Jon Peddie Research states that the add-in graphics board (AIB) market increased in Q1’16, despite the overall PC market falling. AIBs, more commonly called graphics cards, carry discrete GPUs, and are used in desktop PCs, workstations, servers and other devices such as scientific instruments. They are either sold directly to consumers or installed in the factory; in either case, they represent the higher end of the graphics industry.

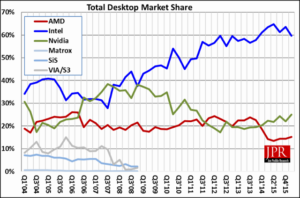

There are now just three GPU suppliers in the AIB market which also build and sell AIBs. They are AMD, Nvidia and S3. There are 48 AIB suppliers (OEM customers of the GPU suppliers).

| AIB Market Share Changes, Q1’16 | |||

|---|---|---|---|

| Vendor | Q1’16 Share | Q1’15 Share | Q4’15 Share |

| AMD | 22.8% | 22.5% | 21.1% |

| Nvidia | 77.2% | 77.4% | 78.8% |

| S3 | 0.0% | 0.0% | 0.0% |

| Total | 100.0% | 100.0% | 100.0% |

| Source: JPR | |||

The market for AIBs peaked in 1999 at 114 million units. Since then it has more than halved, standing at 44 million in 2015. In Q1’16, AIB shipments rose 4.8% QoQ: above the 10-year average of -2.5%. Shipments were also up compared to Q1’15 (5.8%), while desktop PCs fell 14.6%.

In spite of the PC market churn, and partly due to tablets and embedded graphics, the PC gaming market continues to build momentum, and is a bright spot for AIBs. All AIB OEMs are investing in the gaming space, due to robust demand for gaming PCs.

The number of overall GPU shipments (integrated and discrete) is greater than desktop PC shipments, due to the practice of using two or more AIBs in a system with integrated graphics. Dual AIBs are also used, to a lesser extent, in machines valuing performance; for instance, AMD’s Crossfire and Nvidia’s SLI configurations.

AIB attach rate has declined from its Q1’08 high of 63% to 44% in Q1’16: an increase of 17.1% from Q4’15. Compared to Q1’15, attach rate rose 23.9%, which JPR calls ‘outstanding’.

An extended refresh cycle has been caused in both consumer and commercial PC markets by lacklustre applications (excluding gaming) and the failure of Windows 10 to prompt new purchases. As a result, JPR sees consumers buying AIBs to gain performance improvements, rather than changing their whole PC.