It was a sign of our times! A few months ago, the industry held its annual upfronts where network and streaming execs tell potential buyers what a powerful draw they are going to be with the best content and biggest audience in the year ahead–all with the audience’s lust to buy stuff.

“I’m a reasonable guy. But I’ve just experienced some very unreasonable things.” – Jack Burton, “Big Trouble in Little China,” 20th Century Fox, 1986

“I’m a reasonable guy. But I’ve just experienced some very unreasonable things.” – Jack Burton, “Big Trouble in Little China,” 20th Century Fox, 1986

In between the parties, the content industry was serious with confusing fantom charts, eye-popping trailers and a parade of A-listers telling media buyers what a great deal the home viewing market is for advertisers. It has become so confusing they had to divide the event into two segments:

- The upfronts are where marketers pitch commercial time on specific shows at specific times before the payTV season begins.

- The NewFronts are where marketers reveal their upcoming slate of shows to advertisers.

Sound confusing? It is! But streaming ads are nothing new. Hulu has been doing it since 2007 … NBD. It’s just that streaming is hot because appointment TV folks and marketers can’t jam any more ads into their hourly time slots…

Ad folks couldn’t be bothered with streaming before because the studios/networks all followed the example of the tech-born services – be ad free – so marketing could only be envious of their growth, reach.

