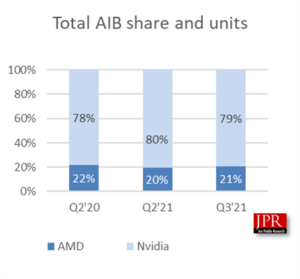

According to a new research report from the analyst firm Jon Peddie Research, unit shipments of add-in boards increased in Q3’21 from last year. AMD saw a one-percent increase in market share while Nvidia remained the dominant market share leader with 78.2%.

Year over year, total AIB shipments increased by 25.7% this quarter compared to last year at 12.7 million units, and up quarter-to-quarter from 11.47 million units in Q2’21.

AMD gained in market share in Q3 with Nvidia gaining on share year-over-year

With the help of the rise of esports and the growing popularity of PC gaming, AMD and Nvidia have been reporting record game segment revenues over the past quarters.Add-in boards (AIBs) use discrete GPUs (dGPU) with dedicated memory. Desktop PCs, workstations, servers, rendering and mining farms, and scientific instruments use AIBs. Consumers and enterprises buy AIBs from resellers or OEMs. They can be part of a new system or installed as an upgrade to an existing system. Systems with AIBs represent the higher end of the graphics industry. Entry-level systems use integrated GPUs (iGPU) in CPUs that share slower system memory.

The workstation segment surged to another volume record in Q3’21, OEMs and VARs are having a major impact by stocking up on inventory, the pandemic showed us what a disruption in the supply chain can do to availability, so we are seeing system integrators plan ahead.

Considering these trends and the addition of Intel into the AIB market we see positive signs overall for the industry.

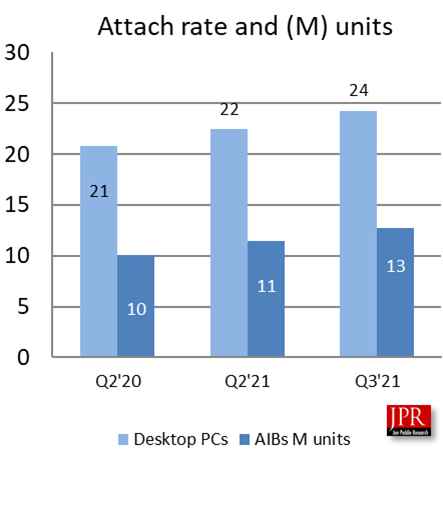

Shipments of Desktop PCs compared to desktop AIBs over time

Shipments of Desktop PCs compared to desktop AIBs over time

Quick Highlights

On a year-to-year basis, we found total AIB shipments during the quarter rose 25.7%, which is greater than desktop CPUs, which rose 16.6% from the same quarter a year ago.

- AIB shipments during the quarter increased from the last quarter by 10.9%, which is below the ten-year average of 17.1% but outpaced CPU shipments by nearly 3%.

- Total AIB shipments increased by 25.7% this quarter from last year to 12.7 million units and were up from 11.47 million units last quarter.

- AMD’s quarter-to-quarter total desktop AIB unit shipments increased 17.7% and increased 20.8% from last year.

- Nvidia’s quarter-to-quarter unit shipments increased 9.3% and increased 27.1% from last year.

- AIB shipments from year to year increased by 25.7% compared to last year.

Dr. Jon Peddie, President of JPR, noted, “Intel is poised to enter the AIB market in 2022. It is unknown if the company will sell add-in-boards as AMD and Nvidia do, or just offer chips. The company is entering the market at a high point and may be surprised when the hangover of Covid and Cybermining falls off. The big question most people are asking is how much market share will the company take?”

JPR has been tracking AIB shipments quarterly since 1987—the volume of those boards peaked in 1998, reaching 116 million units. In 2020, 42 million shipped. So far in 2021, 37 million AIBs have shipped through 3 quarters.

Pricing and availability

Jon Peddie Research’s AIB Report is available now available and sells for $2,750. The annual subscription price for JPR’s AIB Report is $5,500 and includes four quarterly issues, and four hours of consulting. Subscribers to JPR’s TechWatch are eligible for a 10% discount. Bundle packages are also available. For information about purchasing the AIB Report, please call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.