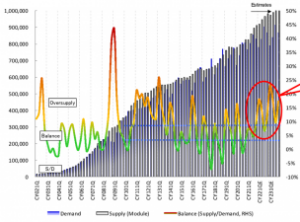

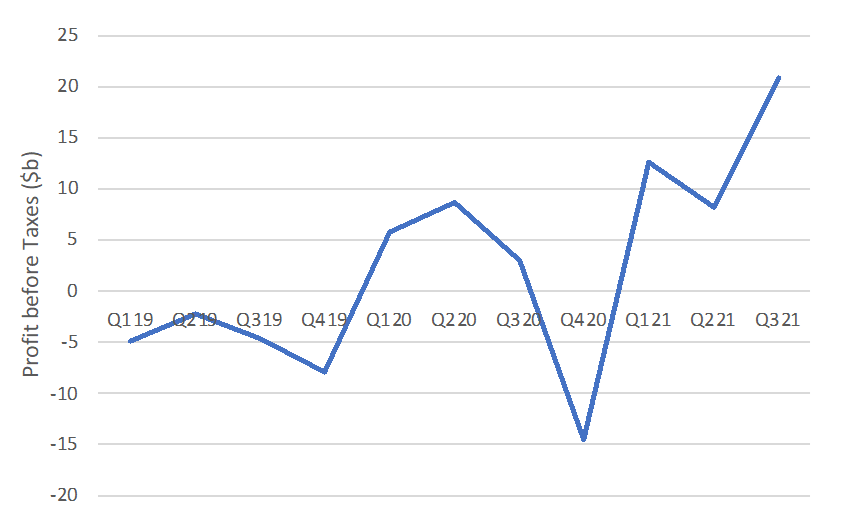

AUO announced Q321 revenue of $3.56b up 35% Y/Y with GP of $0.98b up 670% Y/Y. The firm’s guidance for Q421 calls for low single-digit decline in shipments (surface area) and mid-single digit declines in blended ASP.

Figure 1: AUO Area Shipments and Blended ASP—Q1-13 to Q3-21 – Source: Company Data/Mizhuo

Figure 1: AUO Area Shipments and Blended ASP—Q1-13 to Q3-21 – Source: Company Data/Mizhuo

