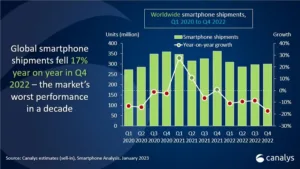

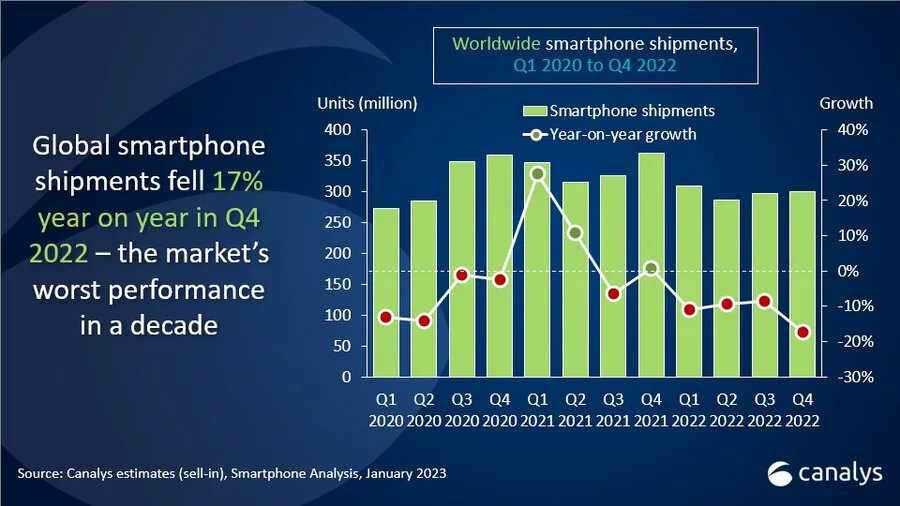

Worldwide smartphone shipments fell 17% year on year in Q4 2022. Full-year 2022 shipments declined by 11% to fewer than 1.2 billion, reflecting an extremely challenging year for all vendors. Apple reclaimed the top spot in Q4 and achieved its highest quarterly market share ever at 25%, despite facing shrinking demand and manufacturing issues in Zhengzhou. Samsung finished the quarter second with a 20% market share but was the largest vendor for the full year. Xiaomi retained third place despite its share falling to 11% in Q4, largely due to challenges in India. OPPO and vivo rounded out the top five, taking 10% and 8% market shares respectively.

“Smartphone vendors have struggled in a difficult macroeconomic environment throughout 2022. Q4 marks the worst annual and Q4 performance in a decade,” said Canalys Research Analyst Runar Bjørhovde. “The channel is highly cautious with taking on new inventory, contributing to low shipments in Q4. Backed by strong promotional incentives from vendors and channels, the holiday sales season helped reduce inventory levels. While low-to-mid-range demand fell fast in previous quarters, high-end demand began to show weakness in Q4. The market’s performance in Q4 2022 stands in stark contrast to Q4 2021, which saw surging demand and easing supply issues.”

“Vendors will approach 2023 cautiously, prioritizing profitability and protecting market share,” said Canalys Research Analyst Le Xuan Chiew. “Vendors are cutting costs to adapt to the new market reality. Building strong partnerships with the channel will be important for protecting market shares as difficult market conditions for both channel partners and vendors can easily lead to strenuous negotiations.”

Canalys forecasts flat to marginal growth for the smartphone market in 2023, with conditions expected to remain tough. “Though inflationary pressures will gradually ease, the effects of interest rate hikes, economic slowdowns and an increasingly struggling labor market will limit the market’s potential,” added Chiew. “This will adversely affect saturated, mid-to-high-end-dominated markets, such as Western Europe and North America. While China’s re-opening will improve domestic consumer and business confidence, government stimuli are only likely to show effects in six to nine months and demand in China will remain challenging in the short term. Still, some regions are likely to grow in the second half of 2023, with Southeast Asia in particular expected to see some economic recovery and a resurgence of tourism in China helping to drive business activities.”