In the recently released Advanced Smartphone Display Shipment and Technology Report, DSCC reveal additional granularity and insights for the expected 13% Y/Y unit decline and 5% Y/Y panel revenue decline for OLED smartphones. OLED smartphone panel revenue is expected to decline to $31B from $33B in 2021.

As a result of the continued macroeconomic environment, persistent supply chain issues and weakened consumer demand, major smartphone brands continue to reduce their OLED smartphone panel procurement for 2022 by double-digit percentages.

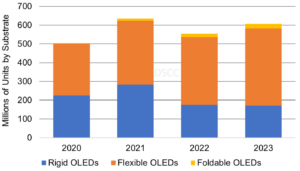

For 2022, DSCC expect OLED smartphone panel shipments to decrease 13% Y/Y to 554M panels. Flexible OLED smartphone panels are expected to increase 6% Y/Y and account for a 65% unit share, up from 54% in 2021. Rigid OLED smartphone panels are expected to decline 38% Y/Y and account for a 32% unit share, down from 45% in 2021. Rigid OLED smartphone panels continue to decline rapidly as a result of several Chinese panel suppliers pricing flexible OLED smartphone panels very close to rigid OLED smartphone panels and several brands are significantly reducing their demand versus 2021. In 2021, for some Chinese panel suppliers, flexible OLED smartphone panel ASPs were more than double the ASPs of rigid OLEDs. That is no longer the case. Separately, foldable OLED smartphone panels are expected to increase 77% Y/Y for a 3% unit share, up from 2% in 2021.

For 2023, DSCC expect OLED smartphone panels to increase 9% Y/Y and flexible OLED smartphone panels to increase by 14% Y/Y for a 68% unit share, followed by foldable/rollable OLED smartphone panels increasing by 34% Y/Y to a 4% unit share and rigid OLED smartphone panels declining by 3% Y/Y for a 28% unit share. In 2023, for flexible OLED smartphone panels, we expect all brands to increase panel procurement by single- and double-digit percentages as a result of flexible OLED panel ASPs declining 17% Y/Y and more flexible OLED capacity coming online. We expect rigid OLED smartphone panels to continue to decline by 3% Y/Y as ASPs for flexible OLED smartphone panels continue to decline, several brands completely exit the rigid OLED smartphone category and excess rigid OLED capacity is used for IT applications.

For 2022, on a smartphone panel revenue basis, DSCC expect rigid OLED smartphone panel revenue to decrease 39% Y/Y for a 13% share, down from 20% in 2021. Flexible AMOLED smartphone panel revenue is expected to remain flat and increase to a 79% revenue share in a smaller market. Foldable AMOLED smartphone panel revenue is expected to increase 55% Y/Y with an 8% revenue share, up from 5% in 2021.

For 2023, DSCC expect smartphone panel revenues to decline 4% Y/Y, with flexible smartphone panel revenue declining 4% Y/Y on 9% Y/Y unit growth, followed by a 20% Y/Y increase for foldable/rollable smartphone panel revenue on 34% Y/Y unit growth. For rigid OLED smartphone panel revenue, we expect a decline of 14% Y/Y on 3% Y/Y unit declines.

