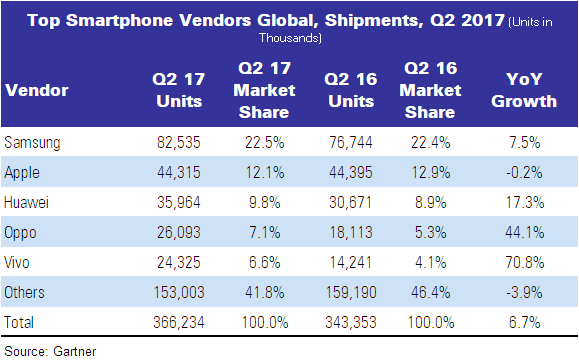

Global sales of smartphones to end users reached 366.2 million units in the second quarter of 2017, a 6.7% increase over the second quarter of 2016, according to Gartner. In the smartphone operating system market, Android extended its lead with 87.7% market share, while iOS accounted for 12.1%.

“Although demand for utility smartphones remains strong, there is growing demand in emerging markets for 4G smartphones, with more storage, better processors and more advanced cameras. This is translating into higher demand for mid-priced [$150 to $200] smartphones,”

said Anshul Gupta, research director at Gartner.

Sales of all types of smartphone grew in the Q2 2017 on an annual basis. However, there is a concern about rising component costs, as well as limited supply, due to the reduced availability of critical components.

“We expect a shortage of flash memory and OLED [organic light-emitting diode] displays will affect premium smartphone supply in the second half of 2017,” said Gupta. “We’ve already seen Huawei’s P10 suffer from a flash memory shortage, and smaller, traditional brands, such as HTC, LG and Sony, are stuck between aggressive Chinese brands and the dominating market shares of Samsung and Apple in the premium smartphone segment.”

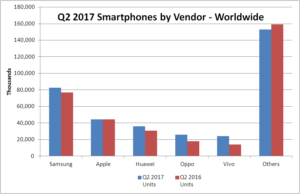

Samsung’s smartphone sales grew 7.5%, year over year, after three consecutive quarterly declines (see Table). The company had been hit hard by problems with the Galaxy Note 7, but the Galaxy S8 and S8+ are bringing back high demand for Samsung smartphones. Despite growing competition from Chinese brands such as Huawei, Oppo and Vivo, Gartner expects Samsung to register growth in 2017,

Despite clearing the distribution channel of iPhone inventory amounting to 3.3 million units during the second quarter, Apple’s sales were flat (down 0.2%), year over year and the firm’s sales in emerging markets are expected to grow as older-generation iPhones continue to attract buyers.

“The new iOS 11, which will include augmented reality, machine learning, an improved Siri and a new display design, will likely fuel strong iPhone sales in the fourth quarter of 2017, and help Apple increase its sales in 2017,” added Mr. Gupta.

Vivo and Oppo achieved the best performances in the second quarter of 2017, with year-over-year sales increases of 70.8%and 44.1%, respectively. Vivo’s smartphones with front-facing cameras have carved out a niche for themselves. Vivo maintained second place in China and grew its sales internationally. Oppo secured its leading position in China by offering dual rear-facing and front-facing cameras.

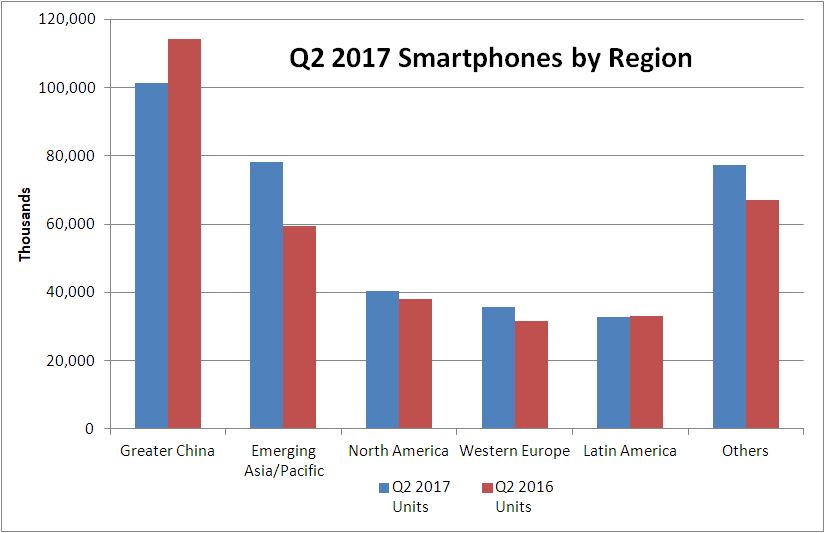

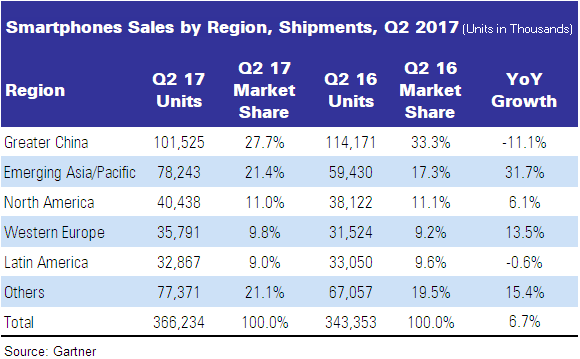

Greater China and Emerging Asia/Pacific Markets Accounted for Nearly Half of Smartphone Sales

Greater China and emerging Asia/Pacific markets drove sales of smartphones in the second quarter of 2017, with market shares of (27.7%) and (21.4%), respectively (see table).

Growing smartphone penetration of India, Indonesia and Southeast Asian countries drove a year-over-year rise in smartphone sales in the emerging Asia/Pacific group.

However, smartphone sales in Greater China declined, year over year, primarily due to longer replacement cycles and as users prefer to buy better smartphones.

“Large vendors continued to strengthen their positions by increasing their market share, while smaller brands lost ground in Greater China,” said Mr. Gupta.

Sales in Western Europe returned to year-over-year growth, fueled especially by strong sales of Huawei and Samsung smartphones.

Analyst Comment

Samsung’s vertical integration into OLED displays and flash memory will help the company to consolidate its position in the market, although we would imagine that there are huge tensions between the smartphone division of the company and the component groups who will be having to disappoint some of their customers – even more frustrating when they probably are prepared to pay more than the ‘internal customer’ .. See (BR)