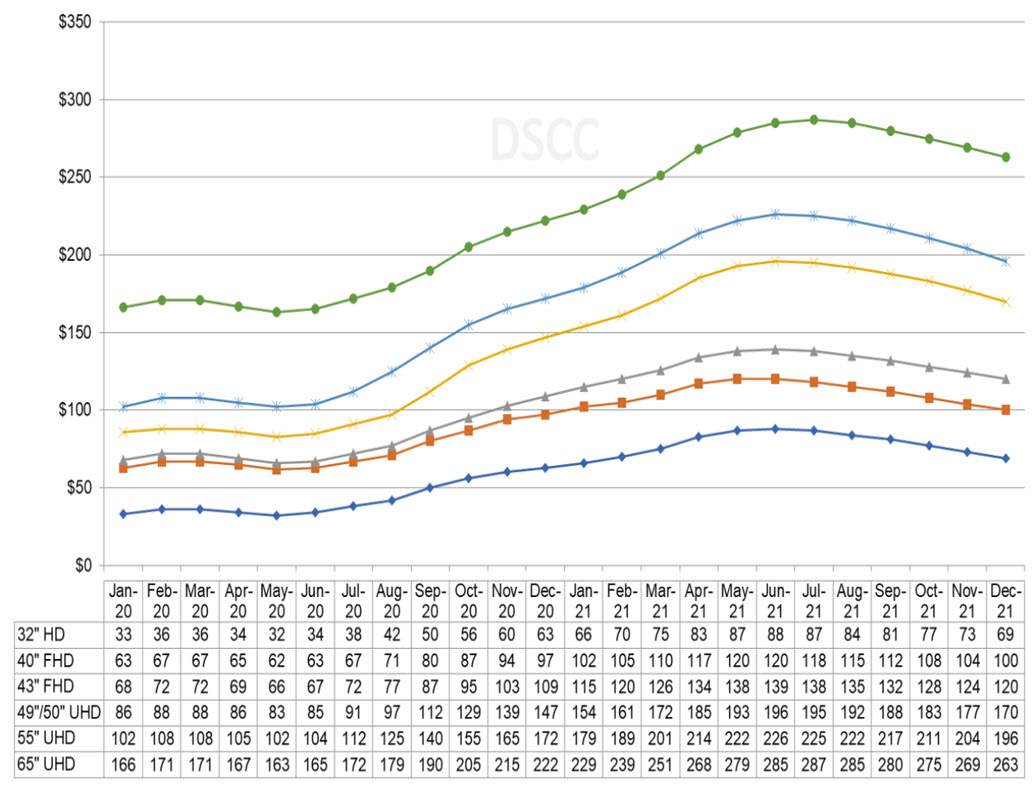

Large LCD panels have seen dramatic increase in prices in the first half of 2021 due to unprecedented tight supply that was impacted by component shortages. Panel prices have been increasing for more than a year starting from mid-2020 due to strong demand both in TV and IT market.

Tight supply and extremely high panel prices have resulted in LCD TV set price increases. Softness in demand (due to higher set prices and changes in the COVID 19 situation globally) combined with supply expansion will lead to panel price reductions in 2H 2021.

Dramatic Price Increase – Impacting Demand

An increase in demand for larger size TVs in the second half (2H) 2020 combined with component shortage (glass, driver ICs, Polarizers and other components) has pushed the market to unprecedented supply constraint and continuous panel price increase from end of Q2 2020 to 1H 2021 according to DSCC’s blog in August this year,

“Prices increased in Q2 2021 by a double-digit percentage for all sizes of TV panels, with increases ranging from 11% to 22%. Also according to the company, “Comparing our forecast for peak panel prices (in June or July 2021) with the prices in May 2020, we see trough-to-peak increases from 32% for 75” to 175% for 32”, with an average of 106%. In comparison, the average trough-to-peak increase of the 2016 to 2017 cycle was 48%, and prior cycles saw smaller increases.”

