The display Industry showcased innovations for next generation displays at the 60th anniversary of the SID Display Week conference in May (San Jose, CA). It was really exciting to attend in-person after three years. The pandemic has changed the industry’s dynamics.

Display revenue surged to record levels due to strong demand from WFH and LFH (work and learn from home) and with the highest level of panel price increases ever seen. It created renewed interest in the IT market for notebooks, tablets and monitors.

Panel suppliers are continuing to add capacity especially in IT panela. Panel price reductions that started in the second half of 2021 are still continuing. Innovations for next generation displays are needed to drive future demand growth.

Changing Dynamics

According to Ross Young’s keynote presentation at the Business Conference, “Display revenue surged 31% YoY in 2021 reaching $164 billion with strong demand from WFH and LFH.

- Notebook PC unit growth: 3% in 2019 followed by 20% and 28% respectively in 2020 and 2021

- Monitor: -2% unit growth in 2019 and then 14% and 5% in 2020 and 2021

- Tablet: -2% unit growth in 2019, jumped to 19% in 2020 and 0% in 2021.

- Mobile phones: -4% unit growth in 2019, -9% in 2020 and 1% in 2021

- TV: 0% unit growth in 2019, -3% in 2020 and -3% in 2021

- Notebook PC revenue growth was 1% in 2019 but jumped to 27% in 2020 and 81% in 2021

- For monitor revenue it was -9% in 2019, but jumped to 26% in 20, and 48% in 2021.

LCD revenues outgrew OLEDs in 2021 on price increases and strong demand in LCD dominated applications. MiniLED LCDs went from a 0% share in 2020 to a 2.2% share in 2021. LCD capacity forecast is 16% higher in 2022 due to Korean manufacturers delaying shutdowns and Chinese manufacturers adding and stretching capacity. In most cases, panel suppliers are adding IT capacity, believing the boom in IT markets will continue. Most of the new fab activity is around OLEDs for IT applications on G8.5-G8.7 glass which represents significant frontplane and backplane challenges.”.

According to DSCC forecasts, demand growth is expected to be flat or down for Q2-Q4 2022 on a Y/Y basis. Prices are expected to be under significant pressure for the rest of 2022.

OLED: Evolving to New Technology

?Max McDaniel, from Applied Materials in his keynote presentation at the Business conference said

“Technology waves drive growth and investments. The large area OLED wave is coming, it will be in TV and IT in replacement of LCD”.

Technology developments, materials improvements and product innovations combined with capacity expansion and higher competition will help OLED display to gain higher share in future. McDaniel pointed out that OLED still has three major challenges: brightness, lifetime and cost. Progress has been made in the past year in large area with QD-OLED from Samsung and WOLED from LGD.

In IT markets there will be more adoption in monitor, notebook, tablet and foldable notebook. He said, “Through lots of innovation OLED cost will come down”.

Mike Hack from UDC, in his Business Conference keynote, presented about UDC’s development of Phosphorescent Blue OLED materials. He pointed out some of the benefits of Phosphorescent Blue:

- Higher efficiency or lower power consumption benefits: extends battery life

- Higher brightness at same power level, improved HDR performance – makes OLED display peak brightness more comparable with LCDs

- Lower panel temperature at same brightness. Extends lifetime

UDC has announced that they expect to meet preliminary target specs with their phosphorescent blue by year-end 2022, which should enable the introduction of their all-phosphorescent RGB stack into the commercial market in 2024.

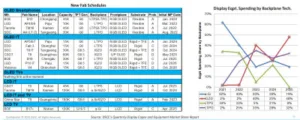

OLED suppliers are investing in 8.5 or 8.7 Gen fabs and high mobility IGZO backplane with low mask count to improve cost. Higher cost saving is also expected by shifting to rigid+ TFE substrate that will have lower capex compared to flexible OLEDs. OLED suppliers are also shifting towards tandem stack structures to improve performance over single stack structures. For example, in a double stack brightness can be doubled at the same lifetime or you can have longer lifetime at the same brightness. As detailed by Oliver Haupt from Coherent’s presentation,

”Tandem OLED might be the game changer for IT OLED displays ? higher brightness and lifetime ”.

The 8.x new OLED fabs for IT are expected to start from 2024 with higher potential for performance, efficiency and cost improvements.

