Despite the Christmas sales period, IDC has reported that the worldwide tablet market fell again in Q4’15. 65.9 million units were shipped, representing a 13.7% YoY decrease. Total shipments for 2015 were down 10.1%, to 206.8 million (from 230.1 million in 2014).

Despite the negative result for the overall market, detachable tablets enjoyed a rise, to an all-time high of 8.1 million units shipped. The transition towards this type of tablet appears to be in full swing, as pure slate-type devices suffered their greatest-ever annual decline: -21.1%. Detachable shipments, however, more than doubled YoY in Q4.

New detachables were launched by all three of the biggest vendors in the market. The biggest seller, despite lukewarm reviews, was the iPad Pro.

The move towards detachables has presented “new opportunities” for both Apple and Microsoft, said Jitesh Ubrani of IDC. Google’s movements in the space, however, have been “rather lacklustre”, as the Android platform requires refinements.

Despite the popularity of detachables, slate-style tablets have still not bottomed out on pricing. Amazon’s $50 Kindle Fire tablet was a hit this holiday season, boosting the vendor to the third place spot in Q4 behind Apple and Samsung. Rivals like Lenovo and Huawei continued to focus on the low-end and expansion outside of China.

Jean Philippe Bouchard, research director, tablets at IDC, believes that, “One of the biggest reasons why detachables are growing so fast is because end users are seeing those devices as PC replacements”. He elaborates: “Apple sold just over 2 million iPad Pros while Microsoft sold around 1.6 million Surface devices, a majority of which were Surface Pro and not the more affordable Surface 3. With these results, it’s clear that price is not the most important feature considered when acquiring a detachable – performance is”.

| Top Five Tablet Vendors’ Shipments, Share and Growth, Q4’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’15 Unit Shipments | Q4’14 Unit Shipments | Q4’15 Share | Q4’14 Share | YoY Change |

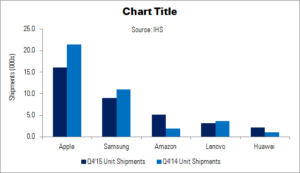

| Apple | 16.1 | 21.4 | 24.5% | 28.1% | -24.8% |

| Samsung | 9.0 | 11.0 | 13.7% | 14.4% | -18.1% |

| Amazon | 5.2 | 1.9 | 7.9% | 2.5% | 175.7% |

| Lenovo | 3.2 | 3.7 | 4.8% | 4.8% | -13.5% |

| Huawei | 2.2 | 1.0 | 3.4% | 1.3% | 124.6% |

| Others | 30.2 | 37.4 | 45.8% | 49.0% | -19.2% |

| Total | 65.9 | 76.4 | 100.0% | 100.0% | -13.7% |

| Source: IDC | |||||

As mentioned above, Apple continued to lead the world tablet market in Q4. However, the company’s iPad shipments fell 24.8% YoY. A revenue decline was limited thanks to the launch of the more expensive iPad Pro.

Samsung’s shipments fell 18.1%, but the company retained its second place spot. Samsung has a wide tablet portfolio, reaching multiple price points and screen sizes. IDC believes that this will serve the firm well in the move to detachables.

The newest Amazon Kindle piqued interest with its $50 price point, pushing the retailer to 175.7% YoY growth. The company’s tablet success so far has been based entirely on price – which bodes well for the holiday season, but is unlikely to be sustainable for the rest of the year.

Lenovo maintained its market share and took fourth place, shipping 3.2 million units (-13.5%). However, the Yoga, Miix and Think lines should help the company to regain share this year.

Fifth-place Huawei continued to focus on cellular-connected tablets and international growth. The company has positioned itself well in the smartphone market, and IDC expects its popularity to bleed over to tablets.

| Top Five Tablet Vendors’ Shipments, Share and Growth, Q4’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | 2015 Unit Shipments | 2014 Unit Shipments | 2015 Share | 2014 Share | YoY Change |

| Apple | 49.6 | 63.4 | 24.0% | 27.6% | -21.8% |

| Samsung | 33.4 | 39.8 | 16.2% | 17.3% | -16.1% |

| Lenovo | 11.2 | 11.2 | 5.4% | 4.9% | 0.4% |

| Asus | 7.1 | 11.8 | 3.4% | 5.1% | -39.9% |

| Huawei | 6.5 | 3.0 | 3.1% | 1.3% | 116.6% |

| Others | 99.1 | 100.9 | 47.9% | 43.8% | -1.8% |

| Total | 206.8 | 230.1 | 100.0% | 100.0% | -10.1% |

| Source: IDC | |||||