Last week, when I wrote about the Samsung purchase of the IP from Cynora, I wrote that at Display Daily, we try not to instantly fire off an article as the time for reflection and research is important. (Has Samsung Created a Hurdle in the Display Marathon?) We broke that pattern last week, and we were grateful to get some more clarification from Barry Young of the OLED Association subsequently.

Barry sent this:

Samsung Buys Cynora’s IP to Protect Its Hybrid Blue Program

Samsung Display Corp (SDC) acquired Cynora’s intellectual property but not its workforce. Cynora’s workforce had been cut to the bare minimum and then totally released in recent weeks. Bloomberg put the acquisition price at $300 million, but that apparently was Cynora’s asking price. TheElec had a more reasonable estimate of $100 million. DSCC suggested a lower price ranging in the “tens of millions of dollars”.

Cynora used Thermally Activated Delayed Fluorescence (TADF) and a form of Hyperfluorescence to create green and blue emitters, which theoretically could compete with UDC’s phosphorescent material. But Cynora’s emitter performance never reached commercial viability. Both LG Display (LGD) and SDC were early investors in Cynora, with ~12% and ~8%, share respectively.

With the investment, SDC signed a joint development agreement (JDA) with Cynora that has since expired. The JDA allowed SDC to develop OLED emitter stacks using Cynora’s IP, but they were not permitted to claim the material in any patent application after the JDA was executed. Since the investment, Samsung developed a hybrid blue that uses both phosphorescent and Cynora’s TADF material.

The hybrid blue was described in technical papers at display events including DisplayWeek. Recently, the material has been undergoing qualification by SDC and has sufficient efficiency, but not the lifetime for commercial use. UDC also announced the development of a pure phosphorescent blue that is expected to be ready for commercialization by 2024. Insiders claim the performance of the UDC and SDC blues are comparable in color point, efficacy and lifetime. The competition to produce a high efficiency blue, apparently led SDC to protect itself by buying Cynora’s only asset, its IP.

According to people knowledgeable about the transaction, UDC and Samsung have been discussing how to proceed should one or both of the companies develop a commercial ready high efficiency blue.

The demise of Cynora, funded with an estimated €200m is a blow to the prospects of Japan-based Kyulux, Poland-based Noctiluca and China-based Summer Sprout, the remaining companies trying to commercialize TADF/Hyperfluorescence. Although each company has claimed to be ready or soon to be ready, none of the three have products on the market.

——-

I was annoyed with myself that I hadn’t picked up that the hybrid blue used Cynora’s materials.

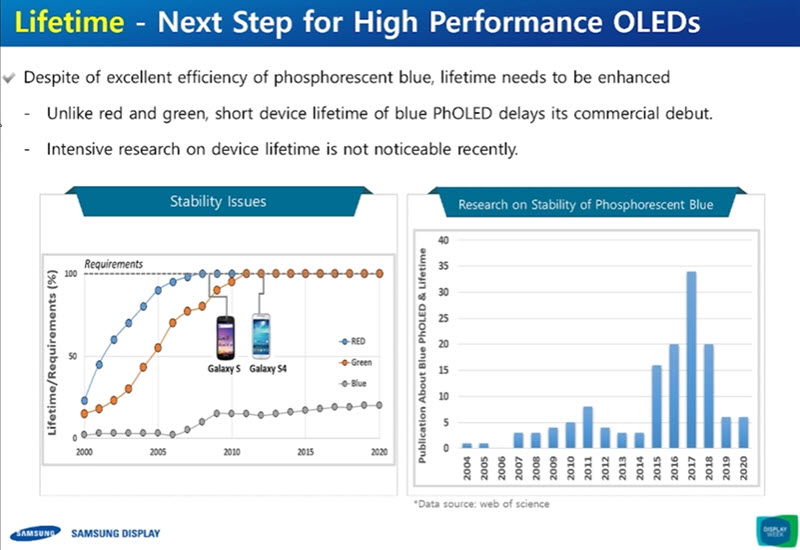

I had a listen to the talk that SDC gave during Display Week and Sunghan Kim explained what the firm had done (and as published in Nature Photonics) to extend lifetime of phosphorescent blue materials and he presented the following interesting chart showing how developments of phosphorescent blues had dropped in terms of publications and real progress.

As can be seen in the chart on the left, red and green have long since got to the right lifetime, but blue progress has been very, very slow. The chart on the right shows that R&D publications have also stalled in recent years.

As can be seen in the chart on the left, red and green have long since got to the right lifetime, but blue progress has been very, very slow. The chart on the right shows that R&D publications have also stalled in recent years.

He explained that the latest blue had been able to get to 1,113 hours at T70 with a CIEy of 0.197.

Kim said that work was continuing on device architectures to get the best out of the material. In questions he also said that more work is needed to get the deep blue that it would like to get to.

Investment

I was surprised that Barry suggested that the investment in Cynora was as high as €200 million. I had seen when I was researching last week’s article that Crunchbase lists the firm as having had up to a Series C investment round in May 2019 (after an A round in 2011 and B round in 2017). Samsung and LGD came in at the B round. However, the website details the total investment at $61.4 million.

So, if DSCC is right that the price was ‘in the tens of millions of dollars’ it looks as though the investors basically got most or all of their money back, but without much of a profit.

I think we may have now got as close to the truth as we are going to get without being one of those involved! (BR)

(we put this article outside the paywall, so that if you used a credit and are not a subscriber, this will not use up one of your two free articles this month).