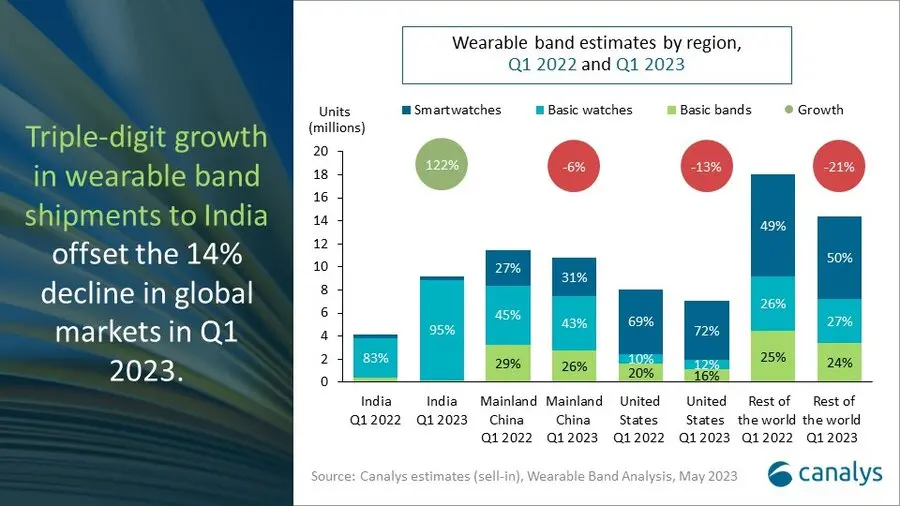

Smartwatches witnessed a slightly rough start in 2023 with global shipments seeing an 11% dip year-over-year (YoY) in Q1’23, settling at 15.8 million units. This occurred despite the Indian market’s remarkable performance, which enjoyed a 122% YoY surge during the same period, according to Canalys.

Apple, despite experiencing an 11% decline in Q1’23 shipments, retained its iron grip over the market. Apple’s comprehensive smartwatch functionality and ecosystem loyalty worked in its favor, giving it a 20% market share. Its market position, however, has slightly loosened compared to the 22% market share it enjoyed in Q1’22.

Xiaomi, with the second-largest volume in Q1’23, has been making strides after revamping its product portfolio last year. It’s clear it is setting its sights on mid-to-high-end basic watches to enhance its brand while also pushing affordable basic bands and watches to maintain overall sales volume.

Huawei and Samsung, bagging third and fourth places respectively, reflected the strong influence of smartphone ecosystem players in the wearable band market, despite seeing drops in their shipments in Q1’23 compared to Q1’22.

While the start of 2023 saw a modest downturn, analysts remain optimistic about a resurgence in growth by the year-end. Vendors should be working strategically to differentiate their brands, products, and ecosystems while paying attention to specific consumer segments like sports enthusiasts and health-conscious individuals. The secret to long-term success, according to Canalys, lies in how well vendors can leverage data from wearable bands to offer personalized insights and recommendations, thereby enhancing consumer interaction and brand loyalty.

| Vendor | Q1’23 Shipments (Million) | Q1’23 Market Share | Q1’22 Shipments (Million) | Q1’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Apple | 8.2 | 20% | 9.2 | 22% | -11% |

| Xiaomi | 4.4 | 11% | 4.2 | 10% | +4% |

| Huawei | 3.6 | 9% | 4.6 | 11% | -23% |

| Samsung | 2.7 | 7% | 3.4 | 8% | -19% |

| Fire Boltt | 2.7 | 7% | 0.9 | 2% | +198% |

| Others | 19.7 | 48% | 19.4 | 46% | +2% |

| Total | 41.3 | 100% | 41.7 | 100% | -1% |

The Wearable Bands Classification Scheme

The wearable band market is typically divided into three primary categories here:

- Basic Bands: These are simple wearable devices that do not run third-party applications. They usually serve a limited set of functions such as step counting, sleep tracking, and displaying notifications from a paired smartphone. These devices are also typically cheaper due to their limited functionality.

- Basic Watches: These are devices that may look and function like traditional wristwatches but come with some added fitness tracking or smart features. They do not usually support third-party apps. Basic watches often provide functionalities such as heart rate monitoring, sleep tracking, activity tracking, and maybe even basic notification support.

- Smartwatches: These are advanced wearable devices that run a mobile operating system and can run third-party applications. They typically offer all the features of basic bands and basic watches, but also include advanced features such as support for a variety of apps, customizable watch faces, on-board music storage, and sometimes even standalone cellular connectivity. They might include features like GPS tracking, voice assistant integration, mobile payment support, and the ability to respond to messages and emails directly from the watch.

In this market, vendors typically try to cater to a broad range of consumers, from those who simply want to track their physical activity or receive smartphone notifications on their wrist, to those who desire more advanced functionalities, such as the ability to use a wide variety of apps or make phone calls directly from their smartwatch. Obviously, different bands would conform to different display characteristics, although there are no hard or fast rules for specifications, but the price range for these products can go from under $20 to over $500, in some cases.