The flood of press releases has switched from ISE to MWC over the last week. The MWC event has a very high quality attendance (it costs around €800 just to walk the show floor!) and companies spend a lot of money on PR so I have been beseiged by requests for meetings. Meanwhile, we are working on the ISE report for LDM subscribers and we expect it to be finished around the middle of next week.

This week, I saw a report from JPMorgan, quoted on the Barrons blog, that has downgraded AUO and Innolux shares to a sell status. The LCD business is currently reasonably profitable – even Sharp is making a profit! JPMorgan is more bullish about the likely capacity expansion of LCD this year, with supply starting to catch up with demand during 2018. By 2019, supply will grow significantly faster than demand, so the market will be under difficult pricing conditions again. Barrons also quoted Morgan Stanley as previously downgrading LG Display.

Of course, the crystal cycle goes around. However, next time the cycle turns negative, AUO, LG Display and Samsung Display will have significantly re-aligned their businesses to try to get away from the mainstream commodity TV panel business. While both of the Korean companies are pivoting to try to replace LCD, as much as possible, by OLED, AUO is developing more towards a specialist strategy. Once there are multiple G10 fabs in China, in 2019, the company will really have a challenge in competing in big LCDs for TVs. However, there will be plenty of opportunity in smaller markets, such as public displays.

However, as we report in LDM, growth in public displays is slowing compared to previous years. It may be harder than it has been in the past to build good volume based on that application. Nevertheless, AUO has little choice, given that Taiwan seems to be a long way behind Korea and China in OLED.

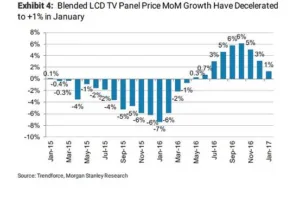

Morgan Stanley sees a slowdown in price increases as a signal of a change in the market

My own feeling is that we are in for a period of, relative, stability in LCD pricing. Panel makers have probably pushed prices as high as the markets can bear at the moment. On the other hand, the JPMorgan forecast of 4% supply growth this year looks a little optimistic to me.

Bob