Hat-tip today to Paul Krugman, an economist that writes for the New York times who introduced me to the phrase “rockets and feathers”. It got me thinking about pricing.

In using the phrase, which was new to me, Krugman was talking about the way that when fuel prices go up, the prices go ‘up like a rocket’ but when they start to reduce, they go down ‘like a feather’. Krugman’s point was that firms can contribute to inflationary pressures by earning ‘excess’ margins at these times, especially where competitive forces are relatively weak.

I’ve never been in the fuel business, but the LCD business doesn’t look too different from oil, being basically a commodity driven by supply and demand. For a number of years I was responsible for setting pricing policy for LCD (and CRT) monitors. I also tracked pricing in the market for around 15 years and that gave me an insight into some of the strategies that were used by different brands.

Bob’s Theory of Reseller Pricing

My own experience of having to decide on pricing was mostly based on dealing with resellers in the monitor business. I used to say to the resellers that “as a reseller, there are only three things that matter about the price that can be summarised by these questions.

- Is the product that I’m reselling to my client good value for that client?

- Am I buying at the best possible price given the quantity and terms that I’m buying on?*

- Can I make the margin that I need to sustain my business?”

If you’re sure on these points, the price is right.

(* There is a clause I’ve often seen in purchasing contracts that said that as a supplier I had to guarantee that the customer gets the best price – i.e. I had to guarantee that nobody else would get better prices for the same volume and payment terms. One potential client changed this ‘standard clause’ in their contract to say “for the same volume or payment terms”. That would have meant that they could have insisted on the lowest price for huge volume, if the payment terms were the same! I didn’t sign that contract and I learned that it pays to read every word carefully even when dealing with apparently reputable international companies!)

Rising Prices a Challenge

Rising prices in LCDs were always a challenge and as I was importing from Japan to the UK, I had a purchase ledger that wasn’t in my sales currency which added extra jeopardy. I had to do some currency gambling, but I hated it and tried to mitigate it where I could. When the £ fell, it made life very difficult and while I bought in Yen, many of my competitors were buying in US dollars, which meant that we were sometimes squeezed when they weren’t.

On one particular occasion, the landed prices were rising and I was forced to raise prices by 10%. I expected a sales disaster, but nothing happened except our revenue went up. They had to go up another 5% and again there was no effect on volume. I was furious as this meant that I had probably been under-pricing my products for some time and could have made much more profit! The third rise, though, really did have an effect.

Finding out the price elasticity for a product can allow you to optimise your revenues, but it’s hard to do in a business with resellers as you can’t keep chopping and changing prices. I always believed that price stability was a real asset to a brand. However, in some businesses you can experiment and I remember talking to Dell several decades ago. The firm, at that time, used to do a lot of different offers for its products when nearly all its sales were direct to users. It allowed the firm to be able to analyse the price curve and optimise its revenues.

Different Strategies I’ve Observed

Watching, in detail, the pricing strategies of different firms was interesting, then, when I started my own business in market research. I collected tens of thousands of product prices every month across Europe and sometimes we would look at the different strategies that brands were using. Here are some:

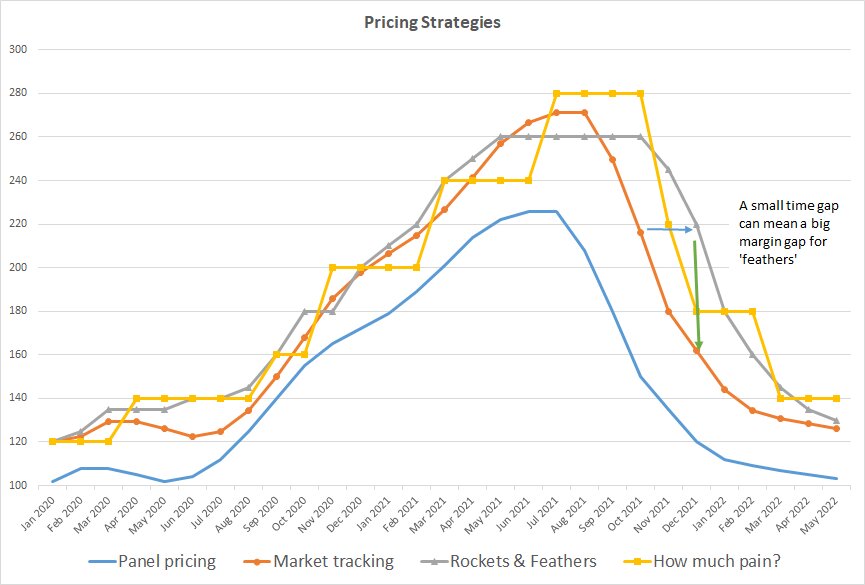

- Tracking the average – there was one particular brand whose prices were always spot on accurate to the average in the market.

- A believer in ‘rockets and feathers’ – the firm would track the market, but just a couple of months later. Customers don’t like to chop and change so they just pushed the tolerance of their customers, but it was a great way to make extra margin.

- “How much pain can I stand” – a company that would hang on and on to its higher pricing until it really started losing significant business – then it would tend to drop sharply.

In the end, tracking the average was probably pretty good for maintaining market share and volume – that brand had a vertical supply chain and needed to keep them working. “How much pain” was a strategy that maintained margins, but at the expense of share at some times. The ‘rockets and feathers’ strategy, had the advantage of keeping share (as long as the price drops weren’t too sharp) while making extra margins as prices fell – a relatively small time difference could make a significant difference to the margin and while it would make customers grumble, they would probably stick with the brand.

Pricing strategies – using DSCC panel price data for the last couple of years as the base. The real advantage of the ‘rockets and feathers was seen when prices are declining.

Pricing strategies – using DSCC panel price data for the last couple of years as the base. The real advantage of the ‘rockets and feathers was seen when prices are declining.

These strategies are great when you have relatively varied channels and lots of resellers, but are probably less effective where you have a market like the US TV market where a handful of retailers have huge buying power. I’m glad I was never active in one of those!

I was often surprised that few of the brands that I talked to ever really used this kind of analysis to work out what the strategy was of others in the market. The strategies of the brands were often surprisingly consistent over time and more careful analysis could have really changed the margins made. (BR)