A couple of years ago, I write a Display Daily about an insight I had come to about how pricing in LED displays works (What LED Has to Do to Be Truly Disruptive). The observation was that the way that the pricing works is different from how it works with outer flat panels and that makes a big difference.

As I mentioned in that article, a Chinese maker of LEDs had sent me a copy of its full price list and when I analysed it, I found that the price ‘per pixel’ was a kind of bathtub curve. There was a ‘sweet spot’ then at around 3.0mm to 3.5mm. Below that, you pay more for extra technology. For example, as I mentioned a couple of weeks ago (SiliconCore Opens up to New LED Opportunities), Silicon Core has technology for boosting efficiency at smaller pixel pitches. However, the more sophisticated power supply does cost a bit more so at smaller pitches, the cost per pixel goes up. That conflicts with, for example, LCD, which is, more or less, a fixed cost per square metre. In LCD, if you want to have a bigger display, the cost basically scales with area.

![]()

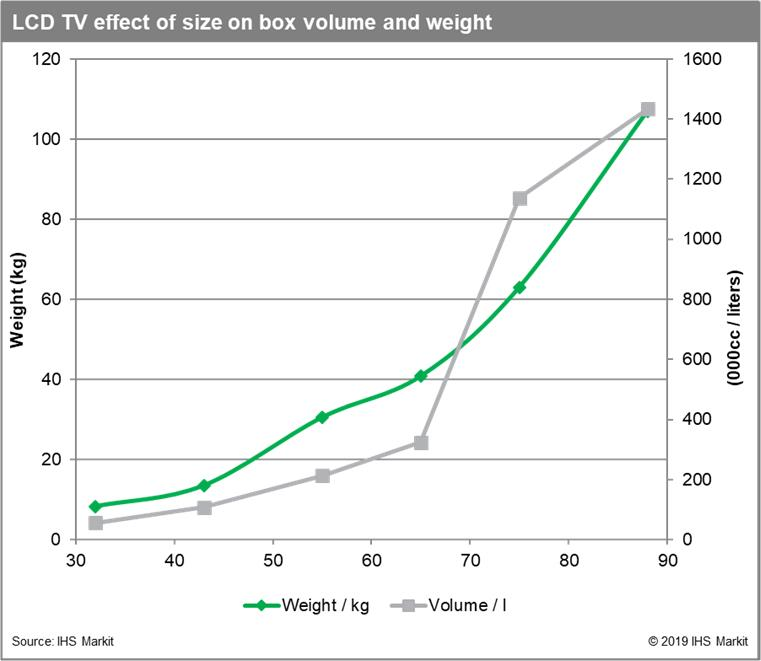

Of course, if you end up at the extreme end of the size scale, even in LCD, issues of logistics and lower yield in manufacture do increase the cost per square metre, but you can probably save some cost by using a single display rather than a 2 x 2 video wall – and, of course, you eliminate the bezels. Paul Gray of IHS Markit (soon to be of Informa) has pointed out that the cost of packaging an LCD jumps up a lot when you go from 65″ to 75″. That has significant implications for the TV business.

“The industry has made the assumption that it is business as usual in the move to ever—larger sizes. In fact, the box volume doubles between 65” and 75”: and with it transport and warehousing costs. Furthermore, it becomes a delivery-only product, also requiring two people to unload. Such costs are of a different nature to LCD panelisation and will be difficult to reduce. Therefore cost differentials are likely to rise, not fall.”

With LED, however, given the same resolution of display, once you go to smaller pixel pitch than the ‘sweet spot’, the cost goes up, even though the display gets smaller. That’s counter-intuitive for buyers who are used to the LCD cost model.

When you go to sizes larger than the ‘sweet spot’, the cost per pixel goes up, as you need more plastics and metalwork to support the display. When you get to the kind of pitch that is used in outdoor displays, the cost goes back to being broadly proportional to the area, again, rather than being related purely to the resolution.

Now, a couple of years ago, when I first did the work, the lowest cost was at 3.0 to 3.5mm pitch. By now, the development of the industry has seen the lowest cost per pixel move down to around 2.0mm to 2.5mm (depending who you talk to). The optimum cost solution around that size is, I have speculated, the reason that Samsung has picked that kind of pitch as the key technology for its LED Cinema activities. Samsung has a serious cost obstacle to overcome with LED cinema. The big change from film to digital projection was highly supported by the cost savings that came from being able to distribute content digitally, rather than on film. However, once you have moved to a digital distribution model, there is no ‘digital dividend’ to support the cost of a switch from projection to LED.

The LED Industry Looks to try to Commoditise Displays

Part of the reason for catching up on this topic is a shift that I have seen over the last year or so. The idea of selling a simple standard configuration LED as a simple display has been around a long time. I remember that Philips had a division selling LED displays (Philips Vidiwall) and they offered a ‘LED TVs’ many years ago. They were 120″ and below standard definition (the 6mm was 384 x 216 and the 10mm was 256 x 144). Brightness was 200 cd/m² and didn’t do very well in the market, I don’t think. Pricing in 2005 was €170K for the 6mm and €85K for the 10mm. The company was looking at a 4mm design (which would have been around €340K and 512 x 288) and we saw that one in 2007. Anyway, eventually Philips dropped out of that market.

I later met several times (at IFA and Gitex in Dubai) with a Chinese company, ANFLED, that was making 200″ and 300″ TVs. It showed a 218″ FullHD TV at Gitex in 2014, priced at $315K and using 2.5mm pitch LEDs. The company found a ready market in Russia and the Middle East, although it didn’t do so well in Western Europe, so only went to IFA once, as far as I know.

Anyway, over the last couple of years, there has been an increasing trend for the LED display suppliers to offer standard configurations such as 130″ with FullHD (1.5mm pitch) or around 160″ with UltraHD (0.9mm pitch). The display that has got the most attention is “The Wall” from Samsung (and we have heard that good numbers of these are selling to high net worth individuals). PrimeView has just put out a video about its offering.

The big advantage that LED has is that the technology is still modular. That means that suppliers can avoid the horrible logistical problems of shipping that plagued the 103″ and, even more, the 152″ PDP that was launched in 2011. That cost, literally, millions of $$ to ship around the world for trade shows. It was also a challenge to get them into buildings as it couldn’t fit into lifts or through doors. On the other hand, Silicon Core told us that its meeting room LED can be installed in three hours by two technicians and is supplied as modules, so handling is easy. (BR)

(Note a late chart and quote from Paul Gray was added, just after publication)