I don’t know about you, but we’re getting awfully tired of looking up people’s noses during Zoom meetings. It probably doesn’t bother you; but one of our college degrees was in radio & TV, so we were drilled on how to act, look and respond to a camera. But today, everything is a closeup and we have to tell you…you need to trim your nose hair!

“I once asked this literary agent, “Uh, what kind of writing paid the best…” he said, “Ransom notes.” – Harry Zimm, “Get Shorty,” 1995, MGM

“I once asked this literary agent, “Uh, what kind of writing paid the best…” he said, “Ransom notes.” – Harry Zimm, “Get Shorty,” 1995, MGM

Seriously!

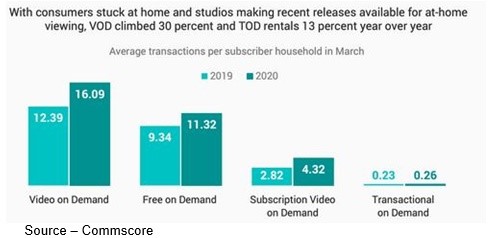

The lockup has done more than change the way we do meetings. It has also changed our entertainment habits. Add to that the universal availability of VOD and kids living on small screens, even adults missed the seismic shift.

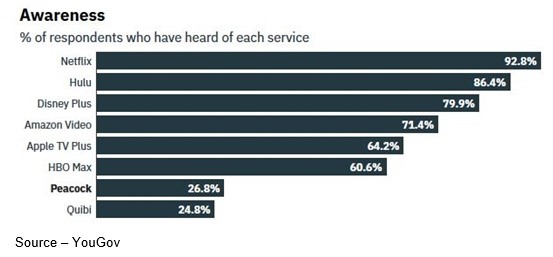

Two years ago, Jeff Katzenberg announced NewTV (renamed to be launched as Quibi). At the time, we couldn’t figure out if he was really smart or had gone off the deep end. Then we also saw the former head of Walt Disney Studios talked Meg Whitman into coming on board as CEO and followed up by convincing Hollywood and tech bigwigs that a streaming service featuring 7- to 10-minute professionally-produced originals was worth a $1B plus investment.

We were sure they could see something we couldn’t.

Nope!

But, they must have read the Microsoft study that highlights people’s attention span had dropped from 12 seconds to 8 seconds–less than a goldfish.

Yeah, What? – Here you thought you were getting old because you can’t go into the bathroom without wondering what in the heck you’re doing there. No, you’re not alone; you’re slowly losing your (something). So, carry your tablet all the time and write stuff down so you remember. Then remember to look at it periodically.

No wonder short content on YouTube, Instagram, TikTok, and other DIY videos sites were doing so well.

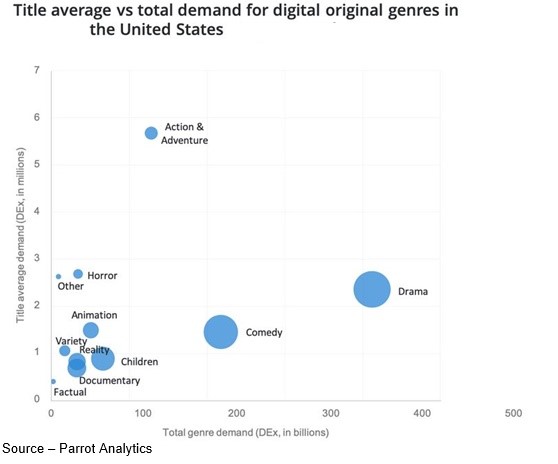

Professional content would give a more discerning audience something to enjoy between/during classes and meetings, during commutes–in fact, anywhere a viewer might have 10-15 minutes versus 30-90. The cost seemed reasonable – $5/mo. for professional entertainment … cool. Who knew that when 2020 rolled around we would suddenly find ourselves barricaded at home with all this extra time on our hands?

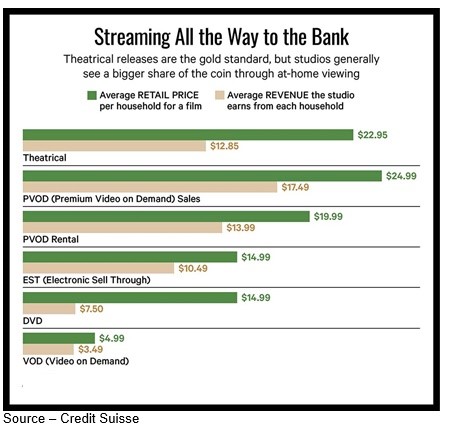

No one could imagine studios/companies were going to aggressively take on Netflix and win over subscribers by charging only $5 – $7/mo. to watch their stuff. Or that all of this was going to occur without some kind of apocalyptic warning. Overstating the obvious, Ms. Whitman said Quibi’s troubles were compounded by unprecedented times.

