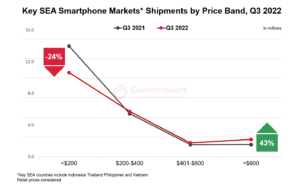

Premium smartphone (priced more than $400) shipments in the key Southeast Asian markets* increased 29% YoY in Q3 2022, according to Counterpoint Research’s Southeast Asia Monthly Smartphone Channel Share Tracker. On the other hand, total smartphone shipments declined 10% YoY during the quarter. Southeast Asia is still facing macroeconomic headwinds.

This has resulted in weak business and consumer sentiments. Investments have slowed down too, including FDI volumes for some countries. All this has led to key smartphone OEMs collecting more than the required inventory before Q4 2022. The massive YoY increase in premium smartphone shipments reflects the resilience of this segment’s customers during difficult times.

September was supposed to see an increase in shipments across the region. But in 2022, this seasonal behaviour has been limited due to consistently low consumer sentiment. The lower economic strata are reeling under economic uncertainty, which shows in lower shipments and higher inventories overall. The Q4 festive season is expected to bring some relief.

There were some brand-level hits and misses too in Q3 2022. While Samsung shipments fell 13% YoY, Apple’s shipments were up 63% YoY across all the key countries. Vietnam seemed to be grabbing iPhones at a faster rate than its neighbours.

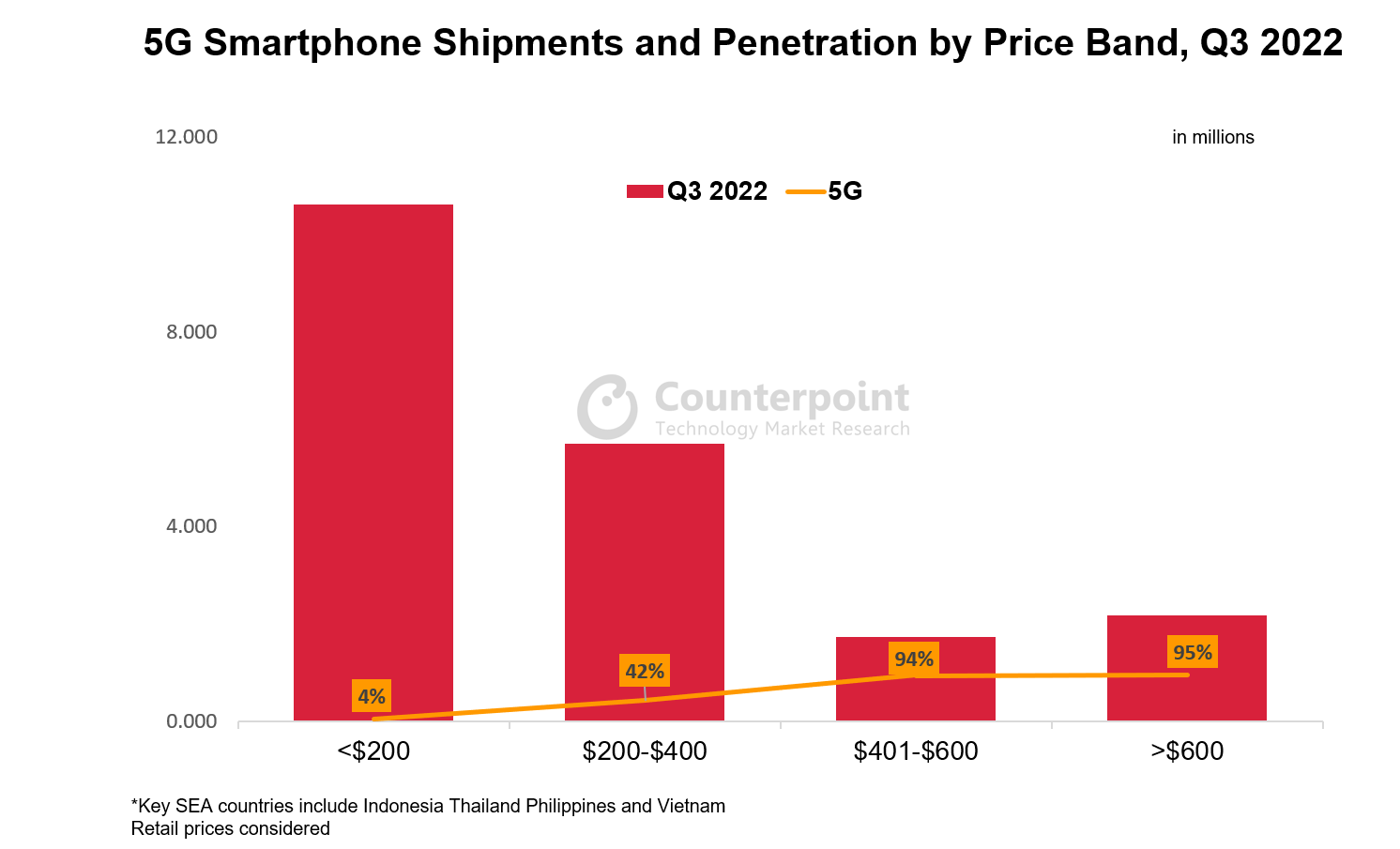

5G smartphone demand has seen slow progress in some countries like Indonesia and Vietnam while it is much faster in Thailand and Philippines, where the network is better and a large number of consumers are quite tech-savvy. Operators are still giving good package value to consumers even as it affects margins.

Specifications like processor, RAM, internal storage, battery capacity and charging speed remain a priority. Even if consumers in Indonesia and Vietnam do not actively consider 5G as a purchase factor, they tend to count it as a feature needed for the future.

Operators like Globe in the Philippines are keen on expanding their 5G infrastructure beyond the metro areas, whereas in Indonesia, 5G use cases have started showing for industries like mining. The $200-$400 5G smartphone price band saw a 73% YoY growth, which means that 5G is being made a staple feature by most OEMs.

Commenting on the economy, Senior Analyst Glen Cardoza said, “Most Southeast Asian countries like Indonesia, Thailand and Philippines raised interest rates in Q3 2022 to ease the blow of rising prices on the common consumer. Inflation during the quarter was an average 5% in most SEA countries, which is not alarming but did take its toll on consumers. Prices for fuel, overall logistics and staple items went up, causing consumers to hold on to their wallets and defer big expenses like smartphones. The majority of such consumers are blue-collar workers or from economically weaker sections. While a country like Thailand is struggling to regain pre-COVID volumes due to depleted tourism levels, Vietnam has shown a 13% GDP growth in Q3. The effect of the same is reflected in the smartphone shipments in the last few months.”

OEMs still have more than the required inventory of older models which they might try to sell using all possible marketing tools across offline and online channels. New models launched since August will continue to fill the market with mostly 5G devices. Offline retail players are likely to propagate experiential outlets, increased payment convenience, trade-in offers and better after-sales support. Models like Samsung’s Galaxy A04s and vivo’s Y02s might lead the charge in increasing low-range smartphone shipments again. This is necessary for the market to portray normalcy.

* Key Southeast Asia countries include Indonesia Thailand Philippines and Vietnam