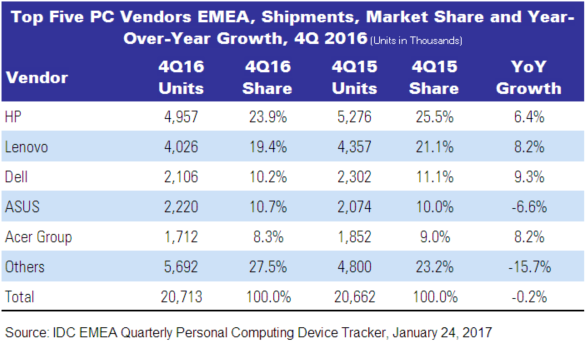

Traditional PC shipments in Europe, the Middle East, and Africa (EMEA) stabilized in the fourth quarter of 2016, registering a close-to-zero decline (-0.2% YoY) and reaching 20.7 million units, according to IDC. Notebooks performed well across all EMEA regions (2.9% YoY), growing 2.7% in Western Europe and 3.3% in CEMA. The strong demand was triggered by the commercial space, which grew 10.1% in Western Europe and 1.2% in Central and Eastern Europe. Consumer notebook demand was positive in Central and Eastern Europe (4.4%) and the Middle East and Africa (5.8%), while Western Europe was stronger than expected but still contracting (-2.4%). While notebooks experienced a strong momentum in 2016Q4, desktops continued to fall, posting an overall 6.9% decline in EMEA due to weak consumer demand.

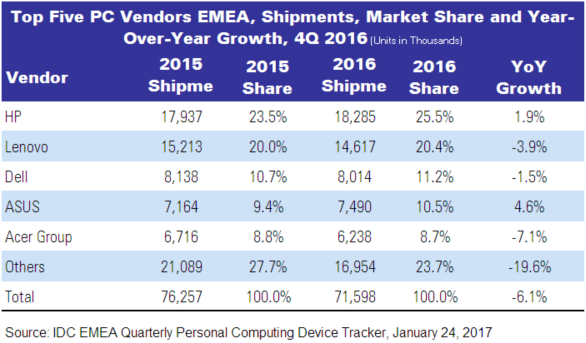

Annually, traditional PC shipments fell to 71.6 million units in 2016, down 6.1% from 2015. Throughout the year, notebooks outperformed the desktop market thanks to strong demand in the commercial space. Windows 10 did not drive extensive renewals in 2016. However, ultraslim PCs targeting enterprise mobility needs, as well as attractive Chromebooks offerings, especially in the education sector during the back-to-school season, led to strong demand for notebooks in the latter half of the year.

“The traditional PC market registered an impressive performance in 2016Q4, and markets are clearly stabilizing in EMEA after a challenging year 2015. Both businesses and consumers leveraged year-end promotions to purchase notebooks and demand for new solutions was strong ahead of price increase expected in the upcoming quarters.” said Andrea Minonne, research analyst, IDC EMEA Personal Computing. Black Friday promotions and Christmas holidays contributed to energize the notebook market in 2016Q4. This also resulted in strong consumer performance in some countries. These drivers created a more-favorable-than-expected scenario for the EMEA traditional PC market, with Western Europe growing 0.4%, and Central and Eastern Europe and Middle East and Africa declining respectively -1.2% and -1.8% YoY compared with last year.

In 2016Q4 the Western European market appeared very fragmented. As the pound has become a turbulent currency following the Brexit vote in the U.K., the British traditional PC market was impacted negatively (-6.2%). Some challenges were experienced also in Southern European economies, such as Spain, due to local political instabilities, with contributed to a YoY decline of shipment with France and Italy close to stabilization. Commercial notebook demand and some deals in the public sector triggered a positive performance in the Nordics, and in Germany, where overall traditional PC shipments were above market average.

The traditional PC market in the CEMA region reported an annual decline of 1.5%. Both regions performed better than forecast in the portable PC market, recording single digit increases YoY. “In 2016Q4 the CEE region reported a slight decline of 1.2% YoY, thanks to notebook results at 3.3% YoY. After a long period of decline, the Russian notebook market recorded double-digit growth, boosted by demand in both the consumer and commercial spaces. The same strong growth was reported across the Baltic States, as well as Kazakhstan and Ukraine, offsetting the declines previously reported,” said Nikolina Jurisic, product manager, IDC CEMA.

“The desktop market, on the other hand, reported a contraction of 9.1% YoY; low levels of deals were recorded across the region. The overall PC consumer market performed positively compared to the commercial segment. A lack of IT spending in the enterprise was the main inhibitor.”

The MEA traditional PC market recorded a mild contraction of 1.8% YoY despite the numerous ongoing macroeconomic challenges, ranging from low oil prices to currency fluctuations which are effecting several countries in the region. The Turkish traditional PC market came in strongly thanks to several year-end promotions led by channels and a healthy commercial demand. The other big markets of the region, namely South Africa, UAE, and the Rest of Middle East sub-region, remained close to flat YoY, while Saudi Arabia suffered a decline, being one of the most impacted due to low crude oil prices.

Vendor Highlights

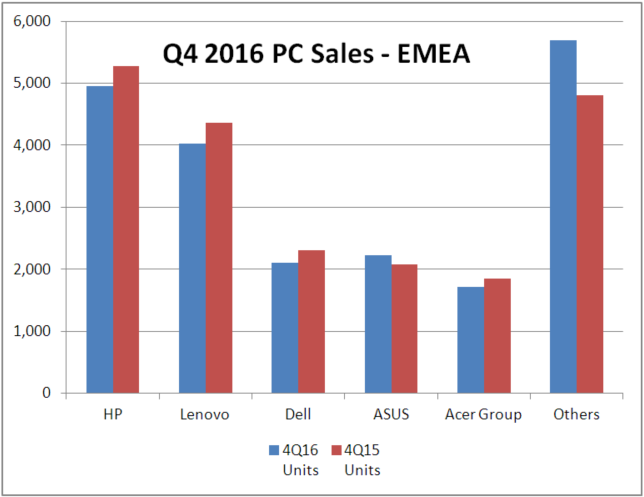

Traditional PC market consolidation is progressing, and the share of the top 5 vendors grew in 2016Q4. The top 5 players accounted for 76.8% of the total market volume vs 72.5% in 2015Q4.

- HP Inc experienced a strong market share increase (25.5%) and continued to reinforce its position. Strong consumer notebook results triggered most of the gain, while commercial posted growth too.

- Lenovo also increased its share to 21.1%, driven by a strong performance in the notebook space, where the company continues to outperform the market in both the consumer and commercial segments.

- Dell‘s market share was boosted by a solid double-digit performance in the commercial notebook space, allowing the vendor to reach an 11.1% share. The vendor’s gains were also strong in desktop.

- ASUS faced some market challenges due to component shortages. The company is consolidating its position in the commercial notebook space in CEMA.

- Acer Group‘s market share increased compared with last year, thanks to a strong performance in the consumer notebook space, in particular in Western Europe.