Well, I signed up for the TechFluence pre-CES technology event and was pleased to see that Stephen Baker of NPD was due to speak. He’s always informative and has a good and unique point of view on the US Consumer Electronics market.

After introducing NPD, Baker said that it has been an extraordinary year but the key products have been the ‘traditional’ ones – TV, PCs and mobiles. He then went to talk on about technology products – we assume he was planning a separate talk in NPD’s activities at CES on TV. He also didn’t cover the notebook or desktop PC markets.

After introducing NPD, Baker said that it has been an extraordinary year but the key products have been the ‘traditional’ ones – TV, PCs and mobiles. He then went to talk on about technology products – we assume he was planning a separate talk in NPD’s activities at CES on TV. He also didn’t cover the notebook or desktop PC markets.

Tech is not a luxury, but a necessity now and WFH and EFH have really helped, he said. IT products have a very wide appeal for work and leisure and looking ahead strong volumes are likely to continue whatever happens in the economy. Tech is said to be a product business, not really a use business and in the last year, tech has had the right products for the new working and leisure conditions.

Direct Channels Develop

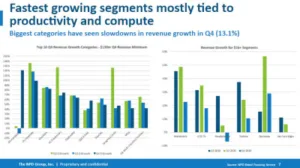

Finding the right channels has always been a challenge for consumer electronics and that was even more true in 2020. The ‘Back to School’ period saw good sales, but Thanksgiving was ‘muted’. NPD is still counting what happened over Christmas, but Q4 may be 15% up over 2019. With 25% up in Q2 and Q3, the market is likely to have been up by $15 billion or 14% in value over the year.

TVs PCs and tablets tracked alongside the marketplace in Q4. There is a question about how much these categories can drive market growth going forward.

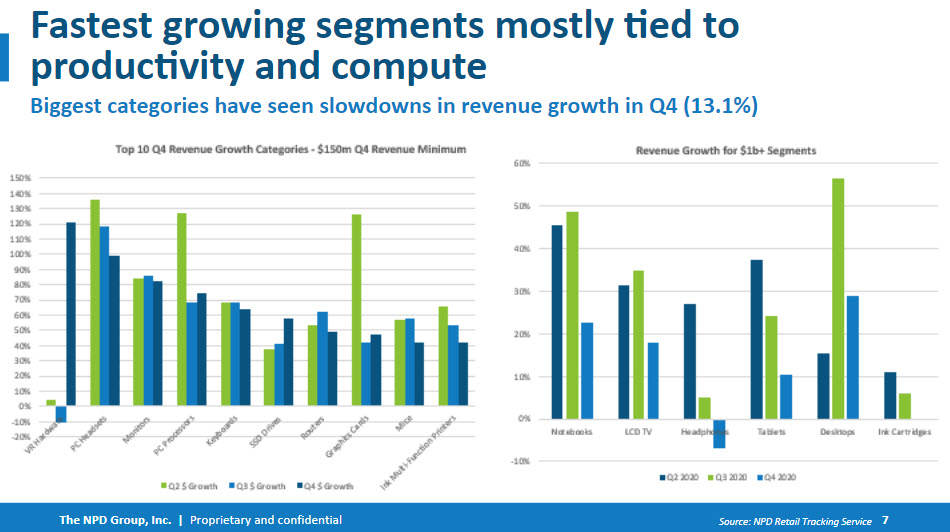

Baker explained that tech is fundamentally an online business and each quarter in 2020 saw more than 50% of sales being done online after a period of several years of 2% growth per quarter. Tech is likely to stay at around 60+% in the future. “The genie can’t go back in the bottle”, he said and the trend will be online.

Retailers did well dealing with the pandemic although they lost some share to online-only retail, but they lost more to direct purchasing from a manufacturer. Direct to consumer has become a major driver of growth.

The Winners Are….

Winners have been

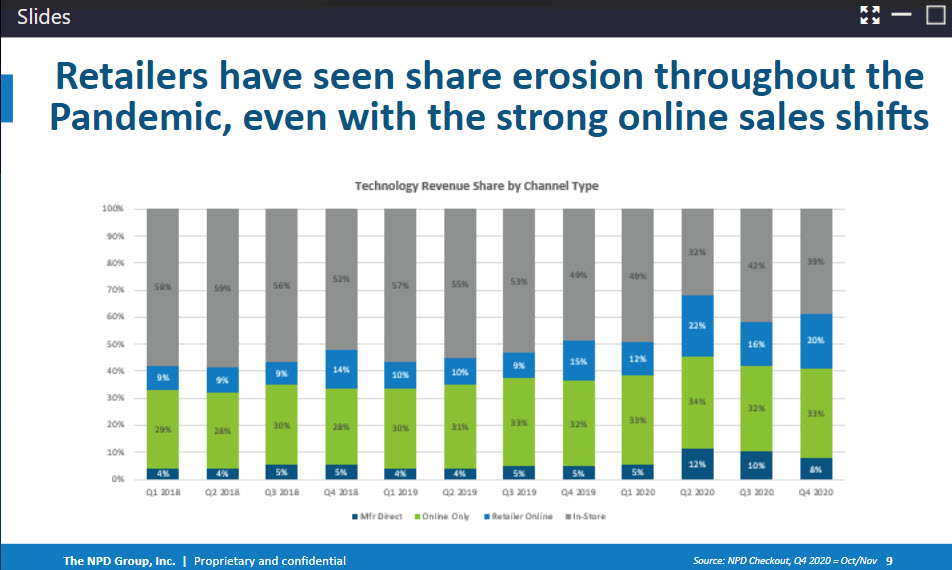

- PC DIY – building a PC has been a very popular activity during the crisis, with gaming PCs particularly popular

