According to DSCC’, global flat panel display fab utilization, which was stable in Q1’24 despite decreased production inputs and some facility closures, has begun to increase as of March 2024. This rise is expected to continue into the second quarter, with a projection of over 10% sequential increase in TFT input.

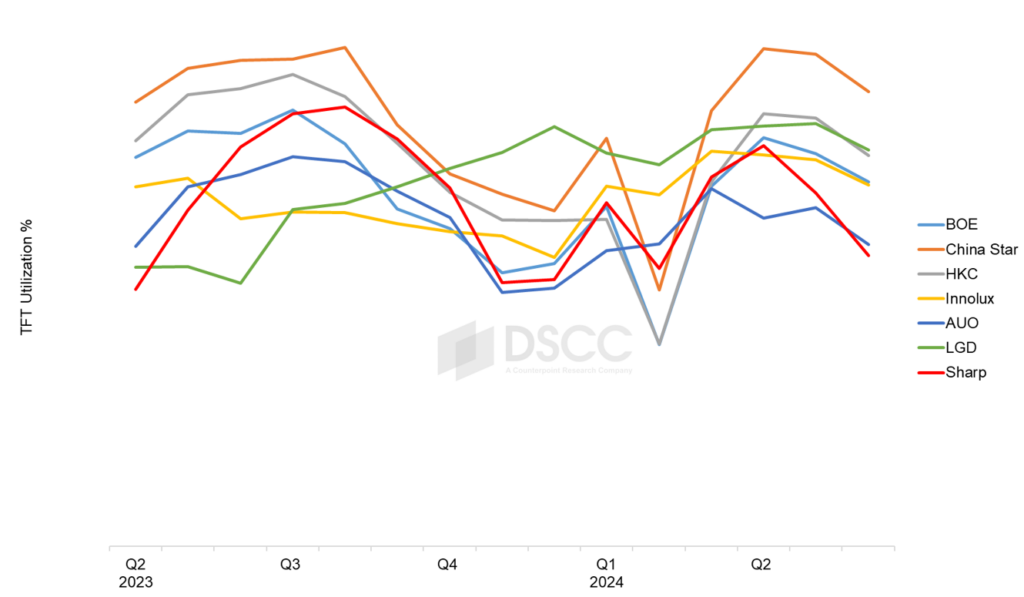

The top three Chinese LCD manufacturers experienced a significant reduction in activity from Q4’23 through early Q1’24, coinciding with the Lunar New Year celebrations. However, their production started to rebound in March 2024. This pattern of reduced production in the winter followed by a recovery is similar across other major manufacturers, reflecting a seasonal trend.

Despite these increases, global fab utilization in Q2’24 is anticipated to reach only 83%, which remains below the high levels of over 85% witnessed from Q3’20 to Q1’22 during the pandemic.

Regionally, Taiwan saw a 7% quarter-over-quarter reduction in capacity due to closures of facilities by AUO and Innolux, contributing to an increased utilization rate there despite the overall lower input. However, Japan might see a decline in utilization, primarily influenced by Sharp’s Gen 10 Sakai Display Products fab, which is reducing its input.

Bob O’Brien, Co-Founder of DSCC, noted that panel makers managed to avoid an oversupply through what he described as a “soft landing,” and are now ramping up production to meet anticipated demand driven by summer sports events and a new cycle of PC refreshes that includes AI-enhanced models.

While the industry aims for higher utilization to meet expected demand, there remains a risk of overshooting into oversupply, which could shift the current balance and potentially lead to only modest price adjustments as companies seek to manage output carefully.