Paul Gray opened the sixth IHS (used to be DisplaySearch) conference and there was a message of support from Dirk Koslowski of IFA.

Morrod of IHSThe first keynote was from Tom Morrod whose topic was “China is more than just a factory”. China accounts for around 65% of all production of consumer electronics across every product category, but China is developing in many otherways.

Morrod of IHSThe first keynote was from Tom Morrod whose topic was “China is more than just a factory”. China accounts for around 65% of all production of consumer electronics across every product category, but China is developing in many otherways.

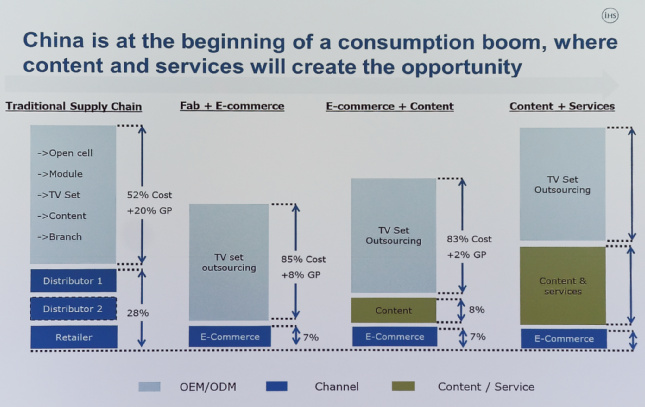

There are a lot of changes in the way that the supply chain works. Traditionally, there was a supply chain from brands through distribution channels, including retailers. Margin was made by the brands and in the distribution. Now, though, a lot of goods are sourced through single layers of channel and there has been commoditisation in almost all electronics products.

GDP has grown faster in China than almost anywhere at any time, and that has meant a huge growth in the middle classes in the region. If you can’t make money by manufacturing or distribution, you need to add something else, for example, services and content such as OTT video. Apple, Amazon and others are examples of companies that have done this. This has changed behaviour in China as well.

China is leapfrogging traditional technology paths and online video is already more important than in Europe as China has no history of optical/physical media to displace. Over 5% of video consumption is taken through streaming. That means that China has enough of a market for streaming that local companies can challenge the US leaders such as YouTube and Netflix. This can’t happen for companies in any other country.

Linear TV viewing is declining in the US and Europe (see our article on the Ericsson media report), but in China there is a lot less TV viewing than elsewhere. That means an opportunity for linear TV growth, still, but also means that there is little linear advertising content to be replaced or competed against. China may be able to develop without the barriers to change in other countries. TV ARPUs have been growing continuously over recent years, but there is still a long way to go to get to the level of other countries.

China Will be 50% of all IPTV by 2018

By 2018, said Morrod, China will represent half of all IPTV subscribers globally, and is already the biggest single market. There is a lot of investment to keep pushing that growth along. Advertising revenue is much closer between TV and online than in the US and is almost balanced, while it is more than 2:1 in favour of linear TV in the US. That changes the industry dynamics.

Asia, especially China, has 45% of all of the world’s fibre broadband and this allows lots of new business models and applications, which will give Chinese companies a big advantage. More than 55% of future investment in fibre-based broadband will be in China.

Moving to devices, Morrod said that China has three times the number of smartphones as the US and that means more investment and technology. Apple and Google have the big app stores globally, but as with online video, China has enough scale to allow local vendors to compete and develop. On the other hand, spend on content is a lot less than elsewhere, so there is a lot of room for growth.

So what does this mean for those that are working there or competing with Chinese companies. The top 15 companies in China have around $150 billion of revenue between them, but that is less than Apple alone. Chinese companies are well below Amazon and Google, but when you drop below the top 3 (Apple, Amazon, Google), the Chinese companies are of sufficient scale to compete. Looking in terms of growth, the Chinese are well ahead even of the huge US companies, so they will start to catch up. They have a good level of income to use for investment and they are looking outside China for opportunities and for diversification.

The big companies such as Tencgent (messaging and content), Alibaba (online commerce), Baidu (search), Wanda and Xiaomi (devices) are interested in many different businesses and services such as taxi calling, health etc. Many of the investments are outside China to help companies develop diversified international portfolios (e.g. Chinese companies have invested in Snapchat). The companies are also cross-investing in some areas.

To summarise, Morrod said that China is moving from being driven by global demand for manufactured goods to diverse domestic consumption. The Chinese are leap-frogging traditional business models, especially in online consumption. The sheer size of the domestic market will give Chinese companies the base to expand from. The companies are also developing to broadly match the same kind of offerings such as those from Apple, Amazon, Facebook and Google. In five year’s time, the big international list of media companies may not just be US companies.