market has started a declining trend after years of growth. In January, Apple reported lower than anticipated iPhone revenue for the 4th quarter, especially in Greater China. Samsung also reported a decline in smartphone shipments for Q4 2018. It appears as though the smartphone market is reaching a saturation point.

At the same time, smartphone vendors are ready to introduce foldable 5G models and the latest technologies at MWC 2019 in February. Can high priced new technology products boost demand or there is also a need for lower cost solutions?

Declining market: market saturation and rising prices

The global smartphone market’s growth-rate started to decline in 2017 and 2018 after double-digit growth in 2015 and single digit growth in 2016. According to the latest data from IDC, 2018 may be the worst year ever for smartphone shipments. Global shipments in 2018 dipped 4.1%, with a total of 1.4 billion units shipped for the full year.

A longer replacement cycle, increasing penetration in many large markets, political and economic uncertainty and growing consumer frustration around rising price points contributed to the decline in growth rates in 2018 according to IDC. The result showed China market had an even worse 2018 than the previous year, with volume down just over 10%. Samsung and Apple had year over year declines in global smartphone shipments in 2018 while Chinese brands, Huawei and Xiaomi, increased their shipments by 33.6% and 32.2% respectively, IDC data showed.

Both these Chinese brands were able to offer flagship models as well as affordable products to meet emerging market needs. In recent years, Apple and Samsung’s new flagship flexible OLED smartphones have seen substantial price increases. Consumers are keeping phones longer as new products are not making innovative leaps, and the cost to upgrade is substantially higher. Apple is starting to offer better trade-in offers and lower cost incentives to drive demand and Samsung is also planning market-targeted lowered priced products to meet emerging market needs. High-end innovative products need to be combined with more affordable mid-range and low range products to meet industry needs and drive global demand.

Foldable 5G phones: flexible OLED & technology development

Two new technology revolutions are coming to the smartphone market this year: 5G networks and foldable form factors in handsets. Samsung is expected to introduce 5G and foldable phone on February 20th before the MWC 2019 event. Huawei is expected to introduce 5G foldable phones at the same conference. Xiaomi, LG, and many others are expected to introduce new models incorporating 5G, AI and foldable models with new designs at the same conference.

These new technology leaps are expected to come at a very high price especially with foldable design and flexible OLED display likely to be in the $1500 to $2500 range. Foldable phones still have many challenges including manufacturing issues, higher costs, durability, design acceptance and consumers’ willingness to pay higher prices for the new designs. Foldable smartphones may be attractive to early adaptors, but will not reach mainstream market in the short term.

As I wrote in my December DD article (Top Display Technology Trends for 2019), foldable smartphones will dazzle the market with a technology breakthrough and new form factors, but high price and complex manufacturing process will limit demand and unit shipments in 2019. In the short run, the industry has to depend on lower cost LTPS LCD to meet lower price smartphone demand from the emerging market, in order to drive unit growth.

Flexible OLED: LTPS LCD enjoying higher utilization rate

Flexible OLED has been gaining market share in the smartphone market in the last few years for its thinner form factor, higher performance and differentiating design. Samsung’s Galaxy smartphone and Apple’s iPhone products have helped to OLED’s increase market share. Other companies such as Huwai, LG, Google and others have also joined in.

Samsung Display is the market leader in the supply side of flexible OLED display although LG, BOE, Tianma, and Visionox are all increasing capacity. Panel suppliers such as Sharp, Japan Display, Royale, and EDO are advancing their commercialization initiatives. Foldable smartphone will contribute further to increase flexible OLED shares. But high price and lower than expected sales from Samsung and Apple products have resulted in lower utilization rates for flexible OLED factories.

According to DSCC information in January 2019,

“in the case of LTPS LCD fab utilization, it has enjoyed the highest utilization among the competing mobile technologies for the past five months. LTPS LCD fab utilization reached a high of 87% in November and has fallen on seasonal weakness to 68% in January. It remains the low priced leader and there are very capable entry level LTPS LCD smartphones under $200”.

Huawei‘s successful Honor products have models in this price range meeting emerging market demand needs. Higher supply of flexible OLED may lead to some price pressure, but manufacturing challenges and yield issues will continue to keep cost at a higher level.

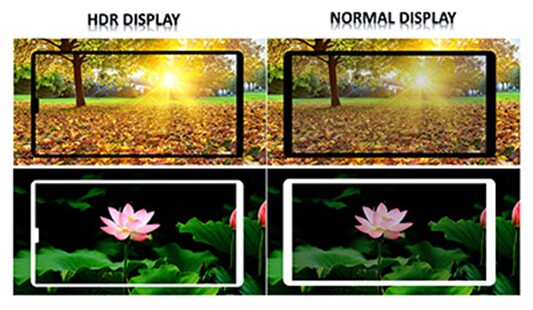

Tianma’s HDR LCD uses miniLEDs in the backlight.

Tianma’s HDR LCD uses miniLEDs in the backlight.

MiniLED & MicroLED: Future solutions?

5G is considered to be a major jump in mobile technology. It promises super fast speed and low latency enabling faster connections and faster downloads leading to better video content consumption. 5G smartphones will be introduced starting from February this year but the real ramp-up is expected in 2020. With 5G, display performance will be increasingly important. OLED is poised to gain higher market share and strong presence with superior performance and thinner form factors. However, LCD suppliers are already starting to show MiniLED backlight HDR LTPS LCD, with very high brightness (peak brightness >1000 cd/m²) and contrast (3,000,000:1) to reduce the performance gap. MiniLED products are still high cost and need to be lower than OLED cost. MiniLED is expected to show up by the end of this year.

MicroLED with its simple structure compared to OLED and LCD has the potential to be cheaper than OLED. It still has many manufacturing challenges that need to be resolved. Many companies are working on microLED displays including AUO, Apple, eLux, Jade Bird, LG Display, Lumens, Lumiode, Mikro Mesa, Play Nitride, Plessey, Rohinni, Samsung, Sony, Visionox and others.

Apple is expected to have a MicroLED-based smart watch within a year or two. R

ecently I got an opportunity to see an impressive LTPS backplane based RGB MicroLED smartwatch display prototype (InGaN & direct transfer, 1.5’ 264ppi) from Glo. According to executive chairman Aniruddha Nazre,

“leveraging existing LED and LCD industry infrastructure, glo’s displays can be cost competitive with high-end OLED at the get go and is expected to have an even more competitive cost curve than OLED going forward”.

According to CEO Fariba Danesh

“glo? uses existing commercial LTPS glass backplanes and existing volume LED manufacturing equipment and capacity. With highly selective direct wafer transfer capability glo technology can scale to all sizes and resolutions (micro display, mobile display and large display) on either CMOS or LTPS backplane”.

Glo’s Smartwatch MicroLED demonstration. Image:Glo

The path between prototype and high volume consumer grade productions can be extremely challenging and can take many years to travers. But if MicroLED smartphone with all its great abilities (very high brightness, high contrast ratio, wide color gamut, fast response time and low power) can come to market with competitive prices within a few years it could help to drive smartphone replacement demand. Technology innovations and cost reductions are real requirements in a negative market period to drive unit shipments. If the technology potential for OLED, MiniLED and MicroLED can come to market at a faster rate and with lower costs, it could open up new growth opportunities for global smartphone market. – Sweta Dash

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com