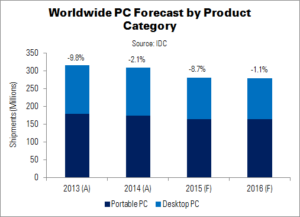

IDC continues to predict the ‘eventual stabilisation’ of the global PC market, with easing competition from other devices; Windows 10 and upgrades to new models boosting demand; and improving economic conditions. However, the decline in PC volume – ongoing since 2012 – is expected to continue into 2016. IDC said that here will be a struggle to boost volume in the coming years, due to lower but continued pressure from competing devices and economic issues.

The impact of falling commodity prices and non-dollar currencies has depressed PC demand in Q4’15 and Q1’16. Windows 10 on legacy devices has also extended the lifespan of legacy computers. Inventory clearing continues to affect demand from channels. IDC has thus adjusted its 2016 forecast downwards to a 5.4% YoY decline. The outlook for later years has been reduced by about 1%: still technically touching positive growth in 2018 and effectively ‘stabilising’ volume, although there will still be some small declines in particular quarters and years.

Competition from tablets has fallen, with tablet volumes down 10% YoY in 2015. However, the detachable market has been boosted (IDC: Slates Fall as Detachables Enter Spotlight) by new large-screen models, which specifically target PC replacements. Volumes more than doubled last year (although were still less than 6% of the PC market). Detachable tablets combined with PCs would still result in a market declining 1% YoY in 2016, and volume would be well below the peak of 2011. However, this metric would see the market return to growth after 2016.

“Detachable tablets and phablets will remain formidable competitors to traditional PCs throughout the forecast”, said IDC VP Loren Loverde.

Despite challenges, IDC expects the ultramobile and convertible notebook segments to have grown substantially by 2020. Convertible shipments will more than double, and ultraslims will rise more than 70%. At the same time, AIO PC volume will rise by more than 30% and sub-14″ notebook shipments will continue to grow, as will lower-priced PCs. IDC notes that the largest PC vendors are still in a position to consolidate their share – and grow, if they can leverage the above trends.

The SMB and education segments are predicted to perform above than the overall market, said IDC research manager Jay Chou. Faster adoption of Windows 10, compared to previous operating systems, should support some growth in the mid-term. IT access for students will also drive projects across regions – although “constrained government spending may limit some projects”.

| PC Shipments by Product Category and Region (Millions) | ||||||

|---|---|---|---|---|---|---|

| Product Category | Region | 2016 Unit Shipments | 2020 Unit Shipments | 2016 Share | 2020 Share | 5-Year CAGR |

| Notebook | Mature | 86.4 | 80.9 | 33.1% | 31.8% | -1.3% |

| Emerging | 69.8 | 77.3 | 26.8% | 30.8% | 2.0% | |

| Portal PC Total | 156.2 | 158.2 | 59.9% | 62.2% | 0.3% | |

| Desktop | Mature | 38.8 | 31.1 | 14.9% | 12.2% | -4.3% |

| Emerging | 65.9 | 65.0 | 25.2% | 25.6% | -0.3% | |

| Desktop PC Total | 104.7 | 96.1 | 40.1% | 37.8% | -1.7% | |

| Total PC | Mature | 125.2 | 112.0 | 48.0% | 44.1% | -2.2% |

| Emerging | 135.7 | 142.3 | 42.0% | 55.9% | 1.0% | |

| Grand Total | 260.9 | 254.3 | 100.0% | 100.0% | -0.5% | |

| Source: IDC | ||||||