OTT TV TV and video revenues will more than double in Western Europe between 2015 and 2021 – but growth rates will vary dramatically by country, says Digital TV Research (DTVR).

“OTT adoption is already high in Scandinavia, the Netherlands and the UK,” said principal analyst Simon Murray, “but it has been much more muted in other countries such as France, Spain and Portugal.”

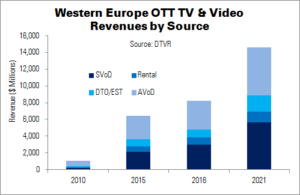

From $6.4 billion in 2015, DTVR expects revenues to exceed $14.6 billion in 2021. Of the extra $8.25 billion to be added, the UK will contribute $2.3 billion; Germany $1.34 billion; France $1.13 billion; and Italy $0.99 billion. The UK will remain the region’s market leader.

In 2018, subscription video on demand (SVoD) will become Western Europe’s largest OTT revenue source. This category will generate $5.6 billion in 2021, up from $2.1 billion in 2015; almost $1 billion will be added this year. The UK ($1.5 billion in 2021) will lead SVoD revenue, generating as much as Germany and France (second and third place, respectively) combined.

‘AVoD’ (advertising on OTT websites) will regain the OTT revenue lead in 2020, boosted by mobile advertising. AVoD will generate almost $5.8 billion in 2021, up $3 billion from 2015. The UK will again lead, supplied $2.3 billion of the 2021 total, followed by Germany at $904 million.

DTVR expects there to be 53.7 million SVoD subscriptions in Western Europe by 2021, up from its forecast of 31.4 million this year. 30.7% of Western European households will subscribe to an SVoD package in 2021, up from 13.6% in 2015.

Despite having 25% of the population, Sweden will have more SVoD subscribers than Spain in 2021 – despite an eight-fold increase in Spanish subscribers. The number of subscribers will quadruple in France and Italy between 2015 and 2021.

Murray said, “The Spanish SVOD sector is stifled as Telefonica provides its Yomvi SVoD platform free to its pay TV subscribers. Yomvi is no longer offered as a standalone service. This also degrades the perceived value of the other SVoD platforms.

“France’s relatively low take-up is harder to explain as there is a good selection of SVoD platforms on offer. However, government-imposed release windows dictate that SVoD platforms can only screen movies well after they have appeared on other platforms.”

| Western Europe OTT TV & Video Revenues by Source | ||||

|---|---|---|---|---|

| 2010 | 2015 | 2016 | 2021 | |

| SVoD | 152 | 2,098 | 3,001 | 5,632 |

| Rental | 137 | 702 | 819 | 1,321 |

| DTO/EST | 97 | 800 | 984 | 1,896 |

| AVoD | 627 | 2,797 | 3,396 | 5,793 |

| Source: DTVR | ||||