Invited Paper (4-3) at the symposium presented by J.S. Park from Samsung Display about “high mobility Oxide TFTs for AMOLED displays” discussed the technical hurdles that need to be overcome in order to successfully implement high performance oxide TFTs in AMOLED products. It said,

“While high performance devices do help the integration of gate driver circuits within constrained real estate and the reduction of power consumption, trade-off issues are inevitable between mobility and reliability.”

At Display Week both Nanosys and Samsung Display showcased the very impressive QD-OLED technology. According to Jason Hartlove’s presentation (Nanosys) QD-OLED can deliver:

- Hyper-realistic color – 1.5X Richer Color

- Perfect viewing angles – 36% wider

- Brighter appearance vs WOLED – 30% brighter

- Lower materials BOM – up to 40% less (source: DSCC)

A presentation by Chirag Shah from Samsung Display noted that with their QD technology of Blue OLED display with the printed quantum dot layer color conversion and sub-pixel level dimming, the display can achieve expanded color gamut, class leading color volume, and color luminosity. Samsung Display has introduced 65-inch and 55-inch QD-OLED (QD)TV and 34-inch monitor panels. Sony and Samsung Electronics are offering QD-OLED TVs and Samsung Electronics and Dell Alienware are offering gaming monitors using a 34″ curved QD-OLED display. (MSI is also adopting the panel – editor)

WOLED Also Progresses

LG Display (LGD) showcased a 97-inch OLED.EX for the first time to the public during DisplayWeek 2022. It represents the next generation WOLED TV technology with enhanced picture quality (boost brightness by 30%). It also exhibited a 42-inch bendable OLED gaming display which boasts a curvature range of up to 1000R, enabling a more immersive experience.

LGD introduced the largest 17-inch foldable OLED laptop which can transform from a tablet, to a laptop to a portable monitor with ease.

Dr. Jang Jin YOO from LG Display presented on the ergonomics requirements of gaming display. Their study results showed that the core display parameters for gaming were derived from four major categories: Interactivity (response time, refresh rate, reaction time), Reality (field of View, Reflectance, Accurate picture (HDR, B/W brightness, contrast, color, viewing angle)), and Safety (Blue Light, Flicker). Kunjal Parikh and Vivek Paranjape from Intel presented on foldable PCs and Intel’s Evo design foldable display specifications which can enable new form factors to adapt to new use cases and experiences (>16.x” >QHD foldable touch immersive display). One physical device can have many postures: laptop, table top, tablet and others.

Samsung Display also exhibited a foldable OLED gaming display that can be folded in half. SDC premiered a 12.4-inch slidable display that expands the screen horizontally from both ends and also increases portability by reducing the length to 8.1-inches offering multi-tasking ability as well as a more immersive experience.

BOE demonstrated a 95-inch 8K Oxide WOLED TV and 17.3-inch foldable OLED display as well as a slidable OLED besides many more new display products. TCL CSOT and JOLED showcased their jointly developed 65-inch 8K inkjet printed OLED display. TCL CSOT also demonstrated an 8” 360° foldable LTPO OLED with a polarizer less technology.

MiniLED: Higher Performance, Cost still a Challenge

MiniLED-based displays were introduced by top consumer brands such as Samsung, LGE, TCL, Apple and others in 2021 for TV, monitors, notebooks and tablets. By the use of multi zone blinking backlights, miniLED with QD has enabled LCD to have higher brightness, very high contrast, excellent HDR, thin form-factor, superior power efficiency and display performance close to OLED. According to David Naranjo’s presentation showing DSCC data:

- In 2021:

- For advanced monitors, MiniLEDs outpaced OLEDs by almost a 10:1 margin.

- For advanced notebook PCs, OLEDs outpaced MiniLEDs by a 2:1 margin.

- For advanced tablets, MiniLEDs outpaced OLEDs by a 40% margin.

In 2022, triple digit Y/Y growth is expected

- Advanced IT displays are poised to grow as brands offer more options with competitive price points and strong value propositions.

- OLED monitors are expected to increase 612% Y/Y while MiniLED monitors are expected to increase 202% Y/Y.

- MiniLED notebook PCs are expected to increase 248% Y/Y while OLED notebook PCs increase 67% Y/Y.

- MiniLED tablets are expected to grow 38% Y/Y while OLED tablets decrease 2% Y/Y.

