Technology developments, material improvements, product innovations combined with capacity expansions and higher competition will help flexible OLED display to gain higher share and drive the next generation smartphone market. There has been slowdown in the smartphone market in recent years. However, the market has shifted to positive growth in 2021 in spite of component shortages and slower shipments in the second half of the year.

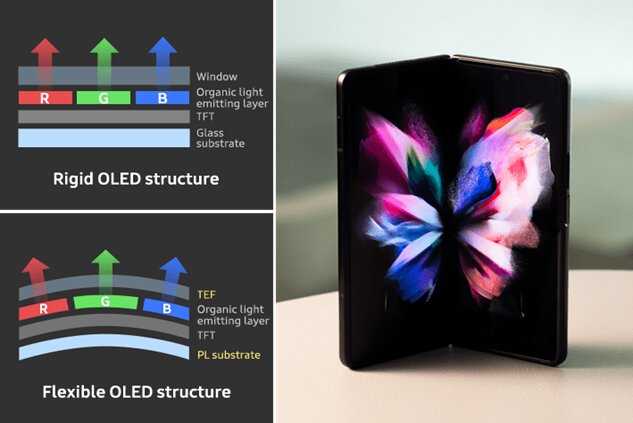

The introduction of 5G-based products needing slimmer displays to accommodate 5G-enabling components will continue to increase flexible OLED demand. The integration of new technology such as under panel camera (UPC), fingerprint under display, integrated touch, power saving, variable refresh rates, and other features to reduce border & increased screen-to-body-ratio will make flexible OLED more critical for 2022 products.

Flexible OLED Gaining Share

According to preliminary data from International Data Corporation (IDC) published in January 2022, smartphone vendors shipped a total of 362.4 million phones during the holiday quarter (Q421), which was down 3.2% year over year but slightly better than IDC had forecast. On an annual basis, the market grew 5.7% in 2021 with 1.35 billion smartphones shipped. The company also mentioned that supply chain and component shortages had a meaningful impact on smartphone market in the second half of 2021. IDC expects to see supply and logistic challenges continue thorough the first half 2022 and expects return to growth in the second quarter and second half of 2022.

DSCC published their preliminary AMOLED smartphone panel shipments results in January showing that 2021 had a total 644 million AMOLED smartphone panel shipments, up 28% Y/Y. Of the 644 million units, rigid AMOLED smartphone panels will have 42% unit share, flexible AMOLED smartphone panels will have a 55% unit share and foldable AMOLED smartphone panels will have a 2% unit share.

Flexible OLED panels are gaining share in the smartphone market even though panel and smartphone prices are higher than rigid OLEDs and LTPS LCDs. Samsung and Apple are driving flexible OLED demand and technology developments. Smartphone brands are adopting flexible OLED for their 5G products. The need for affordable 5G products at less than $400 is leading some suppliers to use LTPS LCD at lower cost levels. Flexible OLED will continue to gain share in smartphone market in 2022 and beyond.

Display Capacity Increasing

Samsung Display continues to be the dominant supplier in terms of OLED capacity, shipments, performance and technology roadmap but LGD and BOE are increasing production. (LGD and BOE Competing with SDC for Larger Share of iPhone Business) More expansion of capacity is coming from companies such as China Star (CSOT), Tianma, Visionox, and others. Chinese OLED makers’ production is growing with improvements in flexible OLED yield rates and customers adoption. They are starting to gain share with more capacity investments. By the end of 2022, there will be nine Gen6 flexible OLED fabs in China.

Flexible OLED – Technologies Evolving

Samsung Display is focusing on LTPO (LTPS + Oxide TFT) that enables variable refresh rates and significantly reduce power consumption. (LTPO is a Hot Technology – but What Is It?) The company has adopted new material whose luminous efficiency has improved dramatically.

Y-OCTA: Samsung has also developed on-cell touch Y-OCTA (Youm On-Cell Touch AMOLED) for flexible OLED technology enabling thinner flexible OLED displays. YOCTA is the process of integrating the touch sensor on-cell in OLEDs. It adds additional backplane steps to the front plane manufacturing. It also has yield challenges. Touch on this TFE concept is gaining higher adoption rates with higher number of suppliers offering it with flexible OLED display. Apple and Samsung are both using it in their products. LG Display, BOE, Tianma, and Visionox are all developing their own brand and processes for on-cell touch integration to reduce the layers and increase performance.

LTPO: there is significant growth in LTPO capacity. The Galaxy S21 Ultra, Galaxy Fold-3 and Flip-3 are already using LTPO technology. Apple has started using LTPO-based flexible OLED panel in iPhone 13 Pro models. Samsung Display started LTPO production in 2020 and LGD, BOE, China Star, Visionox and others are already starting to convert capacity to LTPO or planning to do it. LTPO technology also has some challenges: increased number of photo masks, lower yields, and higher capex; but has big advantages in lower power consumption and variable refresh rates.