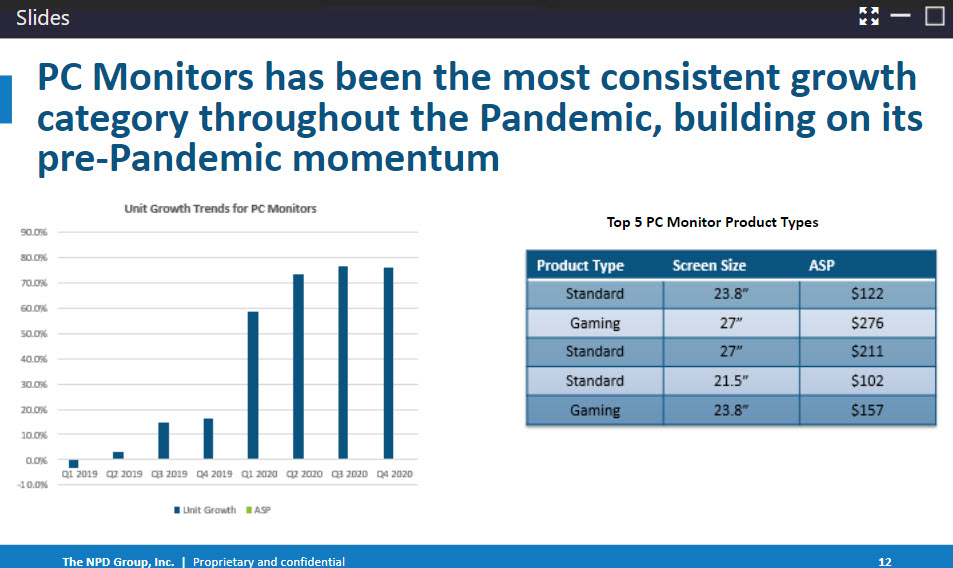

- Monitors were consistently good sellers for work from home (WFH) and education from home (EFH) as well as game playing

- Gaming PCs, mice and peripherals, but overall PC gaming was good (as well as consoles)

- PC headsets were surprise winners. Gaming headsets grew, but they also grew in B2B and WFH

- Networking – “infrastucture is sexy again” and “routers need some love”, Baker said. There was a big change in the appreciation of the need for good infrastructure.

PC component growth was great and PC case sales are a good proxy for PC building. Case sales were up from 1 million to 1.7 million.

Monitor sales started to grow before the pandemic and standard 23.8″ monitors did well while in gaming 27″ was the most popular category. Game products get a good premium, Baker explained. All gaming hardware was up and gaming peripherals went up in ASP.

Unusually, keyboards and mice can be high priced and yet still win high volume – which is not typical of all CE markets, where low prices are usually needed for high volume.

Headsets did well (that is to say, headphones with microphones for conferencing and gaming). Commercial webcams have done better than home devices.

Baker identified three positive surprises in some relatively small markets

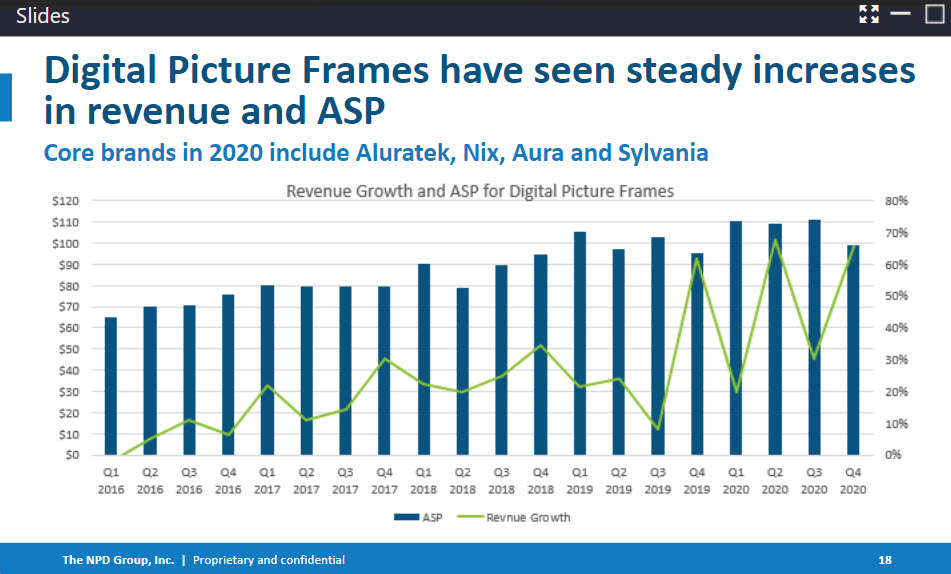

- The value of the Digital Photo Frame (DPF) market has increased as ASPs have increased as the devices have become more connected.

- Cleaning accessory sales have increased

- The Networking cable market grew in value. Wi-fi is great, but cables are best for stable networking. “The world needs wires”, Baker said

He also identified three underperforming categories.

- Smart home – security not so important when you are always at home! Security cameras are around 50% of the segment revenue for smart home products.

- Headphones – some volume was lost to headsets. That was because buyer were away from home less often and for less time.

- Wireless power solutions declined. Again, there was less travel, so there was less need for wireless power.

I plan to try to catch up with Baker’s view of the TV market over the CES period. (BR)