I was very disappointed when the much re-scheduled ISE event was set to take place at the same time as the SID Display Week in San Jose. I like ISE and always learn a lot, having attended all of them since the move to Brussels in 2007 (before that, a colleague attended). There would have been a symmetry to a visit as ISE’s last event in Amsterdam was my last overseas event before Covid locked us all down.

One of the reasons for a move away from Geneva in 2004, where ISE started, was to move inside the EU because it made things much easier (note, Brexiteers). It went to the RAI for 2005/2006, to Brussels in 2007 and then back to the RAI in Amsterdam in 2008. However, the show really succeeded and eventually simply grew too big for the facilities in Amsterdam. After years of different attempts to develop Photokina, Infocomm Europe and other events, Mike Blackman and his team turned the event into the most important AV event in the world, eclipsing Infocomm.

The organisers canvassed opinion widely before moving and I was pleased when my suggestion of Barcelona was chosen. I had been attending MWC in the city in February, and at that time of the year, the climate was much more hospitable than the chill winds from the North Sea in the Netherlands. The city also has a big exhibition centre and the attractive city easily absorbs a lot of visitors.

However, for me, Display Week is the most critical event of the year, so when the revised date was set to clash with ISE, I had no choice. However, consultancy Futuresource sent a lot of people and has made available a PDF with what it saw at the event (registration required).

The event was 16% down from the pre-Covid event at 43,691 in 2020. However, 2020 was itself down from 81,268 visitors in 2020 because of Covid concerns, so from 2019 the drop to 2022 is 47%. The number of exhibitors was flat from 2019 to 2020, but dropped by 36% to 834 in 2022. Futuresource said that there was a ‘palpable buzz’ and a feeling that ‘business was being done’ but that there ‘wasn’t the usual slew of product announcements. (The show is one that hundreds of smaller Chinese LED companies without Europe operations liked to come to, so a lots of those dropped out this time because of Chinese Covid lockdowns).

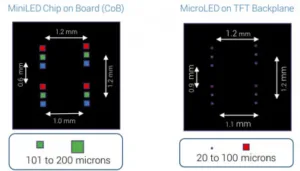

Futuresource’s definition at 100?m is in line with ours. Image:Futuresource

Futuresource’s definition at 100?m is in line with ours. Image:Futuresource

The firm found lots of firms hyping ‘MicroLED’ although the reality is that most of them are actually miniLED. It sees miniLED down to 0.7mm pitch and below while ‘traditional’ SMD LEDs is now at 1.0mm and above. Highlights of the direct LEDs on show were:-

- Samsung’s The Wall, with new ‘Micro Motion’ to support 60Hz to 120Hz and an AI processor for upscaling 4K content to 8K. Peak brightness gets up to 1,600 cd/m² and pitches from 0.63-0.94mm with single bin tolerances and 20 bit internal processing to achieve 24,000:1 contrast.

- Barco’s new TruePix LED line has a new mechanical design to speed integration and offer a more seamless image. It has Infipx 23 bit processing for HDR and is available in 0.9-1.9mm pitches.

- Philips (TPV) has a new 6000 series of LEDs with 1.5 and 1.9mm pitch now being made in the firm’s own factory in Fuqing, China and with finer pitches to come. It’s said to be easy to install with a 135″ unit ready in two hours.

- Sharp/NEC is getting up to speed after the merger and is aiming to combine Sqadrat’s German engineering with Japan’s quality and mass production in China. There are now offerings from 0.9mm to 3.8mm and the company highlighted meeting room applications

- LG’s Magnit ‘Looked magnificent’ with good colour and a black coating to give 150,000:1 contrast at 600 cd/m² and with peak luminance at 1,200 cd/m².

- Futuresource said it was the first time it had seen Sony’s B & C series Crystal LED. (strange – it was shown at the Peerless event in London last year (Peerless Entertains With A/V at Lords)

- Unilumin has so far only shipped a cinema targeted UCini LED technology in China. It has an IMB and there is a 4K 2.5mm version with integrated speakers and is ground-mounted rather than hanging. The firm showed 0.5mm pitch and is said to be developing 0.4mm and 0.3mm. A UMini device uses a 4-in-1 flip chip COB with 0.7mm pitch.

- Leyard is moving to 4-in-1 CoB architechture for 0.6, 0.7 and 0.9mm with 1.2mm staying with SMD. It was highlighting Virtual Production using processing from Brompton. A new monolithic TXP AIO LED display is aimed at meetings and has touch, speakers and Android integrated and has a single power cord. Leyard is said to be pricing its MGP series in 1.2 to 3.0mm to compete with narrow bezel tiled LCD.

- Liantronics had new flip chip CoB technology in 0.9mm and 1.2mm

- Daktronics showed new 0.9mm LED and the FullHD 110″, 138″ and 165″ and 4K 220″ displays previously shown.

- Christie Digital said it would upgrade to 1.0mm miniLED CoB later this year using common cathode drivers and with up 3,000 cd/m². It will use epoxy resin for better durability.

- BOE & Seoul Seminconductor were at the event to talk to brands as they look to be OEM suppliers. BOE had 0.7mm-1.5mm options at 500-800 cd/m² and also had a 0.9mm display based on CoG on an active matrix backplane. (I got to see that one as it was also shown at Display Week!)

The report is 42 pages and I have covered less than a third of it, so if you are in the A/V world, a download could be very useful. And the price is right! (BR)

BOE showed its active matrix LED 0.9mm at Display Week as well. Image:Meko

BOE showed its active matrix LED 0.9mm at Display Week as well. Image:Meko