Global PC shipments marked their sixth consecutive YoY growth in Q3 2021 at 84.2 million units. This came despite the ongoing component shortages and other supply constraints. However, the 9.3% YoY growth during the quarter implied decelerating PC shipment momentum after four consecutive quarters of double-digit YoY growth since Q3 2020. In addition, most OEMs and ODMs are not seeing any shrinking gap between orders (demand) and shipments (supply).

In Q3 2021, the global PC supply chain remained constrained due to component shortages related to power management IC, radio frequency, audio codec and others. We believe there is no solution to this demand-supply mismatch till mid-2022. ODMs are still pulling in chips inventory to tackle any downside risks. Besides, unstable global logistics and manufacturing site shutdowns in Southeast Asia and China add more uncertainties to PC supplies.

PC demand remained solid during the quarter. Commercial PC demand is gradually heating up while consumer PC momentum is decelerating. Chromebook turned out to be the biggest drag during the quarter, as both government and education orders were largely fulfilled in the first half, in addition to the increasing availability of COVID-19 vaccines and reopening of offices and schools across the world. We believe Chromebook demand will not disappear, just take a break this year.

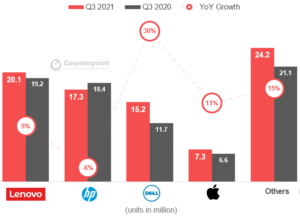

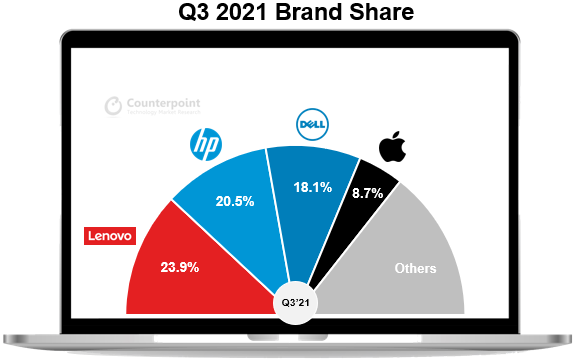

Global PC Shipments by Vendor, Q3 2021

Lenovo was in first place again in the third quarter with a 23.9% market share after shipping 20.1 million units, slightly above the Q2 number mainly due to its operational flexibility. HP’s 20.5% share and 6% YoY decline were largely due to Chromebook slowdown as well as component shortages. Dell had a 30% YoY growth in the third quarter due to a relatively lower base and its commercial/premium product focus. Apple’s shipments grew 11% YoY in Q3 2021 riding on the replacement demand for the M1 Mac. Asus shipments were boosted by both consumer and commercial segments. The brand took fifth place in Q3 beating Acer, which recorded a 3% YoY growth due to Chromebook slowdown.

About Counterpoint Technology Market Research

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.