Pay TV Households will decline from an estimated 921 million in 2020 to 680 million in 2026, impacting the annual shipments of Operator Set Tops, which falls from 242.6 million to 184.8 million, propped up by the upgrade cycle for new Set Top Box operating systems.

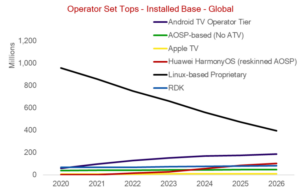

This means that the install base for set tops is set to decline from 1.21 billion in 2020 to 824.67 million in 2026, while the Smart TVs & Connected TV Devices segment is expected to grow from an installed base of 497 million in 2020 to 905 million in 2026.

Operators will ditch resource-thirsty legacy Linux-based Proprietary set tops as their footprint of pay TV homes starts to decline around the world, with the market share such systems falling from around 85% in 2020 to 48% in 2026. This transformation will see a global uptick in Android TV and HarmonyOS set tops, with RDK making some progress in Europe and keeping hold of the US market.

Globally, Android TV Operator Tier will grow from around 5% of the installed operator set top base to some 23%, in 2026. RDK, meanwhile, is only expected to grow from 6% to 10%, even with interest from Tier 1 operators in Europe. Almost doubling your footprint would normally be a cause for celebration, but when compared to Android TV Operator Tier’s success, it is not as emphatic.

Linux is also set to decline in the world of smart TVs and CTV devices, as LG’s WebOS, Samsung’s Tizen and Roku’s platform lose ground to the rise of Android TV and Huawei’s HarmonyOS. This will also drive out Chromecast and AOSP-based installations, with former’s decline catalyzed by a decline in demand for CTV devices as device replacement cycles lead smart TVs become the standard first screen in the home.

Android TV is set to reach 25% share of Smart TVs and Connected TV Devices by 2026, representing an estimated 236 million of a total 905 million devices.

Perhaps the standout feature of our findings is the rise of HarmonyOS. The trade dispute between China and the US, with resulting concerns over access to Android updates, has galvanized the Chinese government to push for a major independent national OS, with HarmonyOS the apparent preferred candidate. The long-term consequences for Google and Android of this trade dispute could be enormous and almost entirely negative.

In the short term, Huawei and others will continue to favor Android for set top and other connected devices, including smartphones and tablets – leading to growth in China for Android, initially. However, the likely longer-term direction is towards HarmonyOS as a ubiquitous cross-platform OS that will also increasingly take on Android in neutral markets outside China – especially in APAC and Latin America.