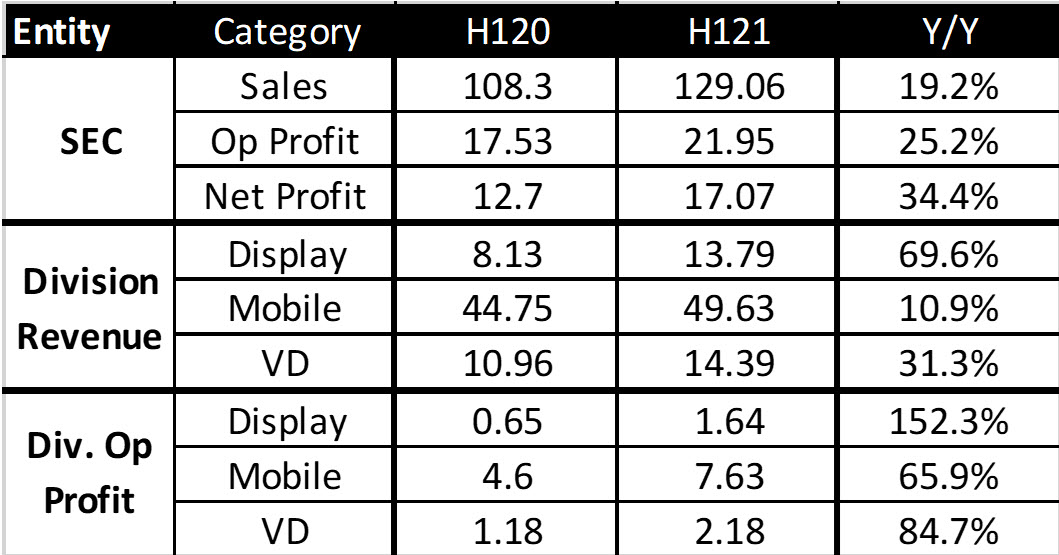

By most measures Samsung Electronics (SEC) is having a banner H121: total revenues are up 19.2% Y/Y and net profits are up even more, 34.4%. Visual Display (the TV & monitor business) revenues are up 31.3%, Samsung Display (SDC) revenues up 70% (albeit helped by Apple’s one-time payment for not buying OLED panels) and Mobile was up 10.9%.

Yet there are doubters in Samsung’s management for these three divisions. One of the obvious problems could be engendered by the acting Chairman’s new culture.

Each business entity is encouraged to be a standalone business and often compete on transfer pricing, which has led Mobile to buy OLED panels from the Chinese, when SDC’s capacity was under-utilized. SDC then then sold to Mobile’s competitors, offering their best display technology, including foldables, which could reduce Samsung Mobile’s very profitable Z Fold and Z Flip share in the near future.

Samsung Visual initially turned down the QDOLED technology, likely delaying its introduction by one year and was then forced to accede to SDC’s demands in order to secure a steady supply of LCD TV panels. This does not encourage cooperation, especially in an industry so dependent on technological change and fast response.