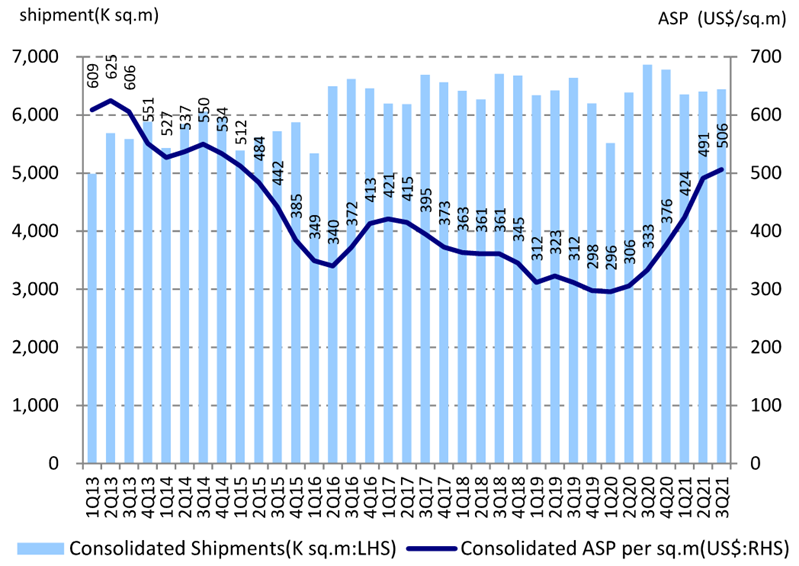

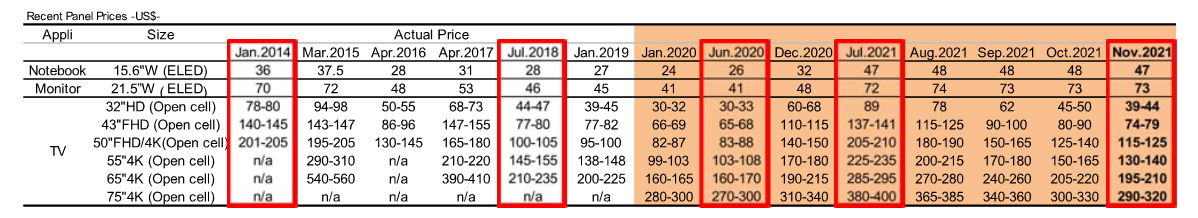

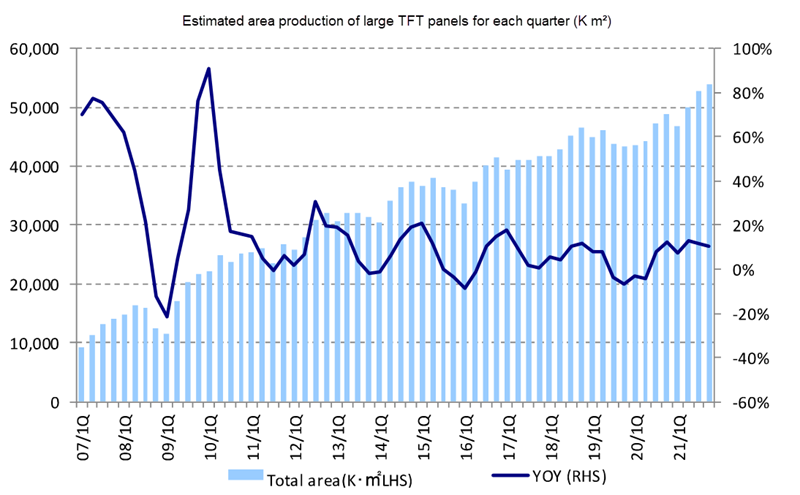

The large area LCD makers are in the throes of the downside of the crystal cycle, where demand is contracting, and supply is expanding. As shown below, over the next two years the imbalance will grow to as much as 22% and averages 12.5% – more than double the 5% glut which signifies a balanced environment. At a 15% glut, prices drop and at 22%, prices will typically drop to below cash cost, driving the smaller panel makers to take drastic action.

Getting out of this condition occurs when new demand is created (by a new application or significant economic growth) neither of which has a high probability. More likely, some panel makers will stop producing and or consolidate. Samsung Display Corp and LGD are already planning to exit the LCD panel manufacture so that will not affect the supply/demand curve and the entry of Sakai Display Product’s (SDP’s) new Gen 10.5 fab will only exaggerate the situation. The weak players, AUO, Innolux, Sharp and smaller Chinese LCD suppliers could become targets for consolidation.

Figure 2: Large Area LCD Panel Supply/Demand – Q1-02-Q4-23 – Source: Mizhuo Securities

Figure 2: Large Area LCD Panel Supply/Demand – Q1-02-Q4-23 – Source: Mizhuo Securities