Annual OLED Smartphone Panels by Substrate, 2020 -2023

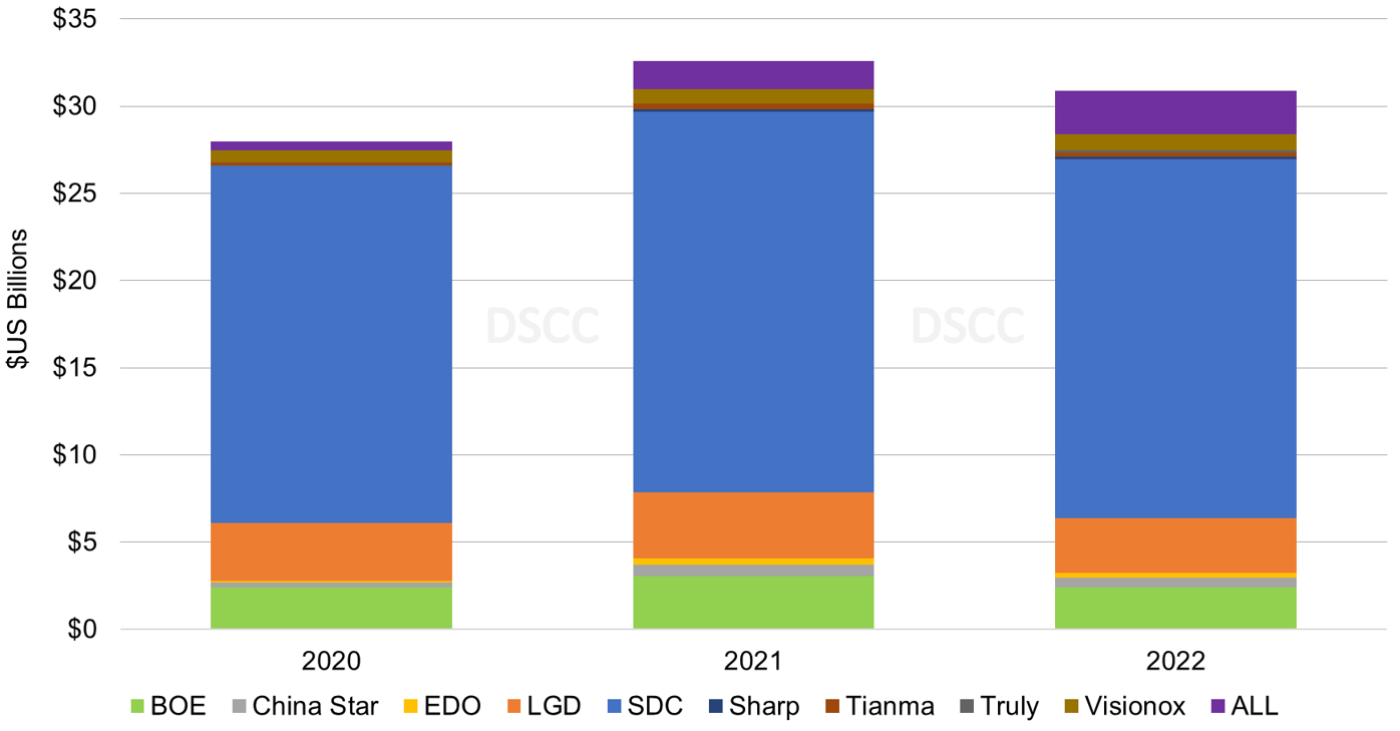

In the case of 2022 panel revenue share by panel supplier, DSCC expect SDC to remain the dominant panel supplier with a 67% revenue share, followed by LGD with 10%, BOE with 8% and Visionox with 3%. In 2023, based on expected panel shipment volumes, we expect SDC to have a 57% panel revenue share, followed by BOE with 12%, LGD with 11% and Visionox and China Star with 3%. The share increase for BOE is a result of the expected increased panel shipments from Apple, Honor, Oppo, Samsung and Vivo. For Apple, BOE currently supplies flexible OLED panels for the iPhone 12, 13 and 14. The share increase for LGD is a result of expected increases for panel shipments from Apple. For Apple, LGD supplies flexible OLED panels for the iPhone 11 Pro Max, iPhone 12, iPhone 13, iPhone 13 Mini, iPhone 14 and iPhone 14 Pro Max.

Annual OLED Smartphone Panel Revenue by Panel Supplier, 2020-2022

In the case of 2022 OLED brand share, DSCC expect Apple to have a 39% unit share and a 54% smartphone device revenue share, up from 29% and 41%, respectively in 2021. We expect Samsung to have a 21% unit share and a 21% smartphone device revenue share, down from 22% and 22%, respectively in 2021.