A power outage at one of NEG’s main glass production sites in Japan may exacerbate an already tight glass supply situation and lead to a full-blown glass shortage. An unrelated tank problem at one of Corning’s Gen 10.5 plants in China adds to the supply woes. A constraint on glass supply may lead to a corresponding constraint on LCD panel supply which may lead to even greater price increases for LCD panels.

On December 15th, NEG issued a statement about the power outage at Takatsuki, one of NEG’s two sites in Japan for melting display glass. The statement indicated that “this power outage has caused the suspension of production of glass for FPDs and we have been working toward an early restoration of production”.

DSCC estimates that NEG capacity at Takatsuki in Q4 2020 is approximately 6 million square meters for the quarter, or 2 million square meters per month. This represents almost 20% of NEG’s worldwide capacity and nearly 4% of total industry capacity for display glass.

Separately, Corning has experienced a tank failure on one of its lines at its Gen 10.5 facility in Hefei, China, which supports BOE’s B9 fab there. That has led to some supply constraints from Corning at Gen 10.5 plants. A single Gen 10.5 tank would represent about 1.5% of Corning’s overall capacity, and about 0.7% of total industry capacity, so by itself would not create any meaningful disruption, but Corning’s problem in Hefei may prevent BOE from accelerating production there to take advantage of supply constraints elsewhere.

Flat Panel Display Glass Production Sites

NEG’s situation is more serious than Corning’s, this will result in a meaningful hit to NEG’s display glass revenues in Q1 2021. A tank failure typically requires a complete re-work which takes 3-4 months, but we understand that this outage was not a complete tank failure but a failure of “feeder lines” (NEG’s older FPD glass plants have multiple fusion draw lines off of each large tank). NEG believes that they will be able to repair the feeder lines gradually from January through March with a “hot repair” and the plant can be back to full capacity by the beginning of April. NEG believes that they will be able to achieve as much as ½ of their capacity in Q1 2021, which would imply a shortfall of 3M square meters in Q1, or about 4M square meters in total, including lost production in December.

Although the power outage results in the loss of 2/3 of December’s capacity, it is not likely to materially impact NEG’s Q4 revenues because of the pipeline of glass supply to customers. Much of the production from Takatsuki is sold to customers in Korea and Taiwan. The glass gets shipped in a semi-finished state to a separate finishing plant in those regions, then finished and sent to customers. The supply chain pipeline would typically take a minimum of three weeks, and more typically four to six weeks, between glass melting and receipt by the customer. Therefore the entire impact of this outage will be felt in Q1. NEG’s statement on the matter indicated that “we do not expect it to have a significant impact on … earnings for fiscal 2020.”

With such a supply disruption, panel makers which rely heavily on NEG will be negatively affected, while panel makers that are supplied primarily by Corning or AGC may be positively affected, especially in the current LCD panel supply/demand environment with panel prices increasing. We understand that Takatsuki has been NEG’s only site that is not capable to make Gen 8.5 glass; it could make up to Gen 7. Gen 8 glass can be cut to smaller sizes, of course, but it’s likely that the main impact will be felt by NEG’s customers in smaller gen sizes.

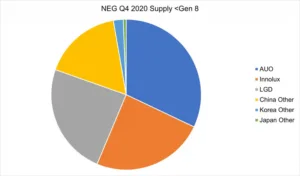

DSCC’s Quarterly Display Glass Report contains a detailed database of the display glass supply chain including glassmaker shares for Corning, AGC, NEG, and all others for every flat panel display glass fab in the industry. The next chart here is generated from one of the pivot tables of that report, showing NEG’s top customers of glass smaller than Gen 8.5.

NEG Supply of Display Glass in Q4 2020 for Sizes Less than Gen 8

Gen 7 and smaller size glass represented about 23% of NEG’s glass demand for Q4 2020, and most of that glass went to three customers: AUO, Innolux and LGD. Additional quantities of Gen 5 glass went to several customers in China, with smaller amounts to Korea and Japan.

NEG has additional glass melting facilities in Japan (Notogawa), Korea (Paju), and China (Xiamen), and NEG will doubtless make every effort to maximize production at all of these facilities, but the most likely impact will be felt by LGD and the two Taiwan panel makers. NEG’s shipments of <Gen 8 glass to these three customers represented 11%, 8%, and 9% of the overall glass demand for AUO, Innolux, and LG Display, respectively. Some smaller players in China, notably Infovision and Truly, get a majority of their glass from NEG and may be impacted more severely.

In response to the power outage, according to a report from en24news.com, LG Display stated that ““We are aware of the power outage, and we will ensure that there is no disruption in the supply of parts.” While LGD has stated that the outage will not disrupt supply, we expect that panel makers throughout the industry will cite the outage in price negotiations, and that this will lead panel prices to continue to rise in December and January.

For its part, while Corning would not comment on problems with Gen 10.5 glass in Hefei, they did provide this statement:

“It’s Corning’s policy not to comment or speak on behalf of others in the display industry. We can, however, reaffirm the messages we’ve shared with investors and other stakeholders – including at our Q3 investor call – about the value chain and the impact of COVID 19 on our operations.

TV demand has remained relatively robust YTD and value chain inventory is tight.

The COVID-19-driven restrictions on travel and transport caused delays to our new G10.5 plants’ ramp schedules. However, we successfully started up our G10.5 melting operations in both Wuhan and Guangzhou in Q3. The pandemic-related logistical challenges mid-year are causing a temporary shortage of our Gen 10.5 glass now. Corning will continue to ramp to fully support our customer needs in the upcoming months.

While we don’t disclose supply plans for specific customers, we have communicated our supply plans with all impacted customers and Corning will continue to ramp to fully support our customer needs in the upcoming months. We are actively pursuing all available options to best meet our customers’ needs. This includes accelerating capacity ramp timelines and leveraging our worldwide manufacturing footprint.”

The last time such a display glass supply disruption happened was more than ten years ago. In 2009, as the display industry was recovering from the 2008 financial crisis when Corning experienced two disruptions, first from an earthquake and then from a power outage, both in Taiwan. The resulting constraints on LCD supply led to panel prices increasing and increased profits for panel makers that were not affected by the glass shortage.

The 2009 supply constraint also led Corning to hold glass prices steady for several quarters; that was the last time that display glass prices did not decline on a Q/Q basis. In the decade from 2010-2020, glass prices declined more than 80% in US$ terms. With a glass shortage looming in Q1 2021 and considering that LCD panel prices have increased by nearly 50% in the last six months, we may see glass prices flat or even increasing in Q1 for the first time in this century, if not the first time in the history of the display industry.