But in a Reuters interview, Katzenberg emphasized,

“Under the circumstances, launching a new business into the tsunami of a pandemic, we actually have had a very, very good launch.”

That may be true Jeff; but coming up literally short with content, tech features and marketing didn’t help. In retrospect, the pandemic was just a convenient inconvenience.

“Focusing on a unique platform and behavior that was created for smartphones and supported by overwhelming research that viewership was shifting heavily over to mobile engagement, it was felt that they might be able to go up against Netflix, Disney+ and Amazon’s strong offerings, even with new and exclusive content,” said Allan McLennan, Chief Executive of PADEM Media Group. “But that has turned out to be a very high bar for them to get over.

“Throw in AppleTV with a modest content budget/content offering but aggressive pricing it really took a swing at Quibi’s chances,” he added. “Apple’s large and loyal customer base would have been a prime target for Quibi’s service to capture attention; but in the M&E industry, timing is everything.”

Because it’s There – We all know that the best way to enjoy video content is on a big screen. In fact, the bigger the better. But when big isn’t handy, we go for convenience; and obviously, that’s the screen in your hands.

Because it’s There – We all know that the best way to enjoy video content is on a big screen. In fact, the bigger the better. But when big isn’t handy, we go for convenience; and obviously, that’s the screen in your hands.

While there was more than a mild disagreement between Quibi and Sensor Tower as to how many folks stayed past the free trial, it was pretty obvious that our kids and lots of other people found solace in using their smartphones for feature-length viewing as opposed to small nibbles during the lockdown.

Sensor Tower also noted that politically controversial TikTok, with more than 87M downloads in June, was wildly more popular with folks around the globe.

Insanely Popular – Whether you’re young or old, TikTok has rocketed to the top of the download and use smartphone app list. Sure, the government worries about how “they” are using your data; but for normal folks, it’s just an insanely great way to grab and enjoy bite-sized entertainment.

Insanely Popular – Whether you’re young or old, TikTok has rocketed to the top of the download and use smartphone app list. Sure, the government worries about how “they” are using your data; but for normal folks, it’s just an insanely great way to grab and enjoy bite-sized entertainment.

The popularity is the same as with most video web sites like YouTube, Instagram and yes, even PC (politically correct) sites like Facebook. First, the sites allowed people to express themselves freely, openly. Then, you get that warm fuzzy feeling when you see how much people like you because you have all these followers. When followers reached critical mass, people discovered there was money to be made in this stuff and that marketers pay big money to be seen with you.

“While the short-form video apps are a very lucrative cottage businesses for most, they have also become interesting outlets for streaming content owners and filmmakers,” McLennan noted.

“Their dedicated apps are providing great opportunity for brand engagement along with widespread show and theatrical movie trailer exposure. The more marketing savvy project owners are creatively using outtakes, mistakes and video clips to attract viewers and build subscribers,” he added.

We also see video app sites as great places for indie filmmakers to promote finished projects and their professional expertise/services to studios, marketers and folks who need creative work done. One of the prime reasons for placing marketing emphasis there is because “everyone” has a phone/smartphone today. There are 5.11 billion phone users and 2.87 billion smartphones worldwide – and they know how to stream with them.

Power in the Hand – The mobile phone is the first (and only) consumer product to become wildly successful in less than five years when it achieved 50 percent penetration around the globe. The greatest penetration is in the APAC region where the personal screen is used for entertainment more than a TV.

Power in the Hand – The mobile phone is the first (and only) consumer product to become wildly successful in less than five years when it achieved 50 percent penetration around the globe. The greatest penetration is in the APAC region where the personal screen is used for entertainment more than a TV.

Asia Pacific countries have the largest number of mobile phones as well as the greatest number video content users (think inexpensive service, lower-cost devices). Their use of mobile phones is almost four times larger than desktop and TV screen viewing.

Total annual mobile viewing worldwide will provide the industry with more than $27.1 billion this year, and the demand will continue to grow.

Pandemic Driven – It’s difficult to prove, but many researchers note the heavy viewing during the day across all ages has been caused by the lockdown. It doesn’t really matter because video story viewing is becoming an integral part of our lives.

Pandemic Driven – It’s difficult to prove, but many researchers note the heavy viewing during the day across all ages has been caused by the lockdown. It doesn’t really matter because video story viewing is becoming an integral part of our lives.

Experts say the increase in video traffic using a smartphone has been driven by the lockdown which has resulted in increased viewing time and more video content embedded in news media and social networking.

Today, most mobile video is streamed at low-definition (360p) and standard-definition (480p) formats because of the bandwidth requirements of higher definition content (HD, 4K, HDR) as well as data caps/throttling levied by service providers.

Netflix has been pushing the performance envelope since the mid-1990s. They were the first to use H.264 and later, the more efficient VP9.

The more efficient streaming formats ensure content will stream with little or no buffering–even where wireless service is marginal.

