In recent weeks many articles discussed the situation of the iPhone X and especially reports from Asia that Apple has reduced their orders for iPhone X components significantly for the first quarter of 2018. To be clear this refers to the calendar year, as the first quarter of Apple’s fiscal year already closed on December 31, 2017. The reports from many outlets claim different reductions – anywhere between 10% and 50%.

The original source seems to be from Nikkei Asian Review, that reported on 1/31/2018 that Apple will half its iPhone X output based on weak holiday sales. Since this would be a very significant development, every news outlet picked up on this report and started their own doomsday prophecy.

Nikkei Asian Review: Apple iPhone X Slashes Output for Q’2018

Nikkei Asian Review: Apple iPhone X Slashes Output for Q’2018

Nevertheless, a few days later Apple had its chance to right a wrong by presenting their quarterly results for the quarter ending in December of 2017. This means that the poor sales results were included in this report. As we now know, Apple reported their best quarter ever and made some interesting statements about the iPhone X. “iPhone X surpassed our expectations and has been our top-selling iPhone every week since it shipped in November,” said Tim Cook, Apple’s CEO.

This really doesn’t sound too bad. Considering that the result was only shown for the whole quarter, one could expect that the sales data could have been even better if it wasn’t for some technical difficulties with some components during start-up (as had been widely reported Apple Supply Delay Not Because of OLED Supply). So let us take a look a little deeper into the results

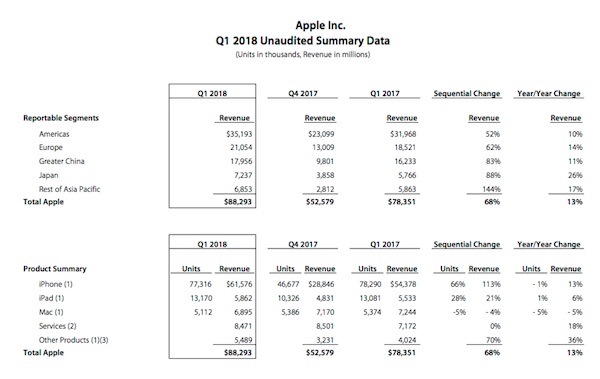

Apple Q118 Results from Press Release

Apple Q118 Results from Press Release

As we can see revenue for the iPhone was $61 billion in this quarter, which represents an increase of 13% over the same quarter in fiscal 2017. On the other hand, unit sales were down slightly by 1%.

Since Apple did not break down their unit sales numbers by phone model we have to rely on third party estimates. Canalys published their estimate as being 29 million units for the quarter.

Since the iPhone X costs at least $999 we can safely assume that Apple made more than $29 billion from their iPhone X sales. When we calculate the average sales price per phone on this basis, we can see that the average sales price went from $692 in Q1’17 to $796 in Q1’18. When we assume $1,000 per iPhone X (low estimate), we see a small drop in the average sales price for the other phones from $692 to $674. This is in line with earlier developments at Apple.

From that perspective, the most important function of the iPhone X was to increase the average sales price per phone and it was very successful at that.

So what does the 1% drop in unit sales mean for Apple? When we look at China as the driver for the smartphone market in recent years, IDC reported a 15.7% drop in unit sales YoY for the forth quarter of 2017. Apple’s unit sales dropped by just under 1% and in line with Apple’s worldwide performance. Overall Apple strengthened its position in China.

