Shipment value of the Taiwanese communications industry, comprising of wireless and network communications, is estimated at around NT$3.3 trillion (US$108.2 billion) in 2015, up 17.2% compared to 2014, according to MIC (Market Intelligence & Consulting Institute), a Taipei-based ICT research institute.

Among all, mobile communications is believed to have the highest contribution to the industry with 20.7% year-on-year growth and shipment value of NT$2.2 trillion (US$72 billion).

MIS estimates that global smartphone shipment volume will reach around 1.5 billion units in 2015 and top over 1.98 billion units in 2019, representing a 7.2% CAGR (Compound Average Growth Rate) from 2015 to 2019.

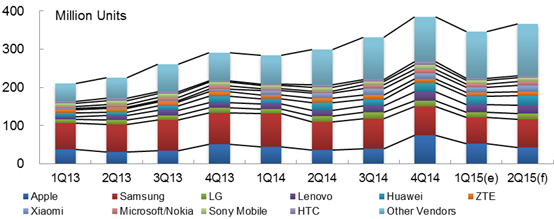

“There are several driving forces behind the smartphone industry”, says Chia-wei Chang, the senior analyst with MIC. “The continuous increase in smartphone shipments resulted from the release of Apple’s iPhone 6 and 6 Plus, positive sales outlook for the upcoming new releases, the increased shipments for Xiaomi and the increased orders placed by customers in China and emerging markets are all growth drivers.” Hence, shipment volume and value of the Taiwanese smartphone industry in 2015 are anticipated to grow at 17.3% and 21.2%, respectively.

Of all Taiwanese brands, ASUS is to enjoy the highest shipment growth in 2015. Apple remains the largest client of Taiwanese contract makers, with an estimated 220 million outsourcing order while Xiaomi is expected to give a 6.6 million to 6.8 million outsourcing order this year, according to MIC. Consequently, Taiwan’s share of the global smartphone shipment volume is estimated to reach around 24.5% in 2015.

Major Smartphone Vendor Shipment Volume, 1Q 2013 – 2Q 2015

Source: MIC, May 2015

Industry Reshuffled

With the LTE (Long Term Evolution) network infrastructure becoming a full-fledged one, the demand for small cells also increases. “North American operators AT&T and Sprint separately announced their plan to undertake small cell plans while others like Vodafone, Telefonica, Softbank, and SK Telecom are also increasing their deployment in outdoor small cell base stations and metrocells to strengthen competitiveness of 4G and support mobile data traffic volumes,” says Chang.

“Amid the fierce 4G competition among operators, the user adoption of 4G services in Taiwan still managed to reach 17% as of March 2015. However, the highly concentrated 4G industry is going to cause relatively high barriers for new entrants.”

Aside from 4G, major CPE manufacturers and operators have been taking aim at emerging service opportunities associated with the next-generation technology like 5G.