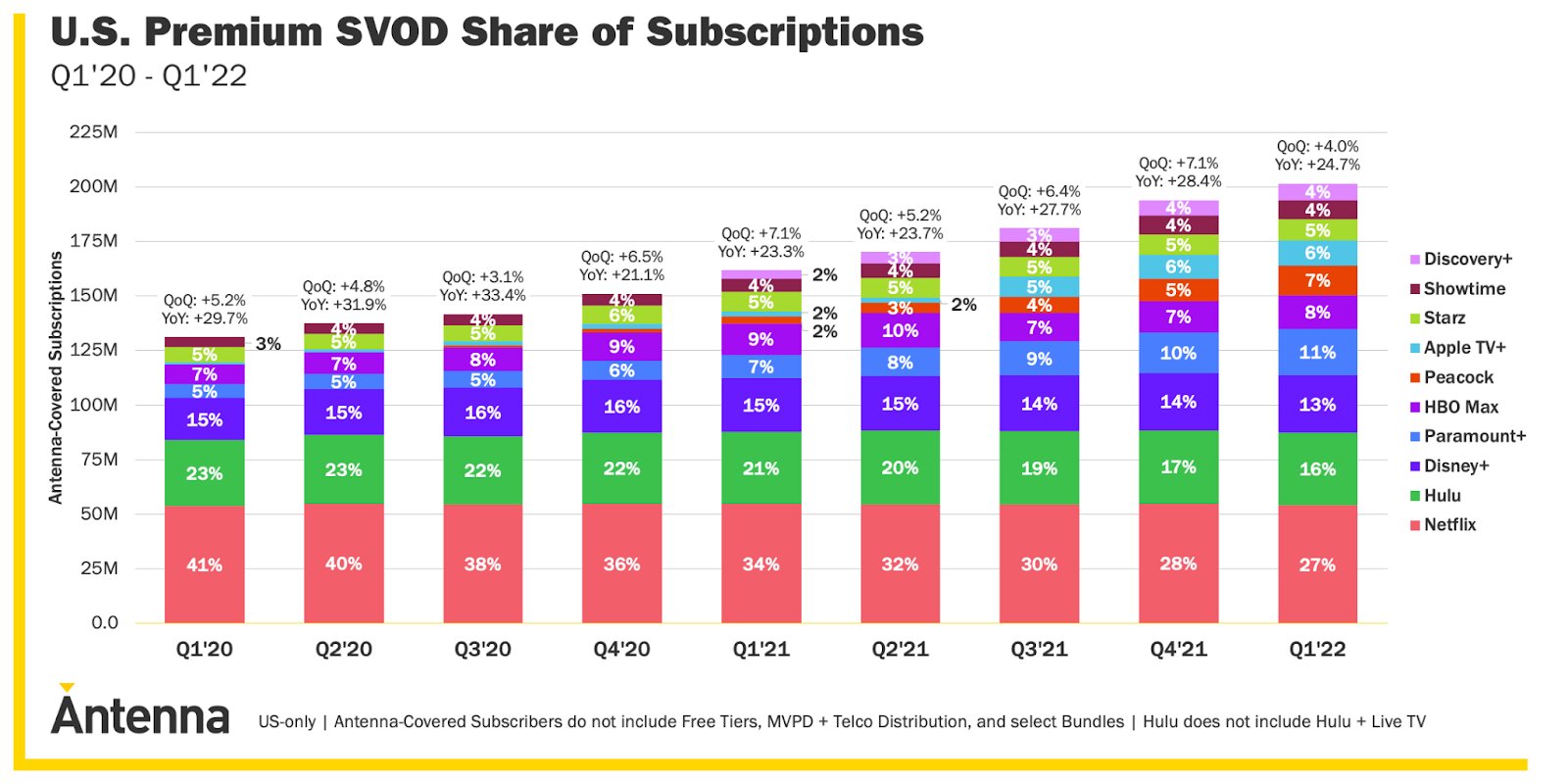

Focus on Eyeballs – The big push for every video streaming service has been to sign up more and more people, which means offering them more and more great (and expensive) content. Worry about profits … later.

Focus on Eyeballs – The big push for every video streaming service has been to sign up more and more people, which means offering them more and more great (and expensive) content. Worry about profits … later.

Focus on the number of eyeballs signing up, keep growing and worry about the content costs … later.

Viola! wall street, shareholders and audience were happy. People warmed up to Netflix, but not because they could save shave/cut their cable bundle. They wanted original content they could watch when they want, where they want without 20 minutes of ads.

Everyone jumped on the airwaves–Amazon, Apple, Disney, HBO, and hundreds or other SVOD options around the globe. Suddenly people could sign up with a few inexpensive streamers, watch insanely great content on their terms and save money. It didn’t take long for the services (with fresh, ad-free content) to blow a major hole in the family entertainment budget:

- ISP – $50+/mo.

- Netflix – $20/mo.

- Amazon Prime – $15/mo.

- HBO Max – $15/mo.

- Disney+/Hulu/ESPN – $14mo

- Apple TV+ – $5/mo.

BAM! folks were right back to their bundle budget with a bunch of services and the hassle of trying to find the one movie/show they wanted to watch without a program guide.

Consumers finally showed the “valuable/desirable” increasingly expensive SVOD services that enough is enough, the entertainment budget was going on a diet, and you may (or may not) still be on the menu.

Services needed a second income to cover some of the mounting content costs and a way to economically keep folks interested in them.

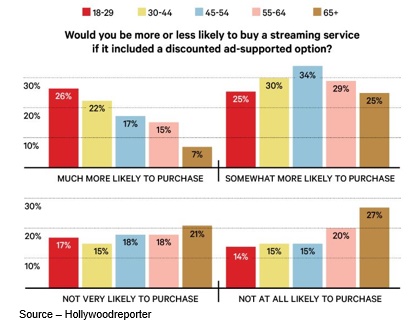

Tiered offerings with advertisers footing some of the costs seemed logical because:

- Services had something marketers wanted – direct viewer relationships

- Services had detailed information about viewers and viewing habits

Marketers didn’t need to “buy” viewers by the gross; they could finally reach people who most closely met their prospective customer profiles.

Paying Attention – Assertions that people hate, don’t watch and don’t pay attention to ads isn’t quite true. What they don’t like are large blocks of ads and uncreative ads that don’t give them a reason to respond.

Paying Attention – Assertions that people hate, don’t watch and don’t pay attention to ads isn’t quite true. What they don’t like are large blocks of ads and uncreative ads that don’t give them a reason to respond.

It was a win-win for everyone. Marketing could be more effective in delivering messages/information to people based on their personal wants, needs, interests and viewing habits. It was a lot more pleasant for the viewer who previously left the room during the 20+ minutes of ads in an hour show or sat there half watching the same ad four-six times an hour that bridged into the second hour just in case you missed it.

