In the ever-evolving mobile phone industry, the third quarter of 2023 brings hope for stable prices of mobile phone panels. Cinno Research’s latest data shows that the steady price trajectory can be attributed to a combination of factors. First, the elimination of inventory stockpiles during the mid-year promotion season has played a role in stabilizing prices. Secondly, the approaching traditional peak season for mobile phone panels has bolstered demand, particularly for LTPS (low-temperature polycrystalline silicon) and flexible AMOLED (active matrix organic light emitting diode) panels.

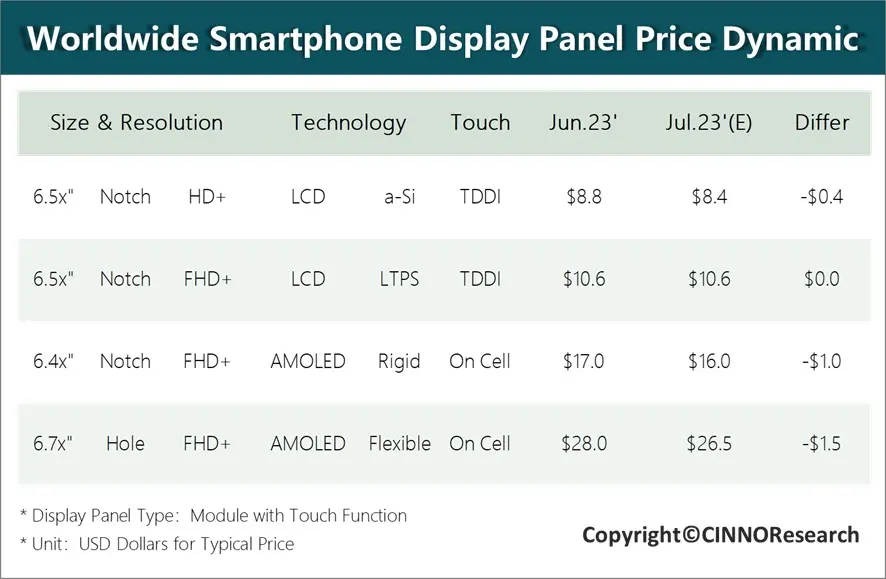

The balance between supply and demand has improved significantly, leading to shortages of some products. In July, the price of LTPS panels saw its first decline, and it is anticipated that a-Si (amorphous silicon) panels will follow suit and stabilize after reaching a bottoming point. Additionally, the prices of AMOLED panels are also projected to stabilize in the third quarter of 2023.

Among the panel types, a-Si panels have experienced a drop in demand but are expected to stabilize due to the moderation of aggressive price competition strategies employed by module factories. On the other hand, LTPS panels have seen a shift in production capacity to medium-sized applications, leading to a more stable demand and, in turn, stabilizing prices.

The outlook for AMOLED panels varies between rigid and flexible types. While the demand for rigid AMOLED panels is weakening, leading to further price declines, the domestic demand in China for flexible AMOLED remains robust. Some flexible AMOLED products have even experienced short supply, reinforcing predictions of stabilization in Q3’23.