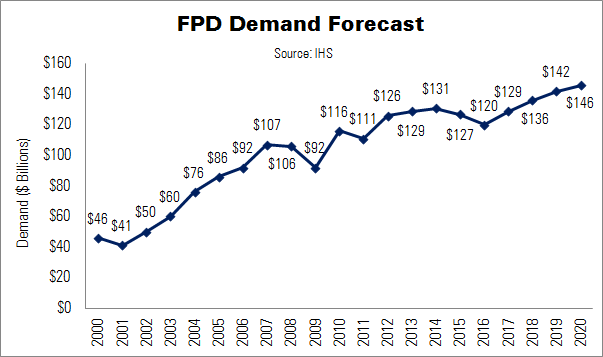

Global flat-panel display (FPD) revenue will shrink by 6% YoY this year, to $120 billion, according to estimates from IHS. This represents the lowest result since 2012.

“The industry has begun to question whether the 2016 Summer Olympics in Brazil will spur panel demand, as Brazil’s domestic situation and economy are worsening,” said IHS’s Rick Park. Park also noted that display demand is being negatively affected by the prolonged decline in oil prices; the resulting economic downturn in oil-producing countries; and the economic slowdown in emerging markets. “There is also growing concern about China’s sluggish domestic market, and the free fall in panel prices that began last year is also hampering market growth”, he added.

The panel oversupply situation (Oversupply Will Continue in LCD Market) caused panel prices to decline faster, in the second half of 2015, than in any year since 2008. In December last year, for example, the price of a 32″ open-cell LCD panel was down 41% YoY.

IHS’ long-term display demand forecast tracker predicts stronger demand for UltraHD and 8k panels to slow declining ASPs. Overall, global display demand may pick up after 2016 – if the world economy improves as expected. FPD shipment area is also forecast to continue rising due to demand for large sets, with a CAGR of 5% between 2015 and 2020.