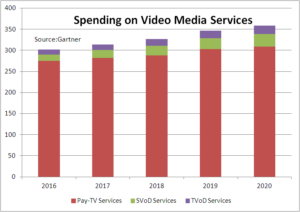

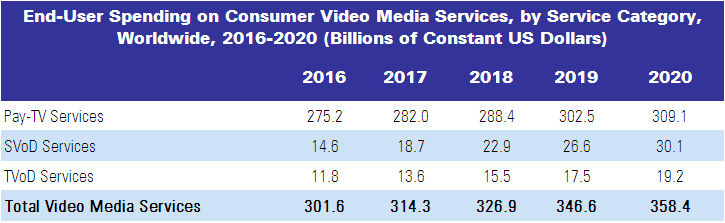

Gartner is predicting that global spending on consumer video media services will total $314 billion in 2017, which is a 4.2% rise compared to 2016. Pay-TV services will be the largest spending segment and is expected to represent 90% of the total market, reaching $282 billion in 2017.

The highest growth in end-user spending on consumer video media services in 2017, is expected to be in the emerging Asia/Pacific region, reaching 20.8% and in the Middle East and North Africa region, reaching 17.4%.

Earlier in 2017, China Mobile began offering its pay-TV service free of charge to its premium subscribers for the first two years of a new contract. This is expected to lead to an influx of new subscribers in the pay-TV marketplace, but will also bolster price competitiveness and put negative pressures on the average revenue per user in the overall pay-TV market.

Internet-delivered linear TV services have already launched in India and the Middle East, and Gartner expects these services will commence across all emerging regions by 2018. Gartner also predicts that one million households in emerging regions will enter the pay-TV market through an Internet TV service by 2020, due to lower pricing.

Gartner believes that OTT-VOD services are the fastest-growing segment in the VOD landscape and eroding pay-TV providers’ share of revenue. OTT-VOD sources began outperforming traditional pay-TV sources in 2016. The availability of premium-priced 4K content will increase end-user spending on T-VOD content in mature regions, from $160 million in 2017 to $400 million by 2020. In emerging regions, increased competition in the T-VOD marketplace from unmanaged providers and increased threats of piracy will put negative pressure on T-VOD prices. End-user spending on T-VOD services in emerging markets will decrease gradually each year, starting in 2017, by about $60 million to almost $445 million by 2020.

Global consumer spending on subscription-based video on demand (S-VOD) services will total $18.7 billion in 2017, an increase of 28% from 2016, and will show double-digit Increases over the next four years. The average consumer adoption of S-VOD services is 10% in 2017, with an average ARPU of $7.41. The highest ARPUs are in Japan ($12.10), Mature Asia Pacific ($10.84) and North America ($9.60).

Gartner believes that universal search is the key to driving further penetration, which will allow consumers to search for content across all their S-VOD services, but true universal search is still some years away.