There has been much development and even more talk about new transparent-conductor technologies to replace the brittle and not-all-that-conductive indium tin oxide (ITO), which has been the dominant technology for creating patterns on touch sensors for many years and remains so today.

The most commercially advanced alternative is theClearOhm silver nanowire (AgNW) ink from Cambrios. Very fine nanowires as small as a few atoms in diameter are dispersed in a carrier. This ink is applied to either a glass or polymer substrate, and can then be patterned.

In the Cambrios suite, CEO John Le Moncheck told us that the market has expanded in the last half year, as has Cambrios’ production. In 2013, the company could produce 22,000 liters per year; in 2014, it’s 175,000 liters. The company announced that its collaboration with the chemical and electronic materials business division of LG Electronics had produced a production run rate of more than a million units AgNW touch panels per year. LG is shipping large volumes to Tier One OEMs in the U.S., China, Taiwan, and Korea. Le Moncheck said that using AgNWs was helped by “real champions at LG, who wanted to sell [touch sensors] outside the company.” And the fact that LG already had a roll-to-roll manufacturing facility helped a lot.

The company also announced that CN Innovations (CNI), a company known for making touch sensors using laser technology with both roll-to-roll and sheet manufacturing, is delivering touch panels based on ClearOhm to Tier One OEMs. LeMoncheck said that the laser patterning that CNI is well known for is hard to do with ITO, but is easy with AgNWs.

Le Moncheck said that the single-layer film (GF1) touch sensors that can be made with AgNWs are very interesting to cost-conscious Chinese manufacturers whose products are targeted at the value end of the spectrum. GF1 dleivers a small amount of crosstalk, but it is well suited to value-oriented products. Other architectures deliver higher level of performance. The two-layer architecture is effective for large displays. One customer is making a 65-inch touch display based on capacitive touch.

Le Moncheck noted that the current “Jupiter” ink produces a little haze in the OFF state in bright ambients because the ambient light reflects from the wires. The new “Mercury” wires are thinner — only a few atoms thick — and these provide a “jet black OFF state in bright light.” This allows Cambrios to go after high-end applications, Le Moncheck said.

In addition, the touch-sensor maker, TPK, has a joint venture with Cambrios. The JV is ramping up and could produce hundreds of thousands of units this year.

Le Moncheck concluded by noting that the capital equipment cost for AgNW-based touch sensors is perhaps one tenth that for ITO. Thus, he is hopeful that when sensor makers have to add capacity or replace worn-out equipment, they will turn to AgNW. “A robust supply chain is in place,” Le Moncheck said, “and AgNWs are the obvious technology to use for the coming wave of flexible devices.”

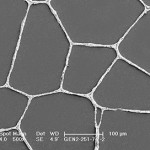

The self-assembling conductive network of Cima Nanotech’s SANTE conductive nanomaterial. (Photomicrograph: Cima Nantotech)

The self-assembling conductive network of Cima Nanotech’s SANTE conductive nanomaterial. (Photomicrograph: Cima Nantotech)Cima NanoTech takes a different approach to transparent conductors, using a conductive nanoparticle technology that self-assembles into a random mesh-like network when coated onto a substrate. In a addition to touch screens, Cima is targeting capacitive proximity sensors, transparent antennas, wearables, transparent microwave and EMI shielding, OLED lighting, and transparent heating. In their suite at CES, Cima planned to showcase a 58-Inch interactive tabletop and 42-inch interactive digital signage.

“For large format touch screens to become a mainstream product, we knew we needed to provide a cost-effective solution that can be easily integrated and creates an engaging user experience,” said Cima CEO Jon Brodd.

Back in the laboratories, other approaches — including organic conductors and graphene — are being investigated, but it is technologies such as Cambrios’s that will be leading the charge against ITO for the foreseeable future. (KW)