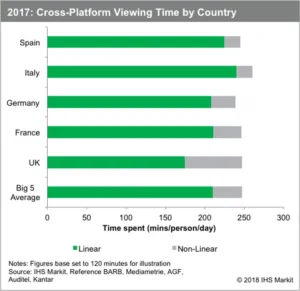

As viewers continue to shift to viewing television content on an on-demand basis, TV and video consumption is changing across the leading five European markets: United Kingdom, France, Germany, Italy and Spain. Linear TV viewing time declined year-on-year across all five markets in 2017, while time-shifted viewing via PVRs has also stagnated or declined, according to IHS Markit. In total, Europeans are watching an additional two hours of on-demand content each month across all platforms, compared to the previous year.

The share of viewing time devoted to online platforms has increased, with an average of 10 minutes per-person per-day devoted to online short-form video content (up to 15 minutes in length) and eight minutes to long-form content (over 15 minutes in length), the report said.

Despite the rise in online video consumption, total TV and video viewing time in the top-five European markets has remained relatively stable for the past six years, at an average of 247 minutes of TV viewing per-person each day, analysts said. However, the composition of total viewing time varies across individual markets as Netflix, Hulu and other subscription video options become more popular with consumers, particularly younger demographics. IHS Markit’s Fateha Begum remarked:

“With

the increasing volume of consumption moving away from traditional linear broadcast, monetisation of on-demand and time-shifted viewing remains a key concern, as ad-insertion and tracking technology has been slow to keep up. However, pay TV operators are still primarily concerned with retaining subscription revenues for the time being”.

Europeans continue to embrace on-demand viewing, with the UK leading the market. Daily linear viewing time in the UK declined by more than eight minutes per person in 2017, as PVR time-shifting also declined for the second consecutive year. However, on-demand viewing added five daily minutes per person, with the UK leading in the amount of time spent viewing non-linear content compared to the other four markets. Online long-form consumption grew 21%, rising three minutes per-person per-day since 2016, with subscription OTT services accounting for 74% of viewing minutes, compared to 69% in 2016.

In France, online long-form viewing time increased by 41.6% year-on-year, or approximately five additional viewing minutes per-person per-day. Netflix, the leading OTT player in France, accounted for three out of four net OTT subscriptions in 2017. CanalPlay, which led the market before Netflix launched in France, experienced subscription declines and closed its standalone OTT service in 2018. Analyst Rob Moyser added:

“Th

e shift to OTT consumption signals the need for pay TV operators to act quickly, in order to retain their foothold in the market. Leading operators are already enhancing their current propositions and embracing OTT, to ensure they capture some of the time spent on other devices and services, so they can stay at the forefront of consumers’ minds”.