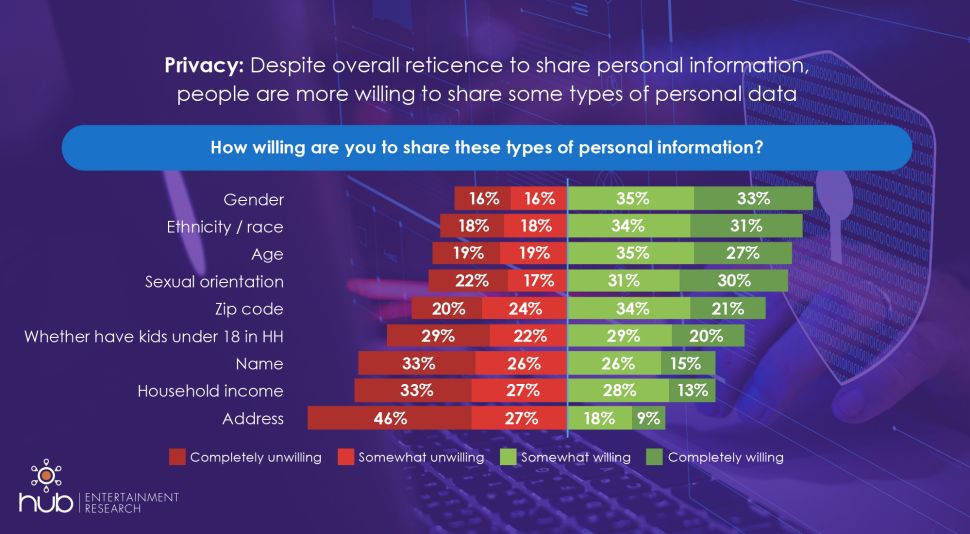

The ongoing problem for marketers is that the streamer’s data bank of viewer information is not something any of them are willing to share in much detail with rating services or marketers/advertisers. The data – locked in a safe inside a vault inside a volcano – is valuable to the service because it enables them to be more valuable to advertisers and viewers.

Cautiously – People will share certain personal information with services and product providers if they feel that you will respect and not abuse their privacy and will protect the data.

Cautiously – People will share certain personal information with services and product providers if they feel that you will respect and not abuse their privacy and will protect the data.

Content and product messages are all about personalization. The data enables services to develop/offer the movies/shows families most want to watch and keep them coming back for more in return for a few minutes of brief product messages.

It helps marketers to do a better job of personalizing service/product messages that recognize, respect and influence the consumer. As long as their personal information is used properly and protected, the more personal information consumers will share. Trust and relationships are built from a foundation of trust and respect.

Shorten Messages – Developing/delivering short, concise and effective ads isn’t easy but it’s well worth the extra effort.

Shorten Messages – Developing/delivering short, concise and effective ads isn’t easy but it’s well worth the extra effort.

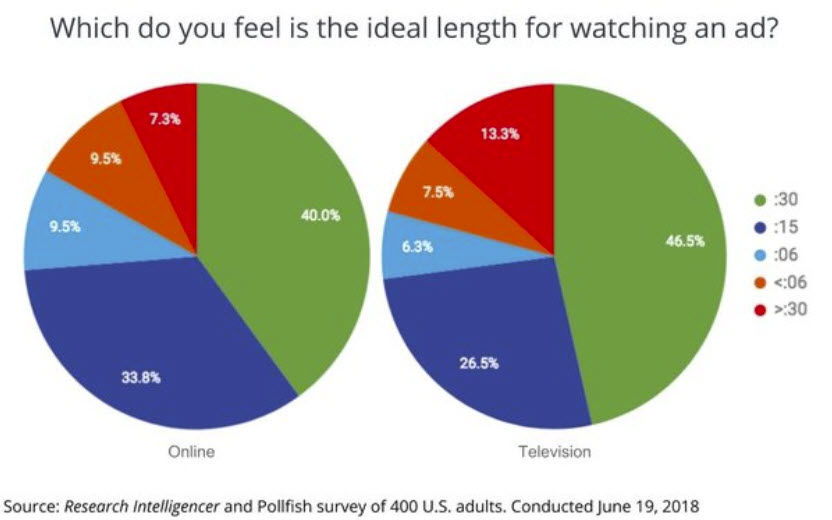

As opposed to the old appointment TV route, AVOD services and advertisers are listening to the audience to keep them involved from the beginning to the end of the message. Marketers and ad folks initially balked at the idea of shrinking their “valuable” messages from 1+ minute down to 15-30 seconds. Surprisingly, creative marketers found that the shorter the amount of time they shared with the consumer forced them to be more effective in their ad message presentation.

Those that don’t listen … don’t get heard.