Market demand for tablets, notebooks, monitors and TVs increased in 2020 especially in the second half of the year due to the ‘stay at home’ impact, when work from home, education from home and more focus on home entertainment pushed the demand to a higher level. With ‘stay at home’ continuing in the first half of 2021 and UEFA European Championship soccer and Olympics in Japan, TV brands continued to see strong panel demand in that period.

Dramatic panel price increases have resulted in higher costs for TV brands reducing profitability. Brands have increased set prices for their TVs. TV brands have also focused more on larger size higher specs products for better profitability moving away from small and medium sizes, which will impact shipments volume. Lower priced brands (Tier2/3) had a difficult time acquiring enough panels to offer lower priced TVs. Panel suppliers are also giving priority to top brands with larger orders during the supply constraint. In recent quarters, the top five TV brands including Samsung, LG, and TCL, have been gaining higher market share.

Countries with better control of COVID variants such as U.S and Europe are starting to open up offices, schools and increasing travel. Demand that surged during the stay at home economy, has slowed down as consumers spend more on other things. Countries like India and Japan continue to struggle with the variant. High set prices combined with changes in the stay-home economy will impact TV demand especially in 2H2021.

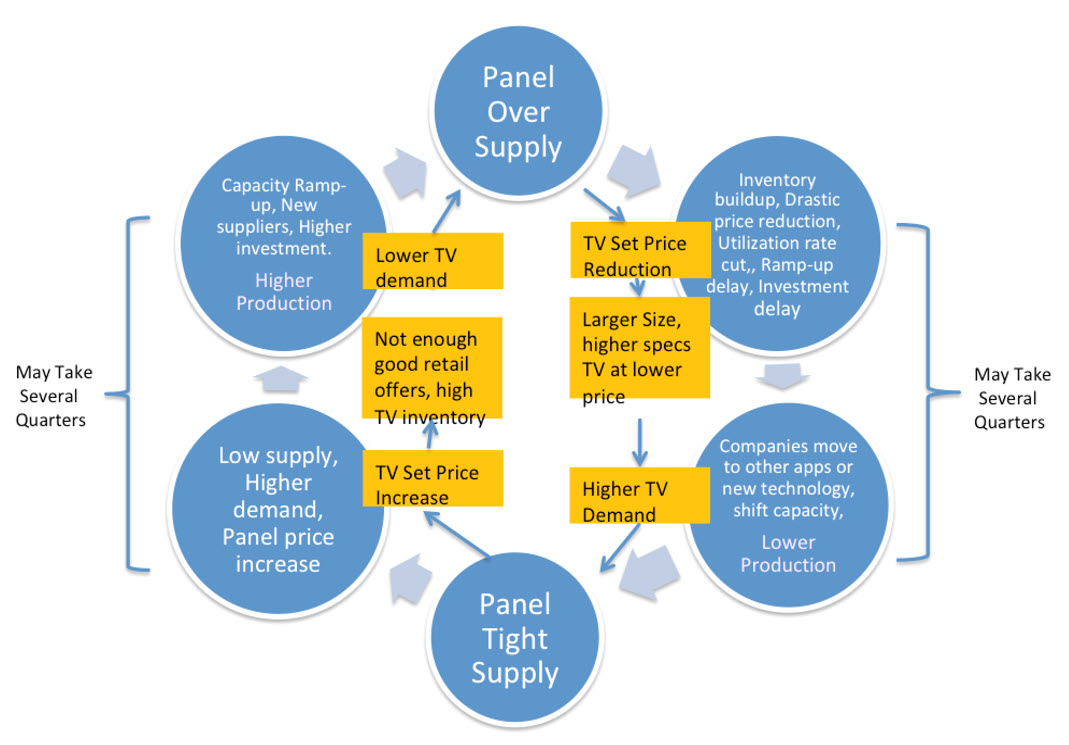

The LCD Crystal Cycle (Source – Dash-Insights)

The LCD Crystal Cycle (Source – Dash-Insights)

LCD Pain – OLED Gain

While LCD TV faced extreme tight supply and panel price increases, OLED TV has made capacity expansions and cost reductions as LG Display added additional capacity in its 8.5 Gen fab in Guangzhou (increasing to 90K/m up from 60K/m). Also TV brands are more focused on expanding their OLED TV product line as the cost gap between equivalent LCD and OLED panels has reduced significantly. OLED TV is also providing higher profitability for brands. OLED TV has gained higher market share.