Variable Refresh Rates: Samsung Display has commercialized “Adaptive Frequency technology”, a low power OLED panel technology that automatically adjusts the refresh rate of the display from 10Hz to 120Hz depending on consumer usage. By supporting variable refresh rates, such as 120Hz for games with fast screen switching and 10Hz for still images, the panel driving power can be reduced up to 22% compared to previous designs according to SDC. This helps with 5G products where video steaming and game content are rapidly increasing. Higher refresh rates like 120Hz are increasing the shares of LTPO panel production with variable refresh rates.

New Organic Material: Samsung Display has developed low-power OLED technology through new organic materials with better luminous efficiency. According to the company, the new organic material has been improved to make the movement of electrons in the organic layer faster and easier. The luminous efficiency has been greatly improved and the power consumption has been lowered by more than 16% compared to previous one. Due to the new process, the OLED panel can create brighter light while consuming less power. The new panel is being used for the first time in the Galaxy S21.

Increasing Sunlight Visibility: Samsung Display’s newest OLED display has been recognized by UL (the global independent safety science company) for its “Sunlight Visibility” performance. Samsung’s new OLED panel achieved an “Ambient Color Gamut” rating of 73% of the DCI (Digital Cinema Initiatives)-P3 level and a peak brightness of more than 1500 cd/m². The organic material is helping to achieve significantly improved outdoor visibility. Samsung Display’s new OLED panel is available for other smartphone manufacturers and is used in its Galaxy S21 Ultra 5G smartphones. Compared with the Galaxy S20, the S21 Ultra offers a 25% brighter picture (1500 vs 1200 cd/m² peak brightness).

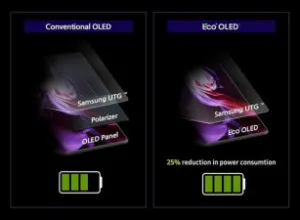

No Polarizers (Eco Square OLED): Samsung Display has also introduced its new “Eco2OLED” technology, which dramatically reduces the power consumptions of panels. It removes the polarizer applied to the panel to increase light transmittance and optimizes the pixel structure to control external light reflection. According to the company “Eco2OLED” improves the light transmittance by 33% while lowering power consumption of display panels by up to 25%. It also increases color purity, increaseing wide color reproducibility.

Under Panel Camera (UPC): UPC will be an essential technology for full screen use. Samsung display has developed UPC technology that allows the front of the camera on the top of product mounted under the panel. Implementation of UPC requires solutions to key challenges such as transparent plastic PI, pixel structure design (ex: transmission windows), and driving algorithms for display and camera. The company “OTI “ has developed CPM (Cathode Patterning Materials). OLED panel makers can use CPM to pattern holes in the cathode. The technology has potential for under display camera+IR to rapidly scale in mobile implementation according to the company. (OTI Highlights the Challenge for Under-Display Cameras)

Foldable form factors – Growing

Flexible smartphone display sizes are reaching their upper limits. Foldable and rollable phones (which can be folded or rolled into bigger screen sizes) with more functionality like tablets are thought to be able to get increased market share. At CES this year Samsung Display showcased three different foldable and rollable smartphone concepts. The flex S foldable device folds both inwardly and outwardly in an S shape. The Flex G folds twice both inwardly, creating a G like shape, where display is protected. The firm also showed the Flex slideable concept which can slide out to a wider display.

Samsung Display showed S-foldable and BOE its slideable OLED displays at SID DisplayWeek 2021. Suppliers such as TCL/CSOT showcased rollable screens that can roll from smartphone to tablet at CES 2021.

Flexible OLED form factors are likely to shift from foldable to rollable and scrollable.

Samsung’s more aggressive pricing for its Zflip3 ($999) and Zfold3 ($1799) and better features have helped the growth of foldable phones in 2021. According to DSCC published data in January 2022, Samsung’s foldable smartphones continue to perform well with December production its second-best month ever at 1.47 million, up 3435%Y/Y. The Z flip 3 accounted for 67% of the total or nearly 1 million units. 2021 foldable smartphone production rose nearly 300% to 8.1 million units.

According to industry news, Samsung Display is planning to more than double its foldable OLED panel production capacity in 2022. The company is also increasing its UTG (ultra thin glass) processing capacity. Companies such as Oppo, Vivo and Xiaomi are also expected to introduce new foldable devices in 2022. Higher capacity, lower price and more products with differentiated features and form factors will drive growth in 2022. With respect to form factors (foldable, rollable, slidable, stretchable and tiled) multi-folding designs will change the way we perceive products in the future with new usability that did not exist before.

With technology developments, material improvements, and product innovations, flexible OLED will continue to drive the next generation smartphone market. (SD)

Sweta Dash, President, Dash-Insights

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com