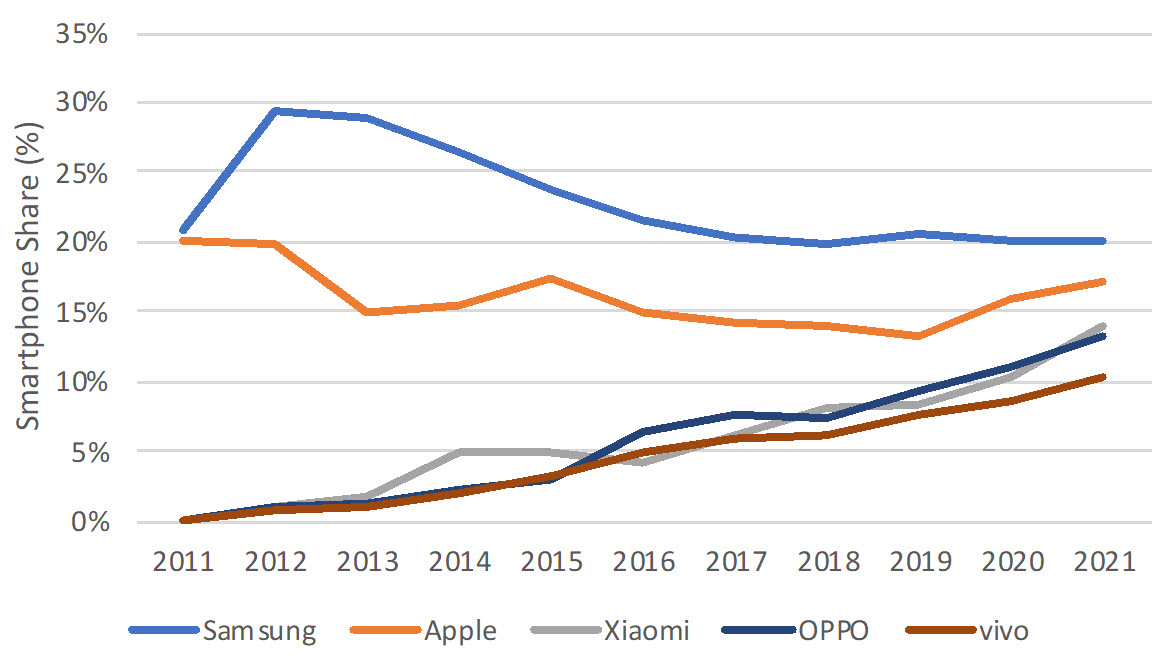

- Mobile’s smartphone business has been losing market share to Apple and top Chinese OEMs for years and their share loss continues. Profit/phone is less than ½ of Apple’s. According to the Elec, Samsung Mobile is undergoing a ‘Special Review’ brought on by lackluster earnings in recent quarters and the ongoing supply chain problems, which ceded Samsung’s smartphone top spot to Xiaomi in Europe. The performance of Samsung’s Galaxy S21series seems the cause of the unexpected review. Estimates suggest 13.5 million Galaxy S21 units have been sold in the first six months of sales, down 20% compared to the Galaxy S20 line, which was deemed a massive failure. Shipments were down 47% from the Galaxy S10 series launch in 2019. Sources say the company’s relationship with MediaTek is on the rocks. The supplier’s chipsets are found in recent Galaxy A models like the Galaxy A32, but MediaTek reportedly told Samsung recently that it couldn’t meet demand.

Samsung Smartphone Market Share – Flat to Down Over 10 Years

Samsung Smartphone Market Share – Flat to Down Over 10 Years

- Visual Display’s TV business is threatened by the Chinese and a potential loss of access to the primary supply of large LCD panels. Although Samsung was the first to commercialize QDs, TCL, #2 in TV shipments and closing (and having released solid financial results after this article was written – editor), beat them to the market for MiniLED TVs and has priced its high-end ~$1,000 less than the Neo, which has had its price reduced at least 4 times in the last 3 months. Even with access to the best chips, the best memory, the best camera technology, the division ranks at the bottom of the rapidly growing and highly profitable notebook market.

- SDC’s OLED TV will not enter the market until the second half of 2022, 9-years after LGD started shipping panels for OLED-by-white TVs. Moreover for the last 2 years the company has been bailed out by one-time payments from Apple, for not buying enough OLED displays. SDC also has a zombie LCD business that is turning out profit at the moment but will operate in the red with the inevitable drop in LCD panel prices unless it is bailed out by (competitor) Samsung Visual. However, now there could be a new OLED TV strategy emerging.

It was reported in June that SDC was considering investing $2 billion to repurpose one of its Gen 8.5 LCD fabs for the OLED IT market. The active matrix process, which was based on a-SI will be converted to IGZO and the deposition process will use a new tool made by Ulvac rather than Tokki. The big difference is that the substrate will be processed vertically along with the FMM. SDC supported Ulvac’s R&D to develop the tool and it is currently in the qualification process.

The tool does not come cheap as Ulvac estimates it will cost between $300 million and $350 million and SDC needs two for each 15,000 substrate/month capacity. While Samsung does not have any firm orders from Apple, there have been reports that Apple could be ordering 100m displays for iPads, MacBooks and monitors and Samsung Visual will buy 10m OLEDs for IT products in 2022 and at least 15m in 2022. A Gen 8.5 fab with 30,000 substrates/month capacity could produce 20m 15.4” panels at 80% yield.

Given that the Gen 8.5 substrate is being processed vertically, and will not be cut, the fab could also be used to produce top-emission, side-by-side TV panels. The Gen 6 horizontal process uses 20 masks for smartphones and the number required for Gen 8.5 has not been provided. A top-emission side-by-side OLED TV panel would be very competitive in the OLED market and perhaps change the long term direction of Samsung’s QDOLED investment and even the way LG produces TV panels.

At present, SDC is just considering TV panels for the Gen 8.5, if there is capacity not being used for IT panels. In 2013, Samsung experimented with the smartphone format for Gen 6 panels with TV size panels on a pilot Gen 8.5. They used LTPS and cut the substrate into 6 pieces before the deposition step. The yields were fine but the cost of LTPS and 6 deposition processes was judged to be too high, and the project was ended. In the new approach, the Gen 8.5 substrate is being cut in half, which could produce three 55” panels on each half or an MMG configuration for panels 65” and above.

The new approach is both good news and bad news for Universal Display. On a positive note, making large panels with a side-by-side format will create more demand for phosphorescent material. On the negative side, it is likely an end to UDC’s foray into OVJP, since OVJP was designed to foster the use of phosphorescent material in large OLED panels, which is accomplished by SDC’s new approach. It eliminates the rational for OVJP and will likely be in production years before OVJP is ready. (BY)

Barry Young is the CEO of the OLED Association