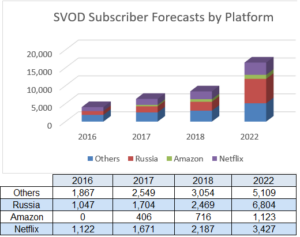

The Eastern Europe OTT TV & Video Forecasts report from Digital TV Research has forecast that Netflix and Amazon Prime Video will considerably boost the Eastern European SVOD sector. The report estimates that Netflix will have 3.427 million subscribers by 2022, up from 1.122 million in 2016. The report also estimates that Amazon Prime Video’s figures will be less impressive, but will still have 1.122 million subscribers by 2022, up from 406,000 this year.

Simon Murray, principal analyst stated that although these numbers may seem modest, they will be accomplished without any subscribers in Russia. The Russian regulator has recently introduced a 20% foreign ownership equity limit on OTT platforms that have more than 100,000 subscribers and Digital TV Research believes that this will force Netflix and Amazon Prime Video to abandon their standalone platforms thus causing a major blow to both company’s expansion in the area.

Digital TV Research believes that both companies are likely to license their original content to a local platform in a similar way that Amediateka already brands itself as the home of HBO. Netflix has already done something similar in China with IQiyi.

Excluding Russia’s 6.804 million SVOD subscribers by 2022, Netflix will control 35% of SVOD subscribers in the remaining 21 countries with Amazon Prime Video expected to contribute a further 12%.

Digital TV Research has forecast that there will be 16.463 million SVOD subscribers across the 22 Eastern European countries by 2022 which is four time the 2016 figure of 4.036 million.

SVOD is expected to become the region’s largest OTT revenue source this year and it is forecast that revenues will reach $1,300 million by 2022. This represents 57% of total OTT revenues, which is up from the 34% of total OTT revenues of $190 million last year.

It is forecast that OTT TV episode and movie revenues for the 22 Eastern European countries will reach $2.23 billion in 2022, which will be four times greater than the $552 million recorded in 2016. Russia will account for 46% of the region’s OTT revenues by 2022, with a further 19% being generated by Poland.

Source: Digital TV Research Showing SVOD Subscriber Forecasts