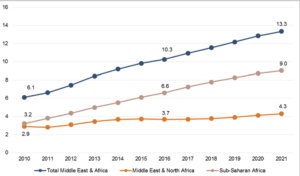

According to IDate, TV market growth in the MEA region is being driven largely by sub-Saharan Africa, which it says will be the world’s fastest-growing TV market over the next five years. The figures, which do not include Turkey and Israel, indicate average annual growth of 5.1%, with sub-Saharan Africa having the strongest performance with an average of 5.7% growth per annum. This would deliver a sub-Saharan TV market worth $10 billion in 2021.

Over 80% of households in the Middle East and North Africa receive TV via satellite, while the figure for sub-Saharan Africa is 40% and rising. Alternative TV delivery networks are progressing at a much slower pace and IDate points out that there is slow development of digital-terrestrial broadcasting and that IPTV and cable networks will remain secondary, except in a small number of countries. Cable and MMDS networks will continue to be used, despite the uncertain legal situation, in parts of central and West Africa, while IPTV is available in the Gulf States.

According to IDate, the big change is the development of OTT TV services, buoyed by the development of 3G and 4G mobile access. The number of pay-TV subscribers is set to double in five years, alongside the rise of OTT video services. These typically low-cost services are contributing, along with still massive levels of piracy in the region, to driving down the price of pay-TV.

Progress in pay-TV is expected from a low base, but with subscriber growth outpacing revenue growth, and subscription VoD services will grow alongside pay-TV in the region. Despite growth in pay-TV, free-to-air TV remains dominant, with only 14% of households subscribed to pay services in 2016.

IDate believes that free TV services are a challenge due to the underfunding of public channels, the uncertain financial situation of many private broadcasters, and weakness in the advertising market. However, the untapped advertising revenue represents a source of potential future growth for these markets, especially in sub-Saharan Africa.

TV Market Growth in Billions of Euros (according to IDate)