Paul Gray of IHS then gave a summary of the market as he sees it. He said that the current situation looks like the “Triumph of the generalist” – the general purpose smartphone is dominating just as PCs, which are also general purpose devices did in the past. The smartphone is also cannibalising everything else and is taking business from many other categories.

Paul Gray of IHS then gave a summary of the market as he sees it. He said that the current situation looks like the “Triumph of the generalist” – the general purpose smartphone is dominating just as PCs, which are also general purpose devices did in the past. The smartphone is also cannibalising everything else and is taking business from many other categories.

However, the smartphone is probably past its peak in growth, although there is still a good high end market. Car satnavs, ebook readers, and photo frames have been and gone as their functions can be beaten by the hardware in modern smartphones. The replacement speed of the smartphone has helped a lot.

Display performance is a figure of merit for smartphones and 4K mobile phones will outship 4KTVs relatively quickly. By 2020, the market will be double that of 4K TVs. 4K will be intimately connected to pocket devices partly because many will have 4K video cameras.

Think about the CD, said Gray. Once the performance hit the good enough level, it has been hard to drive sales of better audio technology. Either consumers couldn’t hear the difference or were not prepared to pay more and seven formats failed. Then along came MP3 to change things. DVD was very successful, but consumers were not happy to move to Blu-ray. Blu-ray will get ahead of DVD in sales soon, but only because DVD will fall. (I spoke to a UK retailer this week that told me it is still trying to “kill VHS tape” – Man. Ed.)

Ease of use is a big factor in device use, but it is hard to measure, specify and design for. Gray quoted that iPlayer data from the BBC shows that people use it at different times compared to when they watch linear TV and Gray believes it shows that use is about convenience at different times and in different places (he suspects as iPlayer viewing is later than regular viewing, it is often done in bed on personal devices).

Smart TV is developing around the world and the smart TV development will allow the delivery of 4K content using OTT. However, SmartTV is basically a failure. Rather than driving the demand for TVs, the addition of Smart technology has become just a cost and set makers are moving to putting Android on their sets to reduce the burden of content maintenance.

Gray believes this is because of their business models (or lack thereof). The set makers did not re-organise their business models around content delivery when they switched to adding intelligence to the sets. They still had the model of “Make box + sell box = profit”. TV makers did not secure recurring revenue rights on the content that was being introduced by service providers and app developers. The TV market is hyper competitive and set makers gave away rights in order to secure attractive deals.

Gray compared the web offerings from Roku and WDLive (Western Digital), two vendors of media players. Roku’s advertising is about content, but WDLive is still about feature and technology. Quoting Coco Chanel, Gray said that “Simplicity is the ultimate sophistication”.

Turning to 4K, there are big regional differences in adoption. Most sets will ship in China, but Japan also has a big 4K market based on its own content. Netflix has developed 4K content and will continue to do so.

8K – There’s a Disconnect in the Start in Japan

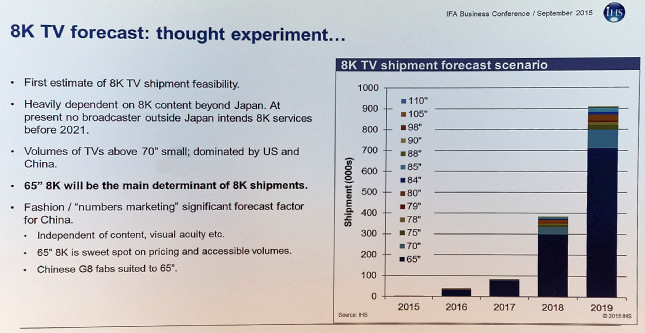

What about 8K? Gray said that it’s very early and will be very dependent on content, except in Japan. Japan has the smallest average screen size in the world at around 32″/33″. Other regions prefer larger sizes. That is something of a disconnect. Markets that like big sets, like the US, tend to be very price sensitive. There may be a very low base of 8K in 2019, with some growth in 2020. 65″ will be the “sweet spot” for volume, but that is equivalent to 32″ at 4K, which nobody thinks is a good market. Panel yield may be an issue for cost in the early stages of the market development.

The Chinese market is now a “hotbed of early adoptors”. They are setting, not following the trends. The brands are finding that in the Chinese domestic market, demand is being saturated, and companies are having trouble getting ahead of their competitors. All the companies are of a broadly similar size. To boost growth, they are trying new business models and riskier territories, such as Africa and Russia. They are also acquiring distressed brands, as Japanese companies did in the 1970s.

Turning to business models, Gray looked at Alibaba, which started in mobile commerce, but also has payment and other businesses. However, what is not so well known that AliExpress is the biggest online retailer in Russia and is becoming “The Amazon of Russia”. Consumers can buy TVs in Russia directly from Chinese brands. This could help Russian consumers to overcome their financial problems while delivering a market to Chinese brands.

There are rumours of free TV sets being possible, funded by subscriptions, in the same way that STBs are supplied free by Pay TV companies in Europe. However, nobody is yet doing this. (I talked to a big brand about doing this ten years ago when they wanted to switch consumers to HD sets. They pointed out that in the mobile phone market at that time, the operators really killed phone makers’ profits. Apple changed that a bit, but there was a reluctance to go that way – Man. Ed.)

Whaley TV has investment from Alibaba, Tencent and China Media Captial and has a lot of content with a good number of content experts from the world of broadcast and content creation. Gray thinks it looks like a serious potential player.

In conclusion, Gray said that Chinese firms are not just investing in physical production, they are very aggressive in business innovation as they don’t have legacies to worry about. Finally, content and hardware will become ever more linked and that is the defining factor for success in the market.