Netflix will remain the dominant force in Western European SVOD for the next five years, according to Digital TV Research. However, Amazon Video will provide a stiff challenge. Digital TV Research said that 15 Western European countries would offer Amazon Prime Video by end-2017, but just after the company issued its data, Amazon announced a roll out in 200 countries.

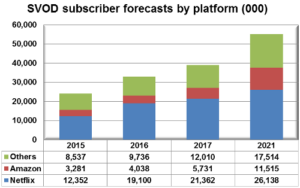

Netflix’s share of Western European SVOD subscribers will fall from 51% in 2015 to 47% by 2021. However, Amazon’s share will grow from 14% in 2015 to 21% by 2021. So, these two companies will control two-thirds of the region’s SVOD subs.

The Western Europe SVOD Forecasts report expects 55.17 million paying SVOD subscribers across 17 countries by 2021, up from 24.17 million in 2015 and an expected 32.87 million by end-2016. More than 8 million subscribers will be added in 2016 alone.

Simon Murray, Principal Analyst at Digital TV Research, said: “The UK will remain market leader, but Germany will close the gap. The UK accounted for a third of SVOD subscribers in 2015, but this proportion will fall to a quarter by 2021.”

He continued: “SVOD growth will be more modest in France, Italy and Spain. In fact, the Netherlands and Sweden will have more SVOD subs than Spain in 2021, despite having much smaller populations.”

About 31.5% of the region’s TV households will subscribe to a SVOD platform by 2021; up from 14.1% recorded by end-2015. Penetration will remain notably higher in the Nordic countries and the UK. However, four of the five largest countries (France, Germany, Italy and Spain) will be below the Western European average. In fact, Spain will only record 14.0% penetration by 2021.

Western European SVOD revenues will total $5.87 billion by 2021 – up from $2.15 billion in 2015. The UK (up by $800 million between 2015 and 2021 to $1,534 million) will remain the SVOD revenue leader – generating more than Germany and France combined in 2021. This comes despite German and French revenues more than tripling over the same period.

Analyst Comment

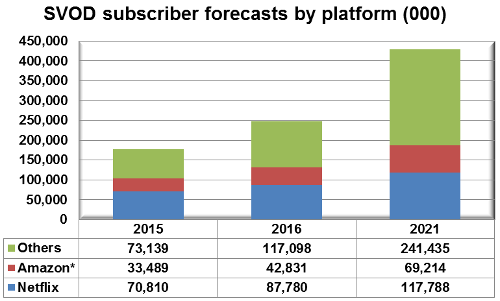

Separately, the company said that Netflix well have more customers outside the US than inside by 2018 and will have a total of 118 million, at 27.5% of the SVOD market. Despite the higher number, US subscribers will account for 52% of Netflix revenue. The firm believes that Netflix has deals with 79 payTV, mobile or telcos in 44 countries and will see revenues double to $13.14 billion in 2020.

Overall, the firm sees the number of global SVOD households growing 70 million this year and going from 177 million in 2015, 248 million in 2016 and 428 million by 2021. By then the US will have 127 million subscribers and China will ahve 74 million. Global revenues will reach $32.28 billion from $12.2 billion this year and $17.46 next year. (BR)