Let’s put aside the notion that technology matters to consumers the way it matters to people building displays. That’s an important assumption when discussing flexible displays because the novelty of the foldable screen is about all that you need to get buy-in from consumers. Sure, they may want to know the price, and it will be high, and they will then want to know about the performance and longevity of the foldable display, which is not high enough at that price, but that will not deter consumers.

When PC sound cards and CD-ROM upgrade kits were first released in the early 90s, consumers paid upwards of $1,000 at today’s prices just so they could hear sound coming out of their computers. It was an emotional reaction, and that’s the same with flexible displays. When you appreciate the emotional value of a product, it opens up a whole world of possibilities. For display manufacturers if they are willing to get aggressive about flexible displays, the road ahead is wide open.

I suppose it is also worth noting that flexible displays in automotive are also an emotional component of the consumer experience. People like to sit in a car with a nice interior and that spaceship console thing that you can get with modern screens and instrumentation. The transition to electronic vehicles (EVs) is one factor that is accelerating the adoption of new display technologies, motivated as much by user experience as it is by the practical implications of low power instruments and in-car infotainment systems. But within the next three years, all new car models, EV or not, will make a pitch to consumers based on the layout of the interior cabin, display options, head-up displays (HUDs), transparent displays, and maybe even augmented reality (AR) features.

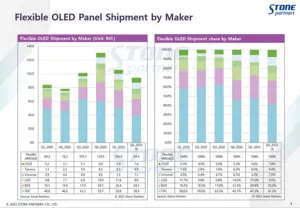

Flexible OLED Panel Shipments

Chinese market research firm, Stone Partners, has a report that says total shipments of rigid OLED panels in Q2’23 are expected to reach 36.6 million units, marking a significant drop of 13 million units compared to the same period last year. What is interesting about the report is that Stone Partners attributes this decline to the rising popularity of Chinese cheap flexible OLED panels, which are being supplied in large quantities to manufacturers such as Xiaomi, Oppo, and vivo. Granted, despite this overall decrease, Samsung managed to increase its rigid OLED panel shipments by 6.6 million units, reaching 29.4 million units, mainly driven by demand for its own A54/A34/A24 series smartphones.

And while Samsung still leads the pack in the flexible OLED segment, the company’s market share dipped below 50% for the third consecutive quarter, highlighting the increasing competition it faces from low-cost flexible OLED panels from Chinese manufacturers, driven by Chinese smartphone makers.

The market dynamics indicate a shifting landscape in the display industry, with rigid OLED panels facing challenges from lower-cost Chinese alternatives as well as existing LCD displays. Samsung’s strong foothold as the market leaders is undeniable but the rise of alternative suppliers suggests that market dominance will be very hard to maintain, and frankly, unlikely if companies like BOE, Visionox, TCL CSOT, and Tianma can continue with their aggressive pricing models, and hammer away at OEMs.

A Shifting Landscape for Displays

We are in a market facing very uncertain outcomes, and that’s not going to go away. Tensions with China, a war in Europe, and an upcoming presidential election in the US are going to keep people guessing about what the future will bring, and while we may not enter a recession, consumers are going to be jittery. So, what makes this a ripe time for flexible displays and foldable smartphones? The novelty is the thing. People need a distraction. Yet another upgrade and a hefty price tag for a new phone is not going to cut it. Apple had to blow up its pristine reputation by trying to convince the world that “spatial computing” is a thing and they have just the answer. This is really about the best time to be getting aggressive on flexible OLED, and the thing is, if Samsung is driven down to below 30% market share, a sort of watershed point, it will mean that the market has flipped to Chinese vendors. That’s a real possibility by 2024.

It was interesting to read through a 2022 research paper from Corning on the future of technical glass. It’s a great read, and has lots of pages about glass technology but only one paragraph on curved and bendable glass. That’s not to criticize Corning, but to point out that we are entering a non-traditional era in display manufacturing. The display business is a semiconductor business and a lot of companies have the ability to compete and innovate at a very high level in the business because of that fact – it ain’t about cutting glass anymore. In the next 3 years, there may not be one dominant supplier, not one dominant technology, and not even one dominant form factor.

Reference

Kohli JT, , Hubert M, , Youngman RE, , Morse DL, . A Corning perspective on the future of technical glass in our evolving world. Int J Appl Glass Sci. 2022; 13: 292– 307. https://doi.org/10.1111/ijag.16560