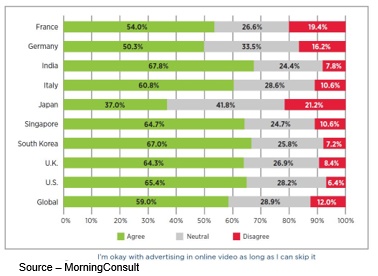

May Not Interest – Not every ad is of interest or import to all people, and if they quickly realize this isn’t me, the ability to skip is something she/he appreciates. Streamers need to keep the audience in mind when they offer up their content and ads.

May Not Interest – Not every ad is of interest or import to all people, and if they quickly realize this isn’t me, the ability to skip is something she/he appreciates. Streamers need to keep the audience in mind when they offer up their content and ads.

In addition, services and marketers have also uncovered new digitally delivered opportunities with the right mix, location and types of ads – binge, preroll, home screen, pause, shoppable or interactive ads. DTC has helped the advertising creative content team of writers, directors, actors as well as production/post crews to better understand how to attract and entertain consumers; capture audience attention/praise.

That data also gives them new opportunities to improve and enhance marketing messages!

The result of all of this behind-the-scenes work (attention to detail and taking their lead from the viewer/consumer rather than the salesperson) is that people like the change and are more receptive to the advertising message(s). The major problem for most AVOD services is that they had a solid reputation of being the place you went when you were nostalgic. You know, when you wanted to watch the stuff that was great when you were a kid – I Love Lucy, Eight is Enough, Buck Rogers, Little House on the Prairie, Love Boat, V, Airwolf, A Team, Chips, Knight Rider, Xena, Walker and a gazillion more including some awesome – and not so awesome – movies.

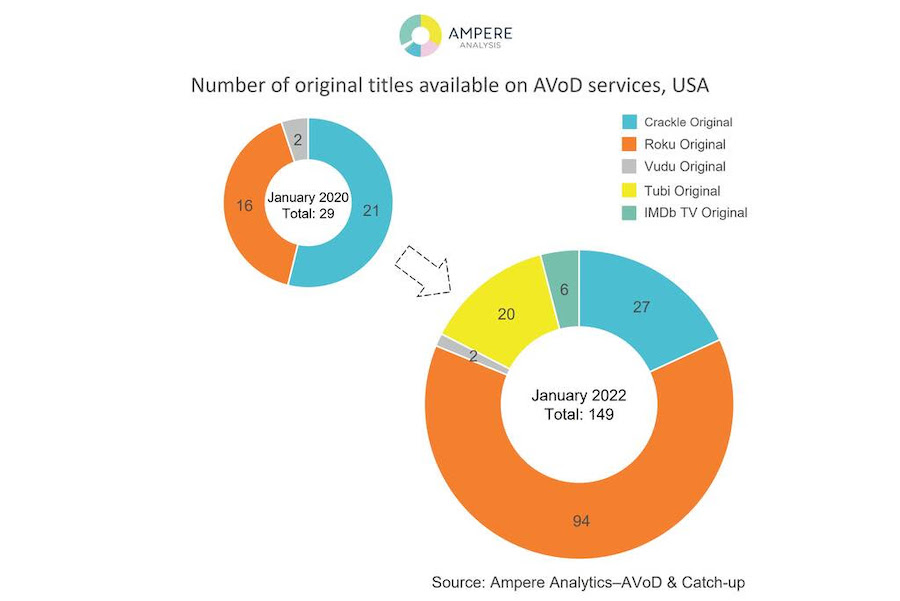

To attract more of the SVOD crowd, the leading AVOD players – Tubi, IMDb TV (now Freevee), Pluto, Crackle, Tudou, IQiyi, Tencent, Eros Now, Rakuten TV, Hotstar and more – have joined the original content goldrush.

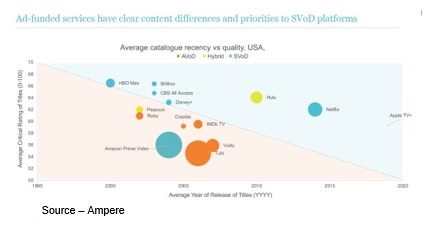

Different Stuff – Ad-supported streaming services understand they also need to invest in unique content to attract an audience and the volume of new material they are delivering continues to grow.

Different Stuff – Ad-supported streaming services understand they also need to invest in unique content to attract an audience and the volume of new material they are delivering continues to grow.