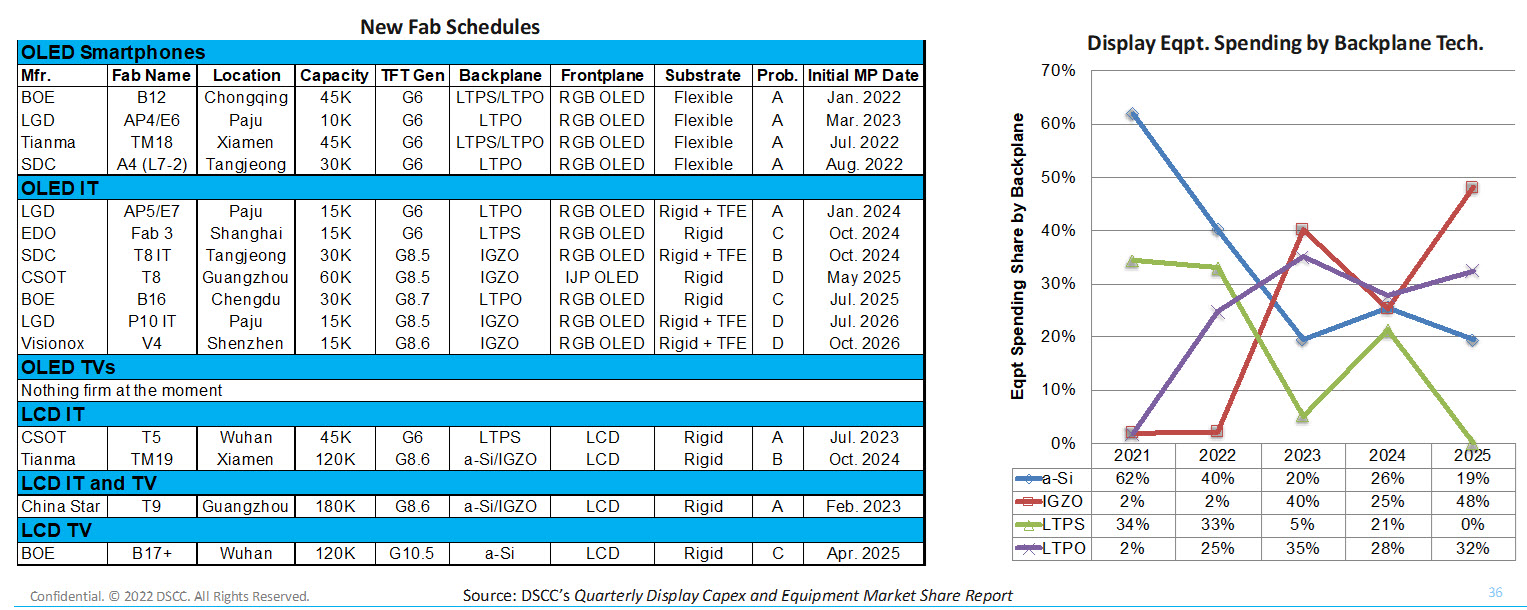

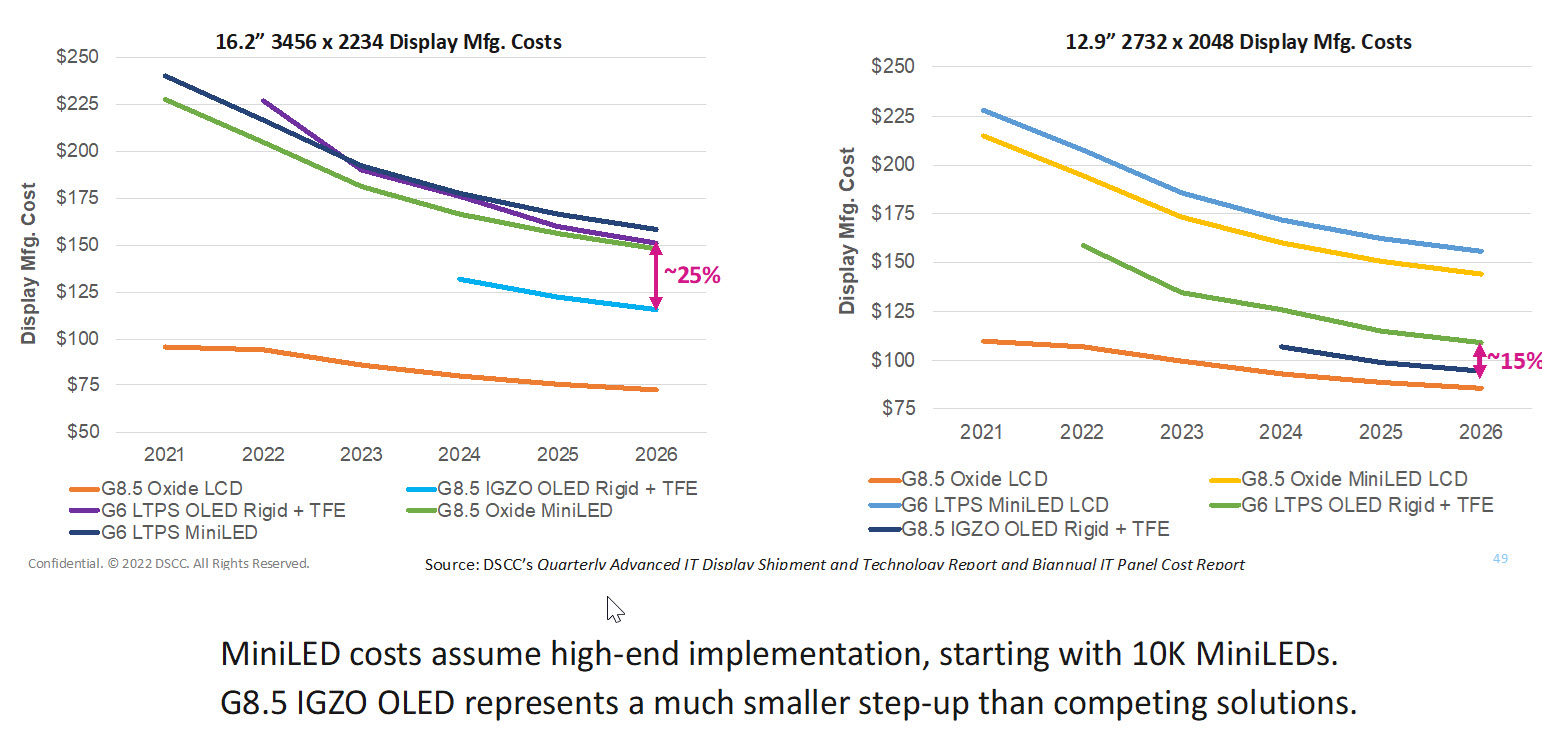

A presentation from Yoshio Tamura from DSCC on advanced IT and TV display costs showed that

“Apple is said to be launching an OLED tablet in 2024 by using a hybrid RGB OLED display next to its current MiniLED product. Rigid and Hybrid OLED displays will have to compete with thinner/lighter LCDs, LTPS LCDs and QHD/UHD LCDs especially in the high end of the Notebook PC market to fill in their new G8.5 to 8.7G fabs from 2024.

- The MiniLEDs in Apple Macbook Pro are embedded with >10,000 LED dies and high dimming zones. The performance is better than entry level designs.

- Even in entry level MiniLED backlights, the optical performance is still much better than conventional backlights.

- LED modules (LED+ backplane + transfer) will dominate MiniLED backlight BOM cost until 2026.

In notebook PC, OLED total costs will be much less than MiniLED LCD costs in the new fabs. However, in monitor, OLED total costs will be much more than MiniLED LCD cost in the new fabs.”

At Display Week, BOE showcased an 86-inch 4K active matrix backlit MiniLED display based on glass substrates with 1500 nits brightness with >2000 zones. The active matrix addressing technique helped in achieving ultra low flicker.

TCL CSOT showed its development of a 75-inch 8K 4 mask glass based miniLED backlight display. It also demonstrated its 34” curved miniLED display for e-sports.

AUO showcased 34” WQHD curved (1000R) miniLED gaming monitors for more immersive experience. It also showed a 16-inch 240Hz MiniLED (LTPS) gaming notebook with >1000nits brightness and 1000 diming zones.

Tianma demonstrated its development of zero border MiniLED displays and showed a 16-inch glass-based AM-TFT MiniLED LCD display.

Technology and process innovations for OLED and MiniLED based display for IT will open up new opportunities for demand growth. However costs will continue to be a challenge. (SD)

Sweta Dash, President, Dash-Insights

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com