According to data published by DSCC in August, OLED shares increased in booming advanced TV market in Q2 2021.

“While OLED TV share of all Advanced TV had declined during 2018-2020, the additional capacity from LG Display’s Guangzhou fab combined with rising LCD TV panel prices has helped OLED TV regain share in the premium category. OLED TV shipments increased by 169% Y/Y in Q2 2021, while Advanced LCD TV shipments increased by a more modest 36% Y/Y, and OLED TV share increased from 25% in Q2 2020 to 40% in Q2 2021.”

According to TrendForce’s data published in August,

“OLED panels expected to reach 3% penetration in TV panel market in 2021 owing to persistently narrowing price gap with LCD panels. The company also reported that high-end OLED TV panels and 8K LCD TV panels showed dramatically opposed movements in 1H21, while OLED TV panel increased market shares to 2.6%, 8K LCD shares fell to a mere 0.2%”. This is because as the company reported “panel suppliers’ concerns about profit and yield maximization resulted in their relatively low willingness to manufacture these products. On the demand side, clients were also unwilling to procure these panels due to persistently high quotes from suppliers.”

OLEDs are expected to enjoy continuous growth, as they take higher market share from TVs and smartphones as well as the IT market, benefiting from supply expansion and cost reduction.

LCD – Supply Expansion

According to an Omdia press release in May this year,

“tight supply, high factory utilization rates, and high profitability are encouraging many panel makers to increase their capacities. There were already multiple Gen 8.6 and Gen 10.5 factories in China that were accelerating capacity ramp-ups in 2021 and 2022 after COVID-19 delayed them in 2020”.

Chinese panel makers are incrementally increasing the capacity of their current factories through productivity enhancements and new equipment purchased for de-bottlenecking or creating capacity expansion according to Omdia.

TrendForce’s found in August this year,

“Chinese panel suppliers were able to achieve a 58.3% share in the TV panel market, which was nearly 5 percentage points higher than their 1H20 market shares, thanks to their growing number of production lines. Conversely, Taiwanese suppliers saw their market share drop by 2.2 percentage points from 1H20 levels to 21.1% in 1H21… Korean suppliers experienced a decline in market shares to 14.3% while Japanese suppliers’ market shares increased to 6.3% as a result of SDP’s Gen 10.5 capacity expansion”.

BOE and CSOT (China Star) have been the top two panel suppliers for LCD TV. They are expanding their production capacity. At the same time HKC is currently increasing its production capacity (4 Gen 8.6 fabs) and is expected to enter the top three rank of TV panel suppliers for the first time with 33.7% YoY increase in TV panel shipments in 2021, according to TrendForce.

The capacity ramp-up by panel suppliers in China and their strong dominance in the TV panel market combined with higher profitability and the need for new suppliers to increase their market share will result in supply expansion in the second half of 2021.

Price Decline – Second Half of 2021

The industry is already reporting some price reduction for TV panels. TrendForce reported in the beginning of August: 7.5% MoM decline for 55’ W UHD open cell TV panels in July. The Display Supply Chain Consultants LCD TV Panel Price Update in August 2021 confirmed LCD panel pricing peaking in June/July and starting to go down. DSCC forecasts price declines for LCD TV throughout the second half of 2021.

It seems that market has reached the end of the “up cycle” of the LCD crystal cycle ending the tight supply situation. The LCD crystal cycle generally creates a multiplier effect with each “up and down” cycle. During the “up cycle” with tight supply and panel price increases, panel buyers buy more, keep higher inventories and sometimes place orders with double bookings to ensure future supply, thereby pushing the market to an even tighter situation. In the “down cycle” when prices decline, panel buyers delay purchases and keep lower inventories to avoid holding higher cost inventory, resulting in a further reduction in demand. With the start of the down cycle, LCD TV panel prices will decline in the second half of 2021. (SD)

Sweta Dash, President, Dash-Insights

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com