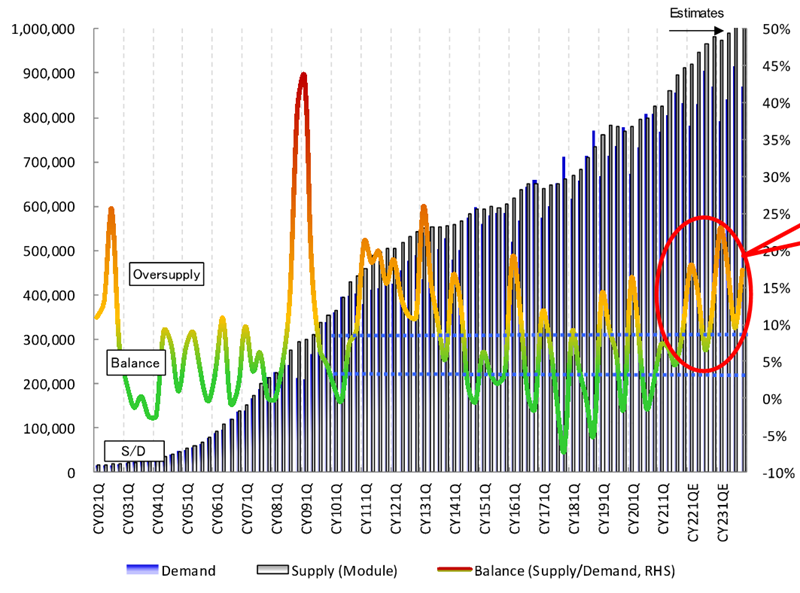

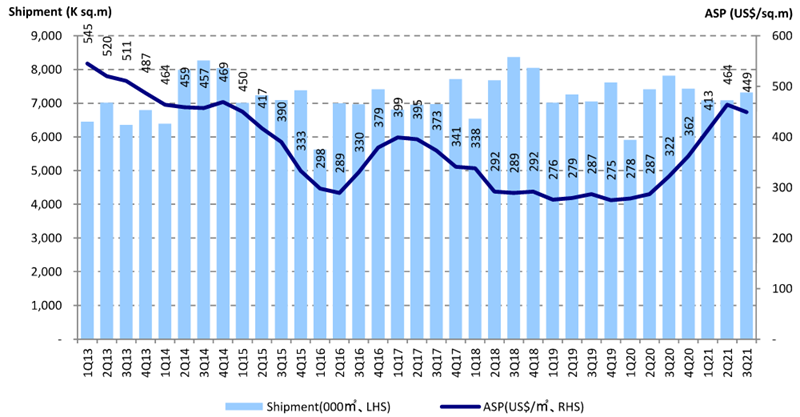

AUO must now recognize that the end of their extraordinary profitability is near. TV ASPs are down 50% from the highs of Jul’21; IT prices are flat to down sequentially and volume in Q421, for. TVs monitors and notebooks are forecast to be down.

Table 1: Recent Panel Prices by Application Source:Mizhuo

Table 1: Recent Panel Prices by Application Source:Mizhuo

Based on the progression of ASPs, AUO could well be headed to the performance levels of the late 2019 and early 2020. Moreover, the recent period of profit growth caused some large LCD panel makers to start re-investing and it appears that in these times, when there is already excess capacity, new capacity is coming to the tune of $12 billion, which is the equivalent of 180K of Gen 10.5 fabs. That excess capacity will put additional pressure on TV pricing.

Figure 3. AUO Net Profit Before Taxes — Q1-19-Q3-21. Source: Company Data/Mizhuo

Figure 3. AUO Net Profit Before Taxes — Q1-19-Q3-21. Source: Company Data/Mizhuo

Innolux, which is in a situation similar to AUO, reported revenue of $3.34 billion, up 25% year on year and down 0.2% sequentially with operating profit of $667.8m up 12-fold year on year. The firm’s guidance for Q421 calls for

- Large Area: Mid-single digit sequential decline in shipment volume plus high single digit decline in ASP

- Small/medium: High single decline in shipment volume and flat ASPs

(BY)

Figure 4: Innolux Area Shipments and Blended ASP – Q1-13-Q3-21 Source: Company Data/Mizhuo

Figure 4: Innolux Area Shipments and Blended ASP – Q1-13-Q3-21 Source: Company Data/Mizhuo

Figure 5:Large Area TFT LCD Panel Production (Km2)– Q1-07-Q3-21 Source: Mizhuo

Figure 5:Large Area TFT LCD Panel Production (Km2)– Q1-07-Q3-21 Source: Mizhuo

(For those that are new to the industry, the Crystal Cycle has been the key dynamic of the LCD supply industry for a couple of decades. Over time, there have been a lot of forecasts that the cycle might finally come to an end – the latest at Display Week 2021, (LCD Industry Stability Could Break Out….). One of the first such forecasts was set out at Display Week in 2005! (Here We Go Again on the Crystal Cycle) This summer has clearly shown that the cycle hasn’t disappeared. As discussed, the fact that Samsung Display and LGD have already made their minds up that there is no long term future for them in LCD may help dampen the cycle a bit, but we’ll see! (BR))