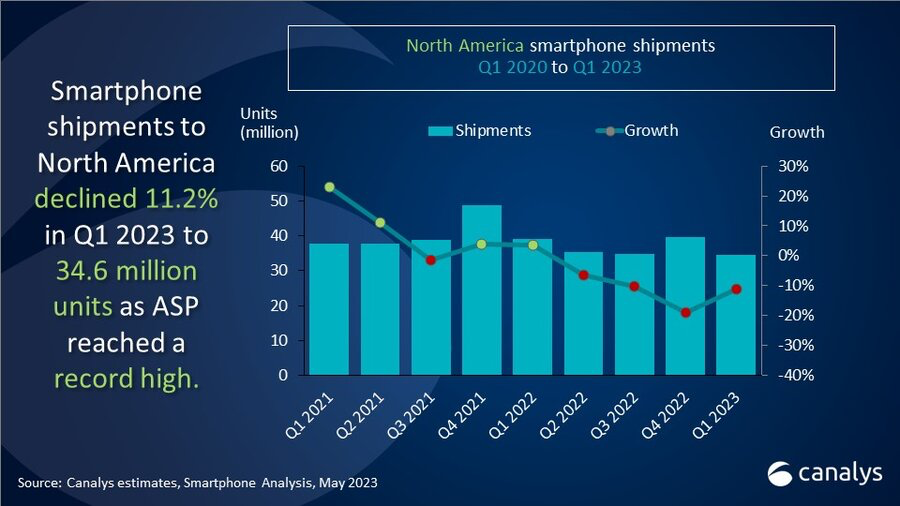

In Q1’23, the North American smartphone market reported a decline in shipments for the fourth consecutive quarter, falling 11.2% YoY to 34.6 million units. The slump was largely due to the challenging economic conditions and inflation impacting the US, which drove down consumer demand, especially in the low-end mass market (below $200).

Nevertheless, the average selling price (ASP) of smartphones in North America reached a record high of $790 in Q1’23, up from $671 in Q1’22. This was primarily influenced by the robust growth in the premium segment ($800 and above), despite overall market decline.

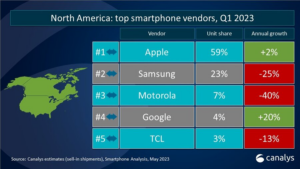

Apple secured its stronghold with a 59% market share, a remarkable increase from 51% in Q1’22. Meanwhile, Samsung faced a 25% decrease in shipments compared to Q1’22. The rest of the market was shared by Motorola (7%), Google Pixel (4%), TCL (3%), OnePlus (1%) and Nokia (1%).

| Vendor | Q1’23 Shipments (Million) | Q1’23 Market Share | Q1’22 Shipments (Million) | Q1’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Apple | 20.3 | 59% | 19.9 | 51% | 2% |

| Samsung | 7.9 | 23% | 10.5 | 27% | -25% |

| Motorola | 2.4 | 7% | 4.0 | 10% | -40% |

| 1.4 | 4% | 1.2 | 3% | 20% | |

| TCL | 1.2 | 3% | 1.4 | 4% | -13% |

| Others | 1.4 | 4% | 2.1 | 5% | -32% |

| Total | 34.6 | 100% | 39.1 | 100% | -11% |

Amid the competitive landscape, the iPhone Pro and Pro Max models played a significant role in Apple’s success, contributing to 45% of the brand’s shipments. Despite this dominance in the premium market, other manufacturers are keen on entering this segment, particularly by enhancing ecosystem integration, interconnectivity, brand reliability, and security.

Google Pixel emerged as the fastest-growing among the top five vendors with a 20% YoY growth, aided by the recent Pixel 7 series launch and Google’s advancements in Generative AI and hardware.

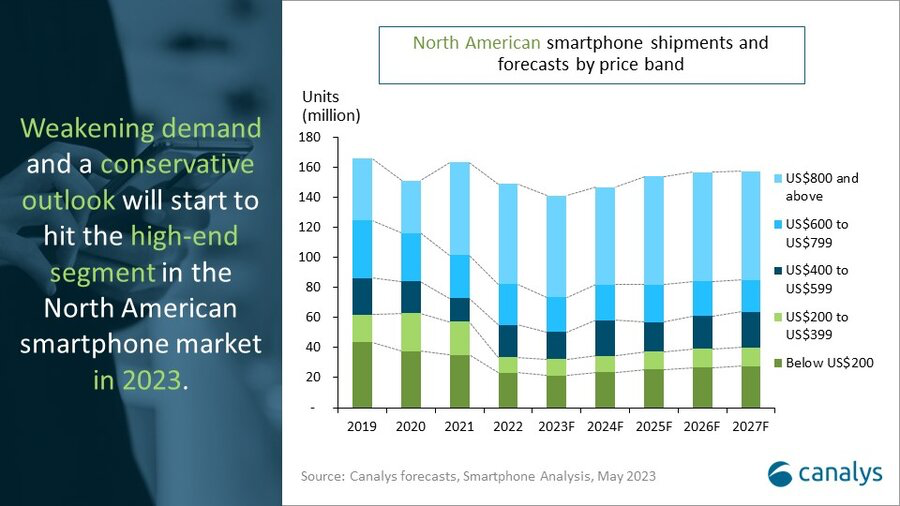

However, Canalys forecasts a 5.4% market decline for 2023. The low-end segment continues to face challenges due to the economic outlook, while the high-end segment of $600+ is likely to experience a decline for the first time since 2020.