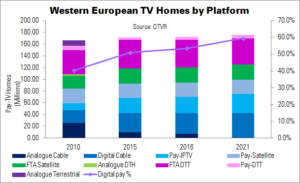

Pay-IPTV homes in Western Europe overtook pay-satellite in 2015, says Digital TV Research – a trend that is expected to continue. While pay-IPTV subscriptions will rise by almost 7 million (27%) between 2015 and 2021, pay-satellite is expected to fall by 300,000.

The satellite fall is mainly due to operators in some countries, such as Spain and Italy, converting subscribers to more profitable bundles on broadband networks. Satellite revenues are forecast to fall every year from 2011, and by $1 billion between 2015 and 2021. However, IPTV revenues are expected to rise $1.2 billion, to $5.8 billion in 2021.

Western European pay-TV is maturing, with penetration forecast to grow minimally: from 56.8% at end-2015 to 59.5% in 2021. The number of subscribers will climb from 97.4 million to 104.3 million. This means that pay-TV subs will only rise by 6.9 million (7%) over the forecast period. However, digital pay-TV subs will climb by 19% (almost 17 million). Digital cable will rise by almost 10 million.

Despite the rise in pay-TV homes, pay-TV revenues will remain flat at around $31 billion. The UK ($7.2 billion) will remain the most profitable market. Germany, which has the most pay-TV subscribers, will remain far behind the UK, at $4.2 billion by 2021. France and Italy, despite having far fewer pay-TV subscribers, will not be far behind Germany.

DTVR believes that the remaining 9.9 million analogue cable subscribers existing in Western Europe today will be the hardest to convert to digital. Many of these customers pay for a very basic package as part of their rent. They are more likely to convert to free-to-air platforms such as DTT or satellite when they do finally make the switch.

By the end of 2015, only seven of the 18 countries covered – Finland, France, Iceland, Italy, Norway, Spain and the UK – were fully converted to digital.

By the end of 2021, DTVR believes that pay-TV penetration will range from almost 100%, in the Netherlands, to 36% in Italy. Eight countries will exceed 90% penetration. However, penetration will fall in those countries with a large number of legacy analogue cable subscribers: Germany, the Netherlands, Norway, Sweden and Switzerland.