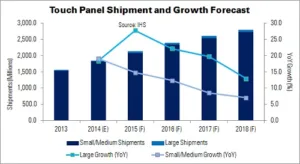

Worldwide small, medium and large touch panel demand has increased by double- or triple-digits in recent years. It is forecast to have risen 19.1% YoY in 2014 and will grow 15.1%, to 2.1 billion units, this year – according to IHS.

Single-digit growth will begin in 2017, as the smartphone and tablet markets become saturated. Touch penetration in PCs has fallen below expectations, although touch on hybrid PCs has been well-received.

| Touch Panel Market Forecast, 2013 – 2018 (Millions) | ||||||

|---|---|---|---|---|---|---|

| 2013 | 2014 (E) | 2015 (F) | 2016 (F) | 2017 (F) | 2018 (F) | |

| Large Shipments | 31.6 | 37.4 | 47.8 | 58.4 | 69.9 | 78.8 |

| Small/Medium Shipments | 1,524.6 | 1,815.6 | 2,084.7 | 2,340.6 | 2,540.6 | 2,718.9 |

| Total Shipment Growth | 1,556.2 | 1,853.0 | 2,132.6 | 2,399.0 | 2,610.5 | 2,797.9 |

| Large Growth (YoY) | 18.4 | 27.8 | 22.2 | 19.7 | 12.9 | |

| Small/Medium Growth (YoY) | 19.1 | 14.8 | 12.3 | 8.5 | 7.0 | |

| Total YoY Growth | 19.1 | 15.1 | 12.5 | 8.8 | 7.2 | |

| Source: IHS | ||||||

2014 was a difficult year for the touch industry (currently dominated by procap panels). Oversupply was ‘severe’, leading to higher competition. Profitability of touch panel makers was down across the industry, with many posting losses. Some expanded businesses or accelerated vertical integration to survive, while others moved from a focus on expansion to an emphasis on profit. The same trends are likely to continue in 2015.

The smartphone and tablet markets – which had fostered the touch panel market – began to slow in early 2014. High-end smartphones contracted, while the market for low-end (sub-$300) has grown significantly. In the tablet space, sub-8″, sub-$200 products grew while 10.x” models at $500+ have stalled.

Traditional touch panel makers must ‘aggressively defend’ their position in the market, as traditional display panel makers are poised to dominate with touch-integrated in- and on-cell LCD and AMOLED panels.

IHS believes that smartwatch and automotive displays will lead the touch market going forward.