For a long time we are reporting on the high potential for the AR and VR markets. With several options available to the consumer and some form of competitive market pressure already at play (see the price drops of some devices) we should see a significant uptick in market adoption. Or should we?

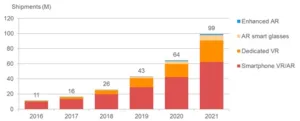

In a recent releasem CCS Insight, a UK / US based market research firm threw their forecast darts on the AR / VR board and came up with the following chart. They published their forecast under the title ‘Virtual Reality and Augmented Reality Device Sales to Hit $11.9 Billion and 99 Million Devices in 2021‘.

CCS Insight – AR / VR device forecast October 2017

As we take a look at the chart we can see how wonderful the future growth of this hardware market will be. I am hoping that some of this will come true as I truly like the idea of VR / AR devices as an alternative display market that could help driving display sales in the future. However, we have to be conscious that an overly optimistic market forecast can create a certain market expectation that, if not met, will lead to some backlash down the road.

I am not saying that CCS Insight is overly optimistic, I am saying that in order to create the kind of exciting forecast their customers would like to see, they are incorporating the smartphone-based AR / VR devices like the Samsung Gear VR that sell today for about $40 on the web and was even a giveaway from Samsung last year (and other such as Alcatel – Man. Ed.). A little better indicator is their statement that the sales of dedicated VR devices in 2017 will add up to about 3 million units. This is still a significant growth over the estimated 1-2 million from 2016. A different view is the look at the expected US$ sales. They believe that the average sales price for a dedicated VR headset is about $355 in 2017, while the smartphone-based devices will hover around US$40. Very realistic indeed.

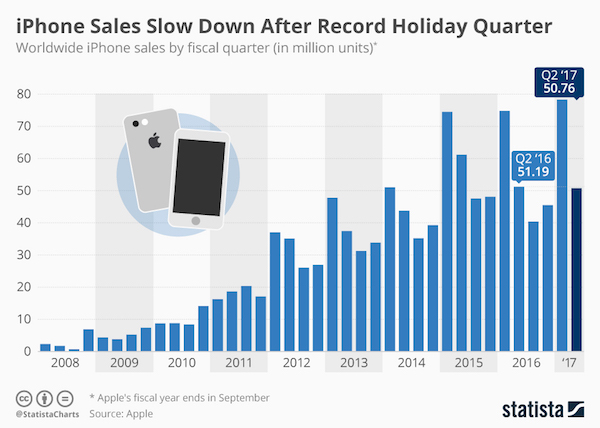

Looking at other markets is a little more sobering for this market segment. When we look back at the last two successful CE device introductions we have to look at the smartphone and the tablet. Looking at the quarterly iPhone sales from 2008, the average sales per quarter after 4 years was around 20-30 million. This is very comparable to the the yearly device forecast for dedicated VR devices in the CCS Insight data. Does this mean they believe that VR devices will be about 50% of the smartphone market in the coming years (counted by units of course)?

Statistia – Apple quarterly iPhone device sales

Statistia – Apple quarterly iPhone device sales

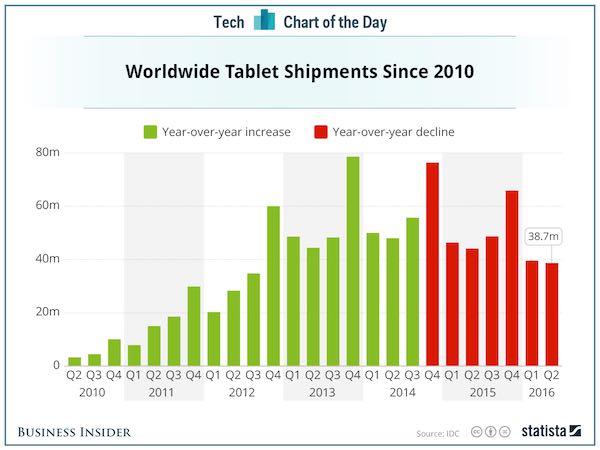

This seems a little overly optimistic in my opinion. They do go back to the question of available content of course but still must be of the opinion that the software / content side will be attractive enough to warrant these device numbers. Comparing the numbers with tablet sales we see that this is about on the same level as the quarterly tablet device sales.

Statistic – Worldwide tablet device sales

Statistic – Worldwide tablet device sales

The tablet market was even hotter than the smartphone market with about 50 million per quarter. AR / VR device sales of about 40 million units in 2021 would make this new market about 25% of the tablet market. Somehow, I am a little skeptical of these numbers. I am not seeing the performance advancements in devices in the market today that would warrant such a mass adoption rate in the coming years.

One More Question

There is one more question I have in relation to this forecast; why are the number for smartphone-based VR devices still growing during the forecast period? If the dedicated devices are catching up with consumer expectations, the lower performance smartphone headsets should take a significant hit in shipment numbers. If the dedicated devices are not living up to consumer expectations they just won’t grow at the rate forecast.

One explanation for this conundrum may be the different growth rate in various countries around the globe. While the developed countries may be responsible for the uptick in dedicated, and therefore more expensive, devices, developing countries may stick with the smartphone-based headsets as buying both devices may not be an option for most in these countries.

On the positive side, we hear with more device releases with new and enhanced headsets for the VR market from several manufacturers. In addition the Microsoft based AR / VR headsets are getting ready to sell within this year and may drive unit sales especially in Asia with the expected lower price levels.

While the VR market is dominated by gaming and professional applications for now, the push for AR is more consumer oriented but unfortunately, at the moment, a pure software solution using the existing display platforms on smartphones and tablets. In the long run, this approach may bring the whole AR idea to the consumer in a way that makes it easier to sell dedicated hardware devices further down the road.

Much of the market success will be driven by the technology advancements creating better images in a smaller and lighter form factor with good battery life. This means that every forecast depends on a technology roadmap that is at this stage very unclear as many larger players are very secretive about their technology development efforts.

When all these factors will drive consumer adoption to the forecast level is, of course, the billion dollar question. Being too early is not good (just ask Google) and being late maybe costly too, in terms of market share. The master of bringing a product to the market at the right time is, of course, Apple, unless this ability was part of the Steve Jobs legacy. So for now, Apple not showing a AR headset means for me that the time is just not right yet. Of course that can change at any time in the future and will certainly be worth another article. NH