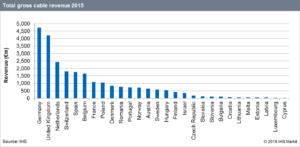

IHS released data about the development of the cable industry in the EU and prepared in collaboration with Cable Europe, the European cable trade association. Key findings from the 2015 yearbook include:

“In response to challenges posed by other platforms, 2015 saw a determined effort by many operators to invest in infrastructure and significantly improve their offerings,” said the report’s author, Maria Rua Aguete, research director at IHS Technology. “Perhaps the most ambitious was Project Lightning, a huge broadband expansion programme undertaken by Virgin Media in the UK.”

“In response to challenges posed by other platforms, 2015 saw a determined effort by many operators to invest in infrastructure and significantly improve their offerings,” said the report’s author, Maria Rua Aguete, research director at IHS Technology. “Perhaps the most ambitious was Project Lightning, a huge broadband expansion programme undertaken by Virgin Media in the UK.”

Funded by a £3 billion investment, Project Lightning aims to connect an additional four million UK homes and businesses, extending Virgin Media’s cable homes passed from 13 million today to 17 million by 2019. Leading operators across Europe have upgraded broadband networks, allowing operators to offer internet download speeds of up to 1Gbps.

Faster speeds will go hand-in-hand with the rollout of Ultra HD services and data hungry SVoD services, the report said.

“Liberty Global’s pan operational deal with Netflix in 2016 shows a level of collaboration between cable and SVoD,” Rua Aguete said. “Our research concluded that the integration of Netflix into pay TV is having a positive impact on cable operators’ key performance indicators, generally benefitting their business while co-existing well with more traditional parts of the bundle.”

Internet revenue grows

In 2015, internet revenue continued to grow, with cable internet revenue totaling €7.2 billion, 9.7% higher than a year earlier. The UK led the way with €1.5 billion, followed by Germany (€1.1 billion) and Spain (€0.8billion). The majority of European markets saw growth in internet revenue, though two Central and East European markets (Poland and Romania) saw slight declines in comparison to 2014.

Take up of digital TV services on the rise

Although the total number of cable TV subscribers in the European Union continued to fall – the total at end of 2015 was 55.1 million, down from 55.7 million a year earlier – the take-up of digital services was on the rise. By the end of 2015, close to two-thirds of cable homes opted for digital TV.

High Definition TV (HDTV) was a service taken by the majority – 54% – of European digital cable homes, while Ultra High Definition (UHD) was still in its infancy. Only a few operators, including Portugal’s NOS, added UHD channels to their line-ups. The take-up of High Definition, bodes well for acceptance of the new formats such as UHD and 4k, in the years to come.

Consolidation trend continues

Important mergers and acquisitions continued to take place in a number of European cable markets in 2015, the IHS Technology report said.

In Germany, the third-largest cable operator Tele Columbus entered into an agreement to buy Primacom, in France, Altice gained complete control of Numericable-SFR, and Spain saw several important deals. Euskaltel, bought the Galicia-based operator R for €1.2 billion, while UK investment group Zegona bought Telecable for €640 million.

“Further consolidation in the sector can be expected, with cable remaining fragmented compared to the platforms it competes with,” Rua Aguete said.