According to a report from UBI Research foldable OLED shipments are projected to increase from 22 million units in 2023 to 61 million units in 2027. This represents an average annual growth rate of 29%.

With the growth in the foldable OLED market, the market for foldable cover windows is also expected to expand. Foldable cover windows are integral components of foldable phones, providing protection and clarity for the flexible displays. This market is predicted to grow from $410 million in 2023 to $840 million in 2027.

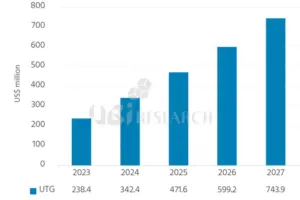

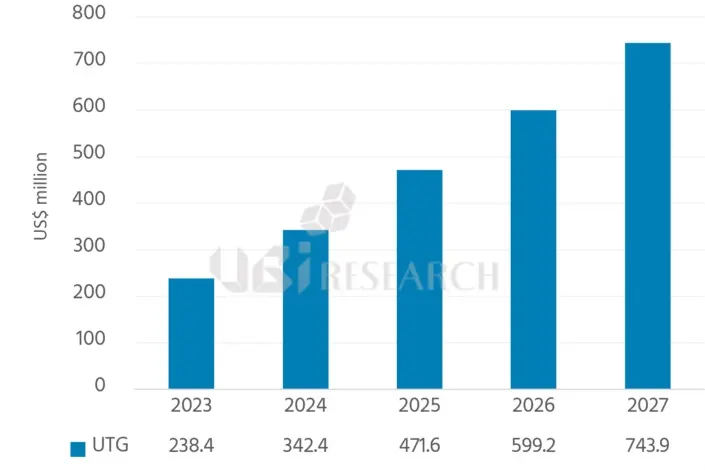

There is a shift in preference towards ultra-thin glass (UTG) for these foldable cover windows, with significant companies like Samsung Display, BOE, TCL CSOT, and Visionox, all developing foldable OLEDs with UTG. Due to this shift, the UTG market is expected to rise from $240 million in 2023 to $740 million in 2027. Concurrently, the market for colorless polyimide (PI), another material used for cover windows, is projected to decrease from $170 million in 2023 to $95 million in 2027.

Samsung has been using UTG for its cover windows in all its foldable phones since the Galaxy Z Fold2. Samsung sources its UTG from Corning and Schott. Chinese companies, which previously used colorless PI due to technological constraints, are also increasing their use of UTG. Motorola and Oppo, for instance, have released or are preparing to release new foldable phones using UTG, supplied by various providers. In contrast, Huawei, with its Mate X3 foldable phone, continues to use colorless PI due to performance issues with UTG.