Analyst Comment

All in all, it seems that the decrease in ordered iPhone X units going forward is more of a reflection of the overall market weakness in smartphone sales rather than a iPhone X specific problem. Looking at the financial success of the iPhone X, I can see more smartphone makers adding high end devices (Samsung Galaxy X, RED Hydrogen) at really high prices to increase their profits the same way Apple showed them last quarter. NH

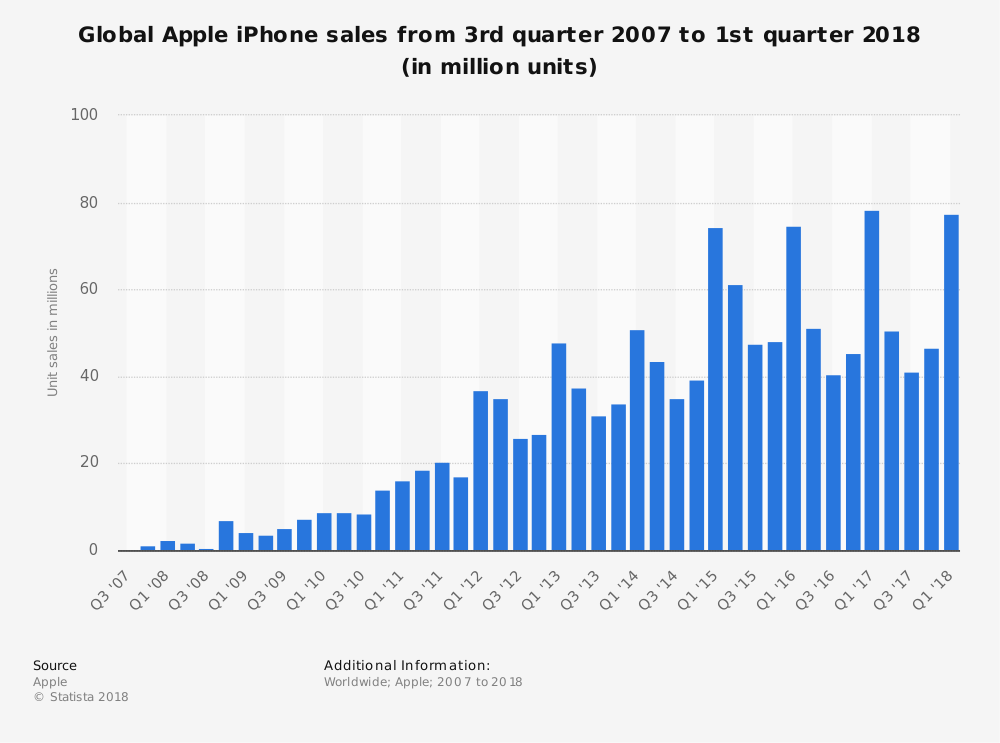

The problem for Samsung that seems to have been highlighted by Nikkei is the difference between actuals and estimations. As shown in the chart below from Statista, this is the result from Apple. However, Apple is reported to have told Samsung that it doesn’t need to buy more OLEDs in the short term as it has enough inventory. This suggests to me that Apple is starting to see some resistance to the price of the iPhone X, which has set a new benchmark. In the past, Apple has responded to sales lower than it hoped by cutting prices, even on relatively newly introduced products – it did it on the original iPhone. However, at that time, it was trying to establish the category, whereas now the aim is surely just to maximise revenue. If Apple cut the iPhone X to boost demand, it might also think that it has to cut the prices of the lower models in the range as well and so the effect on revenues could be significant.

For Samsung, the apparent drop in demand by Apple means that the company may completely drop the planned investment in a new A5 fab for flexible OLEDs. There had been a plan to make a big investment and we heard that this had been reduced, but now it looks as though it may not happen at all. We had heard this ‘informally’ (someone sent an email to us that should have gone to someone else!!), so we weren’t surprised to see public specualtion about this.

Samsung is now in a position to be able to supply Chinese brands, which had been squeezed out by the apparent demand from Apple and Samsung’s own brand. The question is how quickly they could change their plans to move from LCD and whether they are confident enough in the continuity of supply to design based on Samsung as the key supplier. LG has been expanding its capacity for flexible OLEDs, but cautiously. We have seen reports that Sony is a potential customer for LG’s flexible OLEDs. It will be interesting to see what Sony shows at the upcoming MWC event. (BR)