IHS Markit’s David Hsieh.Surging on a wave of demand, the market for oxide displays used in mobile PCs is headed for spectacular growth this year. (Oxide Taking Increasing LCD Share)

IHS Markit’s David Hsieh.Surging on a wave of demand, the market for oxide displays used in mobile PCs is headed for spectacular growth this year. (Oxide Taking Increasing LCD Share)

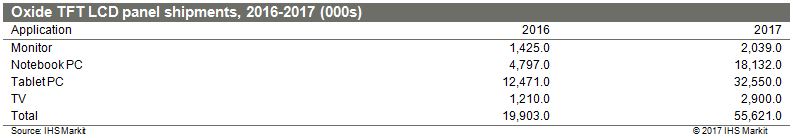

Shipments of oxide TFT-LCD panels sized 9″ and larger intended for the mobile PC market, which includes the notebook PC and tablet PC segments, are forecast to reach 50.6 million units by the time 2017 finishes. Those numbers represent a resounding 194% growth from shipments of 17.2 million units last year, according to the IHS Markit Large Area Display Market Tracker.

The huge growth is due to a big bump in demand from manufacturers incorporating the displays into more notebooks and tablets, thanks to the various benefits bestowed by oxide technology.

All told, the mobile PC segment will account for 91% share of total shipments in the oxide display space, which also includes the segments for monitors and LCD TVs.

Oxide display technology provides several benefits, including high resolution, lower power consumption than traditional mechanisms like amorphous silicon (a-Si), and lower production costs than in low-temperature polysilicon (LTPS).

Moreover, oxide offers higher electron mobility at 20-30 cm²/Vs, compared to less than 10 cm²/Vs for a-Si. A higher electron mobility paves the way for the use of smaller transistors, in turn enabling reduced power consumption, improved performance in refresh rates, and lower noise in touch-screen sensitivity.

Last, the high resolution of oxide TFT LCD means the displays are well-equipped to handle high-resolution content. Increasingly, such content is being produced in greater quantity given the continuing technological advances in smartphones and TVs, with mobile PCs also gaining in the process.

All these benefits are important to the makers of mobile PCs, eager to seize on any advantage that can be obtained to stimulate a stagnant market.

Advantages and drawbacks of each technology

In comparing LTPS, a-Si, and oxide, one can discern the pros and cons in each technology.

For instance, LTPS can deliver higher-resolution images and consume less power than other solutions. However, its drawbacks include high production costs and low productivity; it is also less efficient in producing large-sized panels. For their part, oxide TFT LCD panels are inferior in resolution and power consumption to LTPS displays, but they are superior to a-Si TFT LCD panels. Oxide is also suitable for large-sized panel production, and the production cost of oxide displays is lower than that of LTPS counterparts.

Because competition is so intense, cost is an important consideration for PC brands. While LTPS is a perfect technology for high resolution, low-power consuming displays, the process is too complicated and the production costs too high.

Important market drivers

Several factors account for the strong demand in oxide mobile panels, including the following:

- Apple and Microsoft both use oxide TFT LCD displays for their tablet devices, and their example has encouraged other brands to do the same. Apple devices include the 9.7″ iPad with a resolution of 2048 × 1536 pixels per inch (ppi), the 10.5″ iPad Pro (2224 × 1668 ppi) and the 12.9″ iPad Pro (2732 × 2048 ppi). Microsoft devices include the 12.3″ Surface Pro (2736 × 1824 ppi).

- Apple has also been using more oxide panels for its MacBook series, following the footprint of the iPad Pro.

- Producing an oxide TFT LCD requires a surplus photomask, but not as many as that needed to produce an LTPS display. This helps panel makers enhance their yield rate and production stability when it comes to oxide. To this end, panel makers such as LG Display, Sharp, and CEC Panda have been increasing their shipments of oxide panels.

- In the mobile PC segment, a rising trend is the 2-in-1, in which a laptop and a slate-type tablet converge to form a multipurpose device; the form factor is a foldable or switchable keyboard with a PC. Here facilitating dual usage— the notebook laptop for efficiency computing, and the tablet PC for casual computing—requires a high-resolution display with a low frequency in order to be switchable. System stability is, therefore, important. Moreover, the required ppi spec for a 2-in-1 PCs require a resolution range of from 200 to 280 ppi, for which oxide is especially good. Examples are the 10.5″ with 2224 × 1668 ppi, the 12.3″ with 2736 × 1824 ppi and the 12.9″ with 2732 × 2048 ppi.

- For some notebooks and laptops in which a combination of high resolution and lower power consumption is critical, oxide has become the chosen technology. Examples here are the 13.3″ with 2560 × 1600 ppi; and the 15.4″ with 2880 × 1800 ppi.

- Some panel makers, such as CEC Panda, are also driving the oxide TFT LCD market by shipping more oxide PC panels on their own initiative. Examples here include the 13.3” with 1920 × 1080 ppi; and the 15.6″ with 1920 × 1080 ppi.

The following panels are currently driving oxide panel shipments:

- 9.7″, 2048 × 1536 ppi (iPad Pro)

- 10.5″, 2224 × 1668 ppi (iPad Pro)

- 11.6″, 1920 × 1080 ppi (Lenovo ThinkPad Helix Ultrabook)

- 12.3″, 2736 × 1824 ppi (Microsoft Surface Pro)

- 12.9″, 2732 × 2048 ppi (iPad Pro)

- 13.3″, 1920 × 1080 ppi (Acer V3 and Dell Chromebook)

- 13.3″, 2560 × 1600 ppi (Apple MacBook Pro)

- 15.4″, 2880 × 1800 ppi (Apple MacBook Pro)

- 15.6″, 1920 × 1080 ppi (Lenovo ThinkPad E570)

- 15.6″, 3840 × 2160 ppi (4K2K) (Dell, Asus, Lenovo, Toshiba)

LG Display and Sharp are expanding their oxide mobile PC panel shipments the most aggressively. For its part, CEC Panda will increase shipments from 0.6 million units in 2016 to 4.2 million in 2017.

David Hsieh is Director of Analysis & Research, Displays, within the IHS Technology Group at IHS Markit.