In the U.S., AVOD services have released over 100 new original titles in the last year with aggressive new project development programs in the years ahead. The increasing investment follows the shift of subscription streamers to control exclusive content for their viewers as major studios bring content home for their own SVOD services. The more exclusive content, the greater the number of steady viewers.

Just don’t expect them to invest in new content – projected to be about $70 billion this year – compared to SVOD players including Netflix, Disney, Warner/Discovery, Apple and others which should surpass $230 billion in 2022. It’s difficult to justify the multimillion dollars per-hour SVOD investments.

One exception is Freevee, Amazon’s renamed IMDbTV, which will have access to more of the MGM library and assistance from Amazon Prime TV to expand its visibility, penetration and global expansion. The other exception is Paramount+ with a slow growing library with a number of family-targeted projects like Yellowstone, 1883, Star Trek: Picard, Halo and crossovers from Paramount’s cable offering, Showtime.

AVOD originals are good – and unique – but probably not enough to pull viewers away from favorite SVOD services.

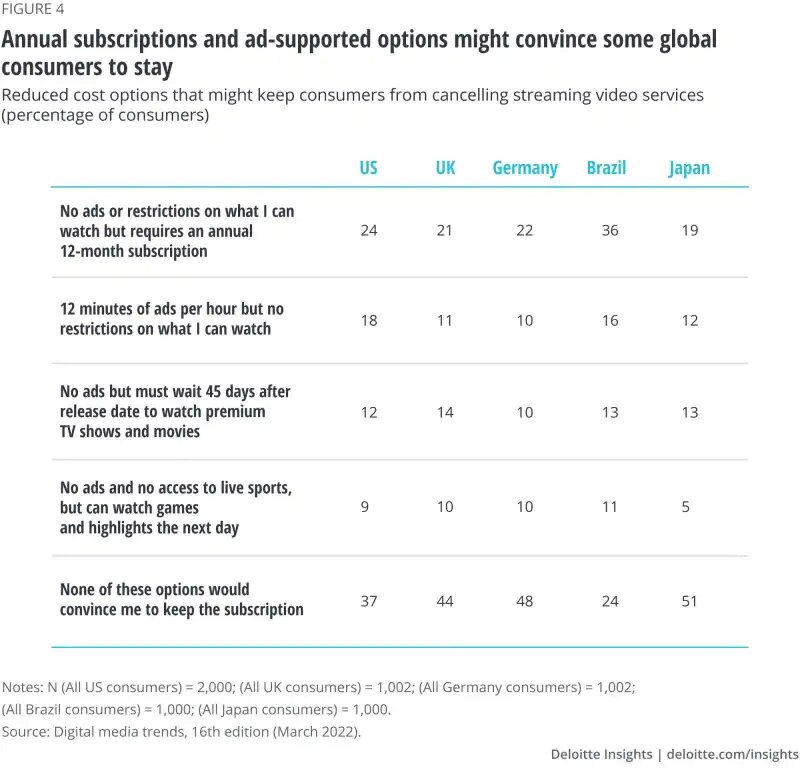

Limiting Churn – The streaming M&E industry has grown to the point where subscriber turnover is becoming a major concern for everyone. Moving forward, management will have to experiment with approaches to win and keep subscribers as long as possible. SVOD subscribers like to think of themselves as first-class viewers that watch their movies/shows without any ad interruption. Changing seats (churn) is okay but moving permanently to main-cabin viewing is tough. People still remember the bundle TV experience when the ad volume grew … and grew … and … The pain still lingers.

Limiting Churn – The streaming M&E industry has grown to the point where subscriber turnover is becoming a major concern for everyone. Moving forward, management will have to experiment with approaches to win and keep subscribers as long as possible. SVOD subscribers like to think of themselves as first-class viewers that watch their movies/shows without any ad interruption. Changing seats (churn) is okay but moving permanently to main-cabin viewing is tough. People still remember the bundle TV experience when the ad volume grew … and grew … and … The pain still lingers.

As Netflix discovered this year, people aren’t willing to sign up for – and keep – every SVOD service that looks sorta, kinda interesting–especially when it’s so easy to sign up for a movie or two, cancel to pick up someone else’s inviting content and maybe come back … maybe. Deloitte estimates that the average churn rate is about 37% in the US and 30% in countries such as the UK, Germany, Brazil and Japan.