Aware of the streaming financial impact for all parties and consumers increasing viewing quality tastes, Germany’s Fraunhofer Heinrich Hertz Institute recently released a new, more bandwidth efficient codec (H.266, versatile video coding).

The new codec should cut data bandwidth requirements at least in half, compared to today’s commonly used H.265 codec.

Apple, Microsoft, Qualcomm, Ericsson, Intel and Huawei were supporting the project which should achieve fast/widespread use–not only because of its obvious bandwidth/cost savings but also because it will be offered using a uniform and transparent licensing model based on the FRAND principle (i.e., fair, reasonable, and non-discriminatory). (and, of course there is AV1 – editor)

More, Faster – Consumers are all excited about updating their mobile devices to new units that are 5G-enabled. They don’t really know why other than watching a movie will suddenly be faster, more enjoyable. The problem is a two-hour movie will still play … two hours.

More, Faster – Consumers are all excited about updating their mobile devices to new units that are 5G-enabled. They don’t really know why other than watching a movie will suddenly be faster, more enjoyable. The problem is a two-hour movie will still play … two hours.

“Nearly all of today’s mobile streaming is HD at 720p and 1080p resolution,” McLennan noted. “New codecs will set the stage for today’s 4K content to be easily delivered to the smartphone shortly and especially when 5G service becomes more widely available.”

In the US, AT& T, Verizon and T-Mobile are conducting a serious battle of investment and wordsmanship to deliver eye-blinking low-latency for everything. But they all lag the infrastructure build-out of China, Korea, France, Japan and well … darn near everyone.

Promises, Promises – Wireless service providers across the globe are investing heavily in upgrading their networks with newer, better, faster hardware. Available in “isolated” heavy population centers, a lot of time, energy and money will be needed over the next five years to deliver true global 5G service–especially time/money. And yes, the US is at the bottom of the delivery list.

Promises, Promises – Wireless service providers across the globe are investing heavily in upgrading their networks with newer, better, faster hardware. Available in “isolated” heavy population centers, a lot of time, energy and money will be needed over the next five years to deliver true global 5G service–especially time/money. And yes, the US is at the bottom of the delivery list.

Carriers tout how many 5G cells/towers they have installed and have running this quarter while 5G conspiracy theory groups brag about how many cells/towers they have destroyed. 5G installations in the US are concentrated in a few large population centers. It is presently live in 24 global markets and is forecast to account for 20 percent of the global connections by 2025 according to the GSMA (Global System for Mobile Communications).

When we showed the above to our daughter, she was suddenly less concerned that the soon-to-be introduced iPhone wouldn’t be 5G ready out-of-the-box.

The majority of the mobile infrastructure – which has been in place for many years without causing medical ailments – is 4G/LTE backhaul or more simply, the infrastructure between the cell/tower and edge of the network (phone). To deliver end-to-end 5G, AT&T will have to invest tens of billions of dollars – as will the others – to build out their 5G networks in the US. This is on top of their $85B M&E note to buy Times Warner (HBO) and ongoing content investment to stay even close to Netflix, Amazon, Disney.

5G will be vital to meet critical data applications such as IoT, smart transportation, industrial automation, remote surgery/healthcare and similar applications that require the minimum possible latency and uninterrupted bandwidth.

Unless you’re running an animation studio like Pixelworks or ILM, editing 8K video or participating in a global eSports tournament, you have more than enough bandwidth for the foreseeable future. And, by using advanced content preparation/production as well as intelligent global distribution of content closer to the user, we’ll be able to enjoy higher resolution, more complex formats and deeper/richer content without dropped frames or sluggish performance.

Cable companies, which have historically had the fastest networks and biggest pipes, aren’t waiting for 5G to take their customers as they move to 10G, 10GB backbone and add 5G mobile to their service offerings.

Still Room – There are still opportunities for wireless providers to sell first time users and subscriptions. Data usage on today’s smartphones vastly surpasses the number of calls people make with the devices and streaming video is increasingly more popular.

Still Room – There are still opportunities for wireless providers to sell first time users and subscriptions. Data usage on today’s smartphones vastly surpasses the number of calls people make with the devices and streaming video is increasingly more popular.

Thanks in no small part to the pandemic shutdown, we agree with the industry’s estimates that by the end of 2024 the global average data consumption per smartphone is projected to be 21GB per month.

Being locked up with our kids for months, we’ve learned how to sit in the living room with the TV on, the smartphone in hand and ear buds in place so we halfway consume a whole lot of entertainment. (AM)

Content production/distribution is so tough that we agree with Chili Palmer in Get Shorty when he said, “Rough business, this movie business. I’m gonna have to go back to loan-sharking just to take a rest.”

Content production/distribution is so tough that we agree with Chili Palmer in Get Shorty when he said, “Rough business, this movie business. I’m gonna have to go back to loan-sharking just to take a rest.”

# # #

Andy Marken – [email protected] – is an author of more than 600 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.