Too Much – The number of streaming entertainment options has quickly become overwhelming for consumers. A services content may be “really worth it” as far as they’re concerned but so is the next guy’s. Changes will have to take place … soon.

Too Much – The number of streaming entertainment options has quickly become overwhelming for consumers. A services content may be “really worth it” as far as they’re concerned but so is the next guy’s. Changes will have to take place … soon.

The problem is there are just too d**n many good services with great content! You have watched their stuff in their walled garden, going from garden to garden until you find just the movie/show you were looking for or simply settle for something to relax with. We lower our blood pressure by using free services like JustWatch to look through movies/TV shows available and go directly to the service/project. The more you use it, the more hints you give the site on what you like – and don’t like – the better the recommendations.

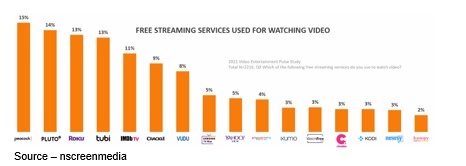

As if the personal/home entertainment didn’t have enough confusion, the most rapid new growth arena is FAST (free, ad-supported television) – services that bring together a growing range of AVOD – and some SVOD – services all in a single location.

Your Ad Here – Free or ad-supported streaming services are growing in popularity and quantity. People are increasingly willing to share a few minutes of their time to “pay” for their viewing enjoyment.

You could access them with your new huge smart TV or CTV device – Xbox, PlayStation, Roku, Amazon Fire TV, Apple TV and others. We chose several smart TV screens (beautiful images/sound BTW), turned off the smarts and added CTV devices connected to the screens in the house.

Why the added boxes? Simple.

- Our son prefers more serious gaming with a serious gaming device.

- Our daughter prefers all things Apple.

Vizio introduced one of the first “smart” TVs that promised a perfect streaming video experience. It turned out they also captured/used/sold our personal information – even when the TV wasn’t on.

Our new LG smart TV probably doesn’t do that but? Heck, we don’t really trust Alexa or Siri completely, but they are part of the family and do so much around the house so…

According to IAB Media Center, CTV/FAST accounts for 36 percent of linear and streaming time and is increasingly important to marketers (currently 18 percent of video ad dollars). The biggest push for advertisers is to enable them to manage cross-platform, cross-channel video buys which could happen as early as next year. FAST entertainment options are growing rapidly.

Tubi has a library of more than 40,000 titles including news and sports. Freevee has more than 75 channels. Roku, perhaps the oldest FAST provider, has more than 200 channels and continues to increase its growth nationally and internationally. And the other entrants are expanding their linear and streaming offerings as quickly as possible to satisfy their growing subscriber base.

At the end of last year more than 129 million folks regularly accessed ad-supported content on demand on a regular basis, according to Insider Intelligence. They project that by 2025, there will be more than 165 million users and advertising revenue will increase by more than 50% per annum.

The gnawing question for content creators and subscribers is how will Netflix respond?

“The first thing they will have to do is harden their subscription service including more robust content protection and security to reduce/eliminate password sharing and piracy,”

said Allan McLennan, Allan McLennan, CEP of media, head of M&E North America for Atos.

“In the near term, they may lose some subscribers,” he continued, “but over the long haul, it will be appreciated by the content creation industry and users who appreciate the best unique video stories. The other SVOD services will quickly follow that lead which will benefit everyone in the industry,” he added.

“When it comes to an ad-supported tier, the company’s home market – the Americas – will experience the greatest change,” he continued. “The most popular speculation is that people will be able to sign up for FAST/AVOD service for about $10 or a 50 percent discount from the subscription rate. The same will be true for their international subscribers.”

McLennan emphasized that with a subscriber base of more than 200 million, the company continues to be the world’s largest SVOD service, far ahead of services that tout their 50-80 million subscribers.

“They continue to be the people everyone else is chasing,” he said, “and they will continue to be one of the top three subscription services, even when the dust settles.”

Source – “Big Trouble in Little China,” 20th Century Fox

Source – “Big Trouble in Little China,” 20th Century Fox

“Quality ad-free and ad-supported content services can live side by side,” said McLennan.

Then he informed me as Jack Burton did in Big Trouble in Little China, “… and your phone is dead, by the way.” Darn! (AM)

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. Internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. Extended range of relationships with business, industry trade press, online media and industry analysts/consultants.

This article does not count as one of your two free articles if you are not a Display Daily